Lisanti Capital Growth LLC lowered its stake in AeroVironment, Inc. (NASDAQ:AVAV - Free Report) by 63.5% during the third quarter, according to its most recent Form 13F filing with the SEC. The firm owned 9,225 shares of the aerospace company's stock after selling 16,065 shares during the period. Lisanti Capital Growth LLC's holdings in AeroVironment were worth $1,850,000 as of its most recent filing with the SEC.

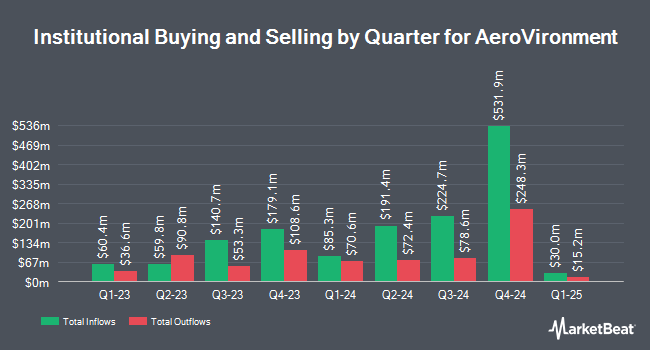

A number of other hedge funds and other institutional investors have also bought and sold shares of AVAV. Baillie Gifford & Co. lifted its holdings in shares of AeroVironment by 132.7% during the second quarter. Baillie Gifford & Co. now owns 1,511,676 shares of the aerospace company's stock worth $275,367,000 after purchasing an additional 861,962 shares during the period. International Assets Investment Management LLC raised its position in shares of AeroVironment by 19,950.0% during the third quarter. International Assets Investment Management LLC now owns 267,066 shares of the aerospace company's stock worth $53,547,000 after purchasing an additional 265,734 shares during the period. Vanguard Group Inc. increased its position in shares of AeroVironment by 6.2% during the first quarter. Vanguard Group Inc. now owns 3,094,831 shares of the aerospace company's stock worth $474,376,000 after acquiring an additional 179,395 shares in the last quarter. Driehaus Capital Management LLC lifted its holdings in shares of AeroVironment by 120.6% in the second quarter. Driehaus Capital Management LLC now owns 136,603 shares of the aerospace company's stock valued at $24,884,000 after purchasing an additional 74,672 shares in the last quarter. Finally, Van ECK Associates Corp grew its stake in shares of AeroVironment by 83.6% in the 2nd quarter. Van ECK Associates Corp now owns 112,913 shares of the aerospace company's stock worth $20,568,000 after acquiring an additional 51,428 shares in the last quarter. Institutional investors and hedge funds own 86.38% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities research analysts have recently commented on the company. BTIG Research reiterated a "buy" rating and set a $245.00 target price on shares of AeroVironment in a research note on Tuesday, September 17th. Baird R W raised AeroVironment from a "hold" rating to a "strong-buy" rating in a report on Wednesday, August 28th. Alembic Global Advisors raised AeroVironment from a "neutral" rating to an "overweight" rating and set a $216.00 price target on the stock in a research report on Wednesday, August 28th. Royal Bank of Canada reduced their target price on shares of AeroVironment from $230.00 to $215.00 and set an "outperform" rating for the company in a research note on Thursday, September 5th. Finally, Raymond James cut AeroVironment from an "outperform" rating to a "market perform" rating in a research report on Monday, September 16th. One analyst has rated the stock with a hold rating, five have issued a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat, the stock presently has an average rating of "Buy" and a consensus price target of $208.20.

Check Out Our Latest Stock Report on AeroVironment

AeroVironment Stock Performance

AeroVironment stock traded up $7.30 during trading on Monday, reaching $235.17. The company had a trading volume of 351,152 shares, compared to its average volume of 335,656. The firm's 50-day simple moving average is $203.71 and its 200 day simple moving average is $191.45. AeroVironment, Inc. has a 52 week low of $116.51 and a 52 week high of $236.60. The firm has a market capitalization of $6.63 billion, a price-to-earnings ratio of 106.98 and a beta of 0.49. The company has a current ratio of 4.26, a quick ratio of 3.04 and a debt-to-equity ratio of 0.01.

AeroVironment (NASDAQ:AVAV - Get Free Report) last posted its quarterly earnings results on Wednesday, September 4th. The aerospace company reported $0.89 EPS for the quarter, topping the consensus estimate of $0.61 by $0.28. AeroVironment had a net margin of 7.82% and a return on equity of 9.87%. The company had revenue of $189.48 million for the quarter, compared to the consensus estimate of $183.18 million. During the same quarter last year, the firm posted $1.00 EPS. The firm's revenue was up 24.4% compared to the same quarter last year. Sell-side analysts forecast that AeroVironment, Inc. will post 3.36 earnings per share for the current fiscal year.

Insider Buying and Selling at AeroVironment

In other AeroVironment news, CFO Kevin Patrick Mcdonnell sold 396 shares of AeroVironment stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $196.22, for a total transaction of $77,703.12. Following the completion of the sale, the chief financial officer now owns 18,254 shares of the company's stock, valued at approximately $3,581,799.88. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Insiders sold a total of 1,782 shares of company stock worth $372,615 over the last three months. Corporate insiders own 1.27% of the company's stock.

AeroVironment Company Profile

(

Free Report)

AeroVironment, Inc designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally. It operates through Small Unmanned Aircraft Systems (SUAS), Tactical Missile System (TMS), Medium Unmanned Aircraft Systems (MUAS), and High Altitude Pseudo-Satellite Systems (HAPS) segments.

Read More

Before you consider AeroVironment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AeroVironment wasn't on the list.

While AeroVironment currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.