LivaNova (NASDAQ:LIVN - Free Report) had its price objective reduced by The Goldman Sachs Group from $64.00 to $55.00 in a research report sent to investors on Monday morning,Benzinga reports. They currently have a buy rating on the stock.

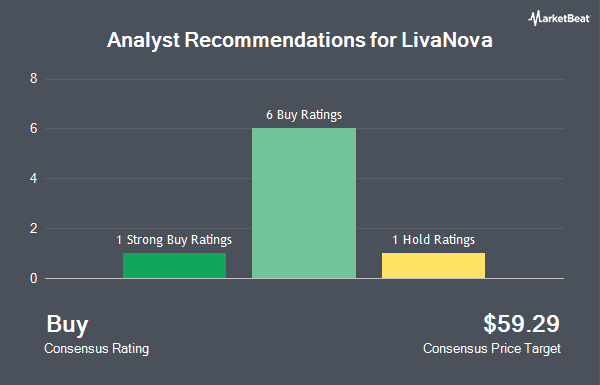

A number of other analysts have also issued reports on LIVN. Mizuho reduced their target price on LivaNova from $70.00 to $60.00 and set an "outperform" rating for the company in a report on Wednesday, February 26th. Needham & Company LLC lowered their target price on LivaNova from $75.00 to $64.00 and set a "buy" rating on the stock in a research note on Wednesday, February 26th. StockNews.com cut shares of LivaNova from a "strong-buy" rating to a "buy" rating in a report on Wednesday, February 26th. Wolfe Research downgraded shares of LivaNova from an "outperform" rating to a "peer perform" rating in a research report on Wednesday, February 26th. Finally, Stifel Nicolaus dropped their price target on shares of LivaNova from $72.00 to $60.00 and set a "buy" rating on the stock in a research note on Wednesday, February 26th. One analyst has rated the stock with a hold rating, six have issued a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, LivaNova has a consensus rating of "Buy" and a consensus price target of $62.20.

Get Our Latest Stock Analysis on LIVN

LivaNova Trading Down 2.2 %

LIVN stock traded down $0.88 during mid-day trading on Monday, reaching $39.99. 1,042,533 shares of the stock traded hands, compared to its average volume of 597,499. The stock's fifty day moving average is $47.08 and its 200-day moving average is $49.43. The company has a market cap of $2.17 billion, a P/E ratio of 95.21 and a beta of 1.10. The company has a current ratio of 3.37, a quick ratio of 2.87 and a debt-to-equity ratio of 0.46. LivaNova has a 52-week low of $39.42 and a 52-week high of $64.47.

Insider Activity at LivaNova

In other LivaNova news, Director Francesco Bianchi sold 1,250 shares of the firm's stock in a transaction dated Wednesday, December 11th. The stock was sold at an average price of $50.99, for a total transaction of $63,737.50. Following the transaction, the director now directly owns 7,522 shares in the company, valued at $383,546.78. This trade represents a 14.25 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. 0.27% of the stock is owned by company insiders.

Institutional Inflows and Outflows

Institutional investors have recently made changes to their positions in the stock. State of Alaska Department of Revenue grew its holdings in LivaNova by 7.3% during the third quarter. State of Alaska Department of Revenue now owns 6,246 shares of the company's stock valued at $328,000 after purchasing an additional 425 shares during the last quarter. Atria Investments Inc boosted its holdings in LivaNova by 6.2% during the third quarter. Atria Investments Inc now owns 5,653 shares of the company's stock valued at $297,000 after acquiring an additional 331 shares during the period. State of New Jersey Common Pension Fund D grew its position in shares of LivaNova by 38.3% in the third quarter. State of New Jersey Common Pension Fund D now owns 42,539 shares of the company's stock valued at $2,235,000 after purchasing an additional 11,782 shares during the last quarter. Entropy Technologies LP bought a new position in shares of LivaNova in the third quarter worth about $529,000. Finally, GSA Capital Partners LLP acquired a new position in shares of LivaNova during the 3rd quarter worth about $292,000. 97.64% of the stock is owned by institutional investors.

LivaNova Company Profile

(

Get Free Report)

LivaNova PLC, a medical device company, designs, develops, manufactures, and sells therapeutic solutions worldwide. The company operates through Cardiopulmonary, Neuromodulation, and Advanced Circulatory Support segments. The Cardiopulmonary segment develops, produces, and sells cardiopulmonary products, including oxygenators, heart-lung machines, autotransfusion systems, perfusion tubing systems, cannulae, connect, and other related products.

Read More

Before you consider LivaNova, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LivaNova wasn't on the list.

While LivaNova currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.