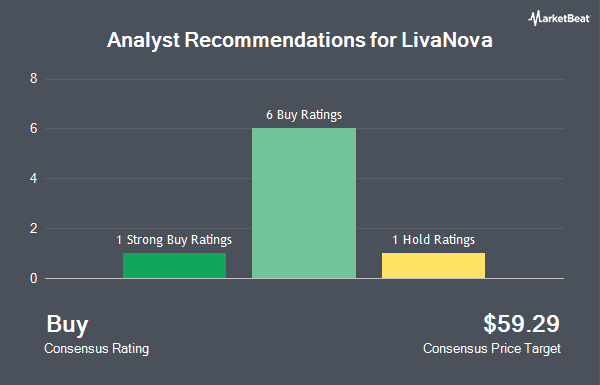

Shares of LivaNova PLC (NASDAQ:LIVN - Get Free Report) have received a consensus recommendation of "Moderate Buy" from the eight ratings firms that are presently covering the stock, Marketbeat.com reports. Two investment analysts have rated the stock with a hold recommendation, five have given a buy recommendation and one has issued a strong buy recommendation on the company. The average 1-year price target among analysts that have updated their coverage on the stock in the last year is $61.17.

A number of brokerages recently weighed in on LIVN. Mizuho decreased their price target on shares of LivaNova from $70.00 to $60.00 and set an "outperform" rating for the company in a research report on Wednesday, February 26th. Wolfe Research cut shares of LivaNova from an "outperform" rating to a "peer perform" rating in a research report on Wednesday, February 26th. Barclays decreased their price target on shares of LivaNova from $58.00 to $56.00 and set an "equal weight" rating for the company in a research report on Friday, March 7th. The Goldman Sachs Group decreased their price target on shares of LivaNova from $64.00 to $55.00 and set a "buy" rating for the company in a research report on Monday, March 3rd. Finally, Stifel Nicolaus decreased their price target on shares of LivaNova from $72.00 to $60.00 and set a "buy" rating for the company in a research report on Wednesday, February 26th.

Check Out Our Latest Analysis on LivaNova

Hedge Funds Weigh In On LivaNova

A number of large investors have recently bought and sold shares of LIVN. Russell Investments Group Ltd. lifted its holdings in LivaNova by 17.1% in the fourth quarter. Russell Investments Group Ltd. now owns 1,502 shares of the company's stock worth $70,000 after acquiring an additional 219 shares during the last quarter. Sterling Capital Management LLC lifted its holdings in LivaNova by 800.6% in the fourth quarter. Sterling Capital Management LLC now owns 1,621 shares of the company's stock worth $75,000 after acquiring an additional 1,441 shares during the last quarter. Central Pacific Bank Trust Division lifted its holdings in LivaNova by 21.2% in the fourth quarter. Central Pacific Bank Trust Division now owns 4,117 shares of the company's stock worth $191,000 after acquiring an additional 720 shares during the last quarter. Vestcor Inc acquired a new stake in shares of LivaNova in the fourth quarter valued at approximately $204,000. Finally, Optimize Financial Inc acquired a new stake in shares of LivaNova in the fourth quarter valued at approximately $208,000. Institutional investors own 97.64% of the company's stock.

LivaNova Stock Up 0.0 %

Shares of NASDAQ LIVN opened at $39.07 on Thursday. LivaNova has a 52-week low of $36.85 and a 52-week high of $64.47. The firm has a fifty day moving average of $46.32 and a 200-day moving average of $49.18. The stock has a market capitalization of $2.12 billion, a PE ratio of 93.02 and a beta of 1.10. The company has a quick ratio of 2.87, a current ratio of 3.37 and a debt-to-equity ratio of 0.46.

LivaNova Company Profile

(

Get Free ReportLivaNova PLC, a medical device company, designs, develops, manufactures, and sells therapeutic solutions worldwide. The company operates through Cardiopulmonary, Neuromodulation, and Advanced Circulatory Support segments. The Cardiopulmonary segment develops, produces, and sells cardiopulmonary products, including oxygenators, heart-lung machines, autotransfusion systems, perfusion tubing systems, cannulae, connect, and other related products.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider LivaNova, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LivaNova wasn't on the list.

While LivaNova currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.