Franklin Resources Inc. boosted its position in LiveRamp Holdings, Inc. (NYSE:RAMP - Free Report) by 11.5% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 1,526,250 shares of the company's stock after acquiring an additional 157,696 shares during the period. Franklin Resources Inc. owned 2.34% of LiveRamp worth $37,653,000 at the end of the most recent reporting period.

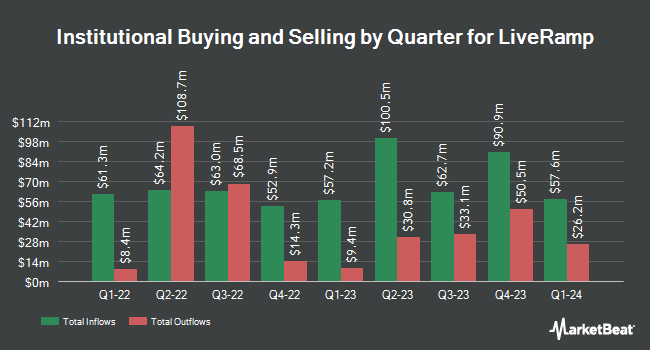

Other hedge funds have also recently modified their holdings of the company. American Capital Management Inc. raised its holdings in shares of LiveRamp by 46.7% during the third quarter. American Capital Management Inc. now owns 2,877,814 shares of the company's stock valued at $71,312,000 after acquiring an additional 916,578 shares in the last quarter. Fort Washington Investment Advisors Inc. OH purchased a new position in LiveRamp during the 2nd quarter valued at $13,214,000. Assenagon Asset Management S.A. raised its holdings in LiveRamp by 111.4% in the 3rd quarter. Assenagon Asset Management S.A. now owns 559,213 shares of the company's stock worth $13,857,000 after purchasing an additional 294,743 shares in the last quarter. Invenomic Capital Management LP lifted its position in shares of LiveRamp by 257.7% in the 3rd quarter. Invenomic Capital Management LP now owns 337,574 shares of the company's stock worth $8,365,000 after purchasing an additional 243,198 shares during the period. Finally, Millennium Management LLC lifted its position in shares of LiveRamp by 143.8% in the 2nd quarter. Millennium Management LLC now owns 395,619 shares of the company's stock worth $12,240,000 after purchasing an additional 233,329 shares during the period. Hedge funds and other institutional investors own 93.83% of the company's stock.

Insider Transactions at LiveRamp

In other LiveRamp news, insider Kimberly Bloomston sold 4,000 shares of the company's stock in a transaction dated Thursday, September 26th. The shares were sold at an average price of $25.17, for a total transaction of $100,680.00. Following the transaction, the insider now owns 117,247 shares in the company, valued at approximately $2,951,106.99. This represents a 3.30 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, Director Debora B. Tomlin sold 9,765 shares of LiveRamp stock in a transaction that occurred on Thursday, September 26th. The stock was sold at an average price of $25.07, for a total transaction of $244,808.55. Following the completion of the sale, the director now owns 24,509 shares of the company's stock, valued at $614,440.63. This represents a 28.49 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 3.39% of the company's stock.

LiveRamp Stock Performance

Shares of LiveRamp stock traded down $0.08 during midday trading on Thursday, hitting $30.35. The company had a trading volume of 429,088 shares, compared to its average volume of 633,968. The company has a 50 day moving average of $28.25 and a 200 day moving average of $27.89. The stock has a market capitalization of $1.98 billion, a P/E ratio of 607.12 and a beta of 0.97. LiveRamp Holdings, Inc. has a 52-week low of $21.45 and a 52-week high of $42.66.

LiveRamp (NYSE:RAMP - Get Free Report) last issued its quarterly earnings results on Wednesday, November 6th. The company reported $0.51 earnings per share for the quarter, beating the consensus estimate of $0.37 by $0.14. The firm had revenue of $185.00 million during the quarter, compared to the consensus estimate of $176.16 million. LiveRamp had a return on equity of 1.25% and a net margin of 0.40%. The company's revenue was up 15.6% on a year-over-year basis. During the same period last year, the company earned $0.21 earnings per share. Equities research analysts forecast that LiveRamp Holdings, Inc. will post 0.36 EPS for the current year.

Wall Street Analysts Forecast Growth

Several brokerages recently issued reports on RAMP. StockNews.com upgraded shares of LiveRamp from a "buy" rating to a "strong-buy" rating in a research report on Monday. Benchmark reduced their target price on LiveRamp from $48.00 to $42.00 and set a "buy" rating on the stock in a report on Thursday, November 7th. Wells Fargo & Company assumed coverage on LiveRamp in a research note on Monday, October 28th. They issued an "equal weight" rating and a $25.00 target price for the company. Finally, Macquarie reaffirmed an "outperform" rating and issued a $43.00 price target on shares of LiveRamp in a research note on Thursday, November 7th. One equities research analyst has rated the stock with a hold rating, six have assigned a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, the company has an average rating of "Buy" and a consensus price target of $41.14.

Read Our Latest Research Report on RAMP

LiveRamp Company Profile

(

Free Report)

LiveRamp Holdings, Inc, a technology company, operates a data collaboration platform in the United States, Europe, the Asia-Pacific, and internationally. The company operates LiveRamp Data Collaboration platform enables an organization to unify customer and prospect data to build a single view of the customer in a way that protects consumer privacy.

Further Reading

Before you consider LiveRamp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LiveRamp wasn't on the list.

While LiveRamp currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.