LMR Partners LLP trimmed its holdings in shares of TD SYNNEX Co. (NYSE:SNX - Free Report) by 96.7% in the third quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 10,000 shares of the business services provider's stock after selling 288,670 shares during the quarter. LMR Partners LLP's holdings in TD SYNNEX were worth $1,201,000 as of its most recent filing with the SEC.

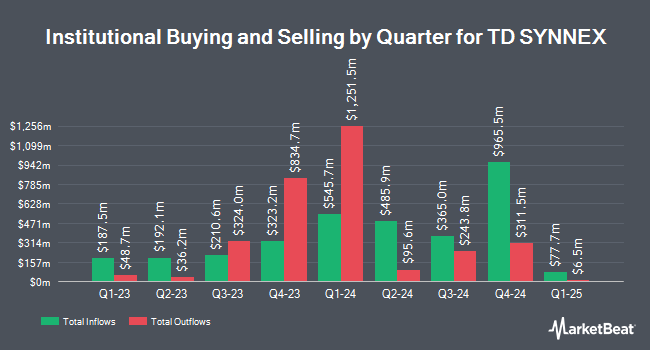

Other institutional investors have also added to or reduced their stakes in the company. V Square Quantitative Management LLC acquired a new stake in shares of TD SYNNEX in the 3rd quarter valued at approximately $30,000. UMB Bank n.a. raised its stake in TD SYNNEX by 99.3% in the 3rd quarter. UMB Bank n.a. now owns 289 shares of the business services provider's stock valued at $35,000 after acquiring an additional 144 shares during the period. Kathleen S. Wright Associates Inc. acquired a new stake in TD SYNNEX during the 3rd quarter valued at $37,000. Blue Trust Inc. boosted its position in TD SYNNEX by 52.3% during the second quarter. Blue Trust Inc. now owns 358 shares of the business services provider's stock worth $40,000 after purchasing an additional 123 shares during the period. Finally, Ashton Thomas Private Wealth LLC acquired a new position in shares of TD SYNNEX in the second quarter valued at $52,000. 84.00% of the stock is owned by institutional investors.

Analyst Ratings Changes

A number of brokerages have recently issued reports on SNX. Royal Bank of Canada restated an "outperform" rating and set a $140.00 price objective on shares of TD SYNNEX in a report on Friday, September 27th. Loop Capital restated a "buy" rating and issued a $150.00 price target on shares of TD SYNNEX in a research note on Monday, October 7th. Barclays raised their price objective on TD SYNNEX from $131.00 to $132.00 and gave the stock an "equal weight" rating in a research note on Friday, September 27th. StockNews.com upgraded shares of TD SYNNEX from a "hold" rating to a "buy" rating in a research report on Friday, August 16th. Finally, Barrington Research reaffirmed an "outperform" rating and issued a $138.00 target price on shares of TD SYNNEX in a report on Monday, September 23rd. Three equities research analysts have rated the stock with a hold rating and six have given a buy rating to the stock. Based on data from MarketBeat, TD SYNNEX has an average rating of "Moderate Buy" and an average target price of $134.75.

Check Out Our Latest Report on TD SYNNEX

Insider Buying and Selling at TD SYNNEX

In related news, insider David R. Vetter sold 20,000 shares of the company's stock in a transaction dated Friday, October 18th. The stock was sold at an average price of $123.14, for a total transaction of $2,462,800.00. Following the sale, the insider now owns 66,381 shares in the company, valued at $8,174,156.34. This represents a 23.15 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Simon Leung sold 6,249 shares of the firm's stock in a transaction that occurred on Wednesday, November 6th. The stock was sold at an average price of $123.17, for a total value of $769,689.33. Following the sale, the insider now directly owns 23,339 shares of the company's stock, valued at $2,874,664.63. This represents a 21.12 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 69,645 shares of company stock worth $8,414,329. Insiders own 1.90% of the company's stock.

TD SYNNEX Price Performance

SNX traded up $1.35 on Wednesday, reaching $116.06. The stock had a trading volume of 364,035 shares, compared to its average volume of 780,160. The firm has a 50-day moving average of $118.55 and a 200-day moving average of $119.73. TD SYNNEX Co. has a fifty-two week low of $96.93 and a fifty-two week high of $133.85. The company has a market capitalization of $9.88 billion, a price-to-earnings ratio of 14.84, a price-to-earnings-growth ratio of 1.17 and a beta of 1.48. The company has a current ratio of 1.25, a quick ratio of 0.77 and a debt-to-equity ratio of 0.46.

TD SYNNEX (NYSE:SNX - Get Free Report) last issued its quarterly earnings data on Thursday, September 26th. The business services provider reported $2.86 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.80 by $0.06. TD SYNNEX had a net margin of 1.20% and a return on equity of 12.15%. The business had revenue of $14.68 billion during the quarter, compared to analyst estimates of $14.11 billion. During the same quarter last year, the business earned $2.71 EPS. The firm's quarterly revenue was up 5.2% on a year-over-year basis. As a group, sell-side analysts anticipate that TD SYNNEX Co. will post 11.03 EPS for the current year.

TD SYNNEX Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, October 25th. Shareholders of record on Friday, October 11th were issued a dividend of $0.40 per share. This represents a $1.60 annualized dividend and a yield of 1.38%. The ex-dividend date was Friday, October 11th. TD SYNNEX's payout ratio is presently 20.70%.

About TD SYNNEX

(

Free Report)

TD SYNNEX Corporation operates as a distributor and solutions aggregator for the information technology (IT) ecosystem. The company offers personal computing devices and peripherals, mobile phones and accessories, printers, supplies, and endpoint technology software; and data center technologies, such as hybrid cloud, security, storage, networking, servers, technology software, and converged and hyper-converged infrastructure, as well as computing components.

Further Reading

Before you consider TD SYNNEX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TD SYNNEX wasn't on the list.

While TD SYNNEX currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.