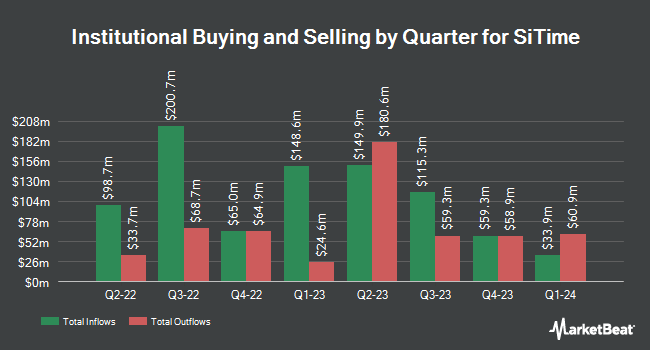

LMR Partners LLP raised its stake in shares of SiTime Co. (NASDAQ:SITM - Free Report) by 705.0% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 80,500 shares of the company's stock after buying an additional 70,500 shares during the quarter. LMR Partners LLP owned about 0.35% of SiTime worth $13,807,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other institutional investors and hedge funds have also recently modified their holdings of the stock. Thrivent Financial for Lutherans increased its holdings in SiTime by 0.6% in the 3rd quarter. Thrivent Financial for Lutherans now owns 14,714 shares of the company's stock valued at $2,524,000 after acquiring an additional 94 shares during the last quarter. CIBC Asset Management Inc purchased a new stake in shares of SiTime during the 3rd quarter worth approximately $205,000. Saturna Capital Corp purchased a new position in shares of SiTime in the third quarter valued at $206,000. Crossmark Global Holdings Inc. bought a new stake in SiTime in the third quarter worth $236,000. Finally, Atria Investments Inc bought a new position in SiTime during the third quarter valued at $228,000. Institutional investors own 84.31% of the company's stock.

Insiders Place Their Bets

In other SiTime news, insider Lionel Bonnot sold 3,230 shares of the business's stock in a transaction dated Thursday, August 22nd. The shares were sold at an average price of $140.55, for a total value of $453,976.50. Following the completion of the transaction, the insider now directly owns 87,525 shares in the company, valued at approximately $12,301,638.75. The trade was a 3.56 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, insider Fariborz Assaderaghi sold 1,083 shares of the firm's stock in a transaction dated Wednesday, August 28th. The shares were sold at an average price of $139.05, for a total transaction of $150,591.15. Following the completion of the sale, the insider now owns 112,584 shares in the company, valued at $15,654,805.20. This represents a 0.95 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 38,464 shares of company stock worth $6,698,053 in the last three months. Corporate insiders own 2.30% of the company's stock.

SiTime Price Performance

SITM stock traded up $5.82 during mid-day trading on Monday, reaching $199.40. The company had a trading volume of 86,806 shares, compared to its average volume of 204,492. The firm has a 50 day moving average of $176.00 and a 200 day moving average of $146.34. SiTime Co. has a 12 month low of $72.39 and a 12 month high of $228.12. The company has a market capitalization of $4.66 billion, a PE ratio of -46.76 and a beta of 1.83.

SiTime (NASDAQ:SITM - Get Free Report) last issued its earnings results on Wednesday, November 6th. The company reported $0.40 earnings per share for the quarter, beating analysts' consensus estimates of $0.26 by $0.14. SiTime had a negative return on equity of 9.89% and a negative net margin of 53.55%. The business had revenue of $57.70 million during the quarter, compared to analyst estimates of $55.10 million. During the same period in the previous year, the company posted ($0.81) EPS. SiTime's revenue was up 62.4% on a year-over-year basis. Analysts anticipate that SiTime Co. will post -2.98 EPS for the current year.

Wall Street Analyst Weigh In

A number of brokerages recently commented on SITM. Barclays increased their price target on shares of SiTime from $90.00 to $130.00 and gave the company an "underweight" rating in a report on Friday, November 8th. Roth Mkm increased their price target on SiTime from $205.00 to $230.00 and gave the company a "buy" rating in a report on Thursday, November 7th. Needham & Company LLC lifted their price objective on shares of SiTime from $140.00 to $225.00 and gave the stock a "buy" rating in a research note on Thursday, November 7th. Finally, Stifel Nicolaus increased their target price on shares of SiTime from $175.00 to $200.00 and gave the company a "buy" rating in a research note on Thursday, October 17th.

Check Out Our Latest Stock Analysis on SiTime

About SiTime

(

Free Report)

SiTime Corporation designs, develops, and sells silicon timing systems solutions in Taiwan, Hong Kong, the United States, Singapore, and internationally. The company provides resonators and clock integrated circuits, and various types of oscillators. It serves various markets, including communications, datacenter, enterprise, automotive, industrial, internet of things, mobile, consumer, and aerospace and defense.

Recommended Stories

Before you consider SiTime, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SiTime wasn't on the list.

While SiTime currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.