LMR Partners LLP lessened its position in shares of Establishment Labs Holdings Inc. (NASDAQ:ESTA - Free Report) by 69.6% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 10,000 shares of the company's stock after selling 22,938 shares during the period. LMR Partners LLP's holdings in Establishment Labs were worth $433,000 as of its most recent SEC filing.

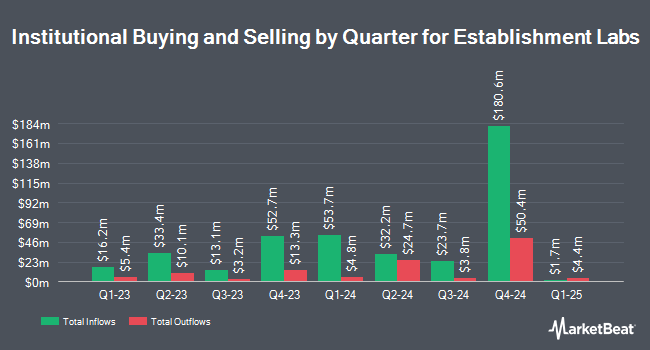

Other hedge funds also recently made changes to their positions in the company. Capital Research Global Investors acquired a new position in Establishment Labs in the first quarter worth $45,888,000. Rice Hall James & Associates LLC grew its position in shares of Establishment Labs by 10.7% during the 3rd quarter. Rice Hall James & Associates LLC now owns 793,300 shares of the company's stock valued at $34,326,000 after buying an additional 76,959 shares during the last quarter. William Blair Investment Management LLC raised its stake in Establishment Labs by 14.5% during the second quarter. William Blair Investment Management LLC now owns 481,572 shares of the company's stock worth $21,883,000 after acquiring an additional 60,848 shares during the period. Bamco Inc. NY lifted its holdings in Establishment Labs by 28.4% in the first quarter. Bamco Inc. NY now owns 429,775 shares of the company's stock worth $21,876,000 after acquiring an additional 95,000 shares during the last quarter. Finally, Sofinnova Investments Inc. boosted its stake in Establishment Labs by 204.1% in the second quarter. Sofinnova Investments Inc. now owns 429,244 shares of the company's stock valued at $19,505,000 after acquiring an additional 288,082 shares during the period. Institutional investors and hedge funds own 72.91% of the company's stock.

Establishment Labs Price Performance

ESTA stock traded up $4.29 during trading on Wednesday, hitting $41.81. The company had a trading volume of 996,952 shares, compared to its average volume of 389,323. The business has a 50 day moving average of $42.95 and a 200 day moving average of $45.36. The firm has a market capitalization of $1.17 billion, a price-to-earnings ratio of -15.53 and a beta of 1.20. The company has a current ratio of 3.62, a quick ratio of 2.29 and a debt-to-equity ratio of 5.94. Establishment Labs Holdings Inc. has a fifty-two week low of $21.25 and a fifty-two week high of $60.12.

Analyst Ratings Changes

Several brokerages recently issued reports on ESTA. BTIG Research raised their price target on Establishment Labs from $62.00 to $65.00 and gave the stock a "buy" rating in a report on Monday, October 14th. JPMorgan Chase & Co. reduced their price target on shares of Establishment Labs from $61.00 to $50.00 and set an "overweight" rating for the company in a report on Wednesday, August 7th. Citigroup increased their price objective on shares of Establishment Labs from $45.00 to $50.00 and gave the stock a "neutral" rating in a report on Tuesday, October 1st. Finally, Stephens reissued an "overweight" rating and set a $68.00 target price on shares of Establishment Labs in a research note on Wednesday, August 7th. One analyst has rated the stock with a hold rating and four have given a buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $60.60.

View Our Latest Stock Report on Establishment Labs

Establishment Labs Profile

(

Free Report)

Establishment Labs Holdings Inc, a medical technology company, manufactures and markets medical devices for aesthetic and reconstructive plastic surgery. The company primarily offers silicone gel-filled breast implants under the Motiva Implants brand. It also provides Motiva Ergonomix and Motiva Ergonomix2 gravity sensitive round soft silicone-gel-filled breast implants; and Motiva Flora Tissue Expander, a breast tissue expander.

Featured Articles

Before you consider Establishment Labs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Establishment Labs wasn't on the list.

While Establishment Labs currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.