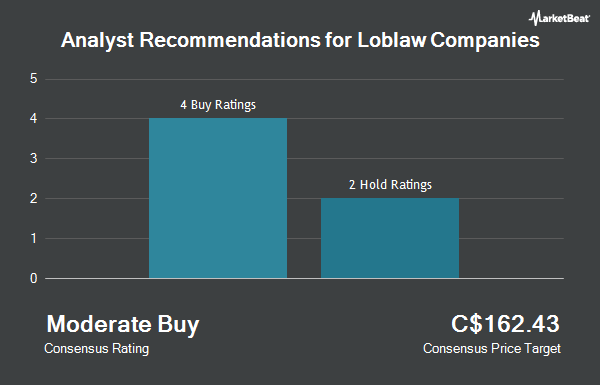

Shares of Loblaw Companies Limited (TSE:L - Get Free Report) have received an average rating of "Moderate Buy" from the seven brokerages that are presently covering the firm, MarketBeat reports. Two equities research analysts have rated the stock with a hold rating and five have given a buy rating to the company. The average 12 month price objective among analysts that have issued a report on the stock in the last year is C$199.38.

Several research analysts have weighed in on L shares. Scotiabank lowered shares of Loblaw Companies from an "outperform" rating to a "sector perform" rating and set a C$200.00 price objective on the stock. in a research note on Wednesday, January 8th. Royal Bank of Canada increased their price objective on Loblaw Companies from C$205.00 to C$217.00 and gave the stock an "outperform" rating in a report on Monday, December 9th. CIBC lifted their price objective on Loblaw Companies from C$206.00 to C$208.00 in a research report on Friday, February 21st. UBS Group dropped their target price on Loblaw Companies from C$225.00 to C$210.00 in a research report on Friday, February 21st. Finally, TD Securities reduced their price target on Loblaw Companies from C$202.00 to C$195.00 and set a "buy" rating for the company in a report on Friday, February 21st.

Check Out Our Latest Research Report on Loblaw Companies

Loblaw Companies Stock Down 0.2 %

Shares of L stock traded down C$0.35 on Friday, reaching C$195.83. 309,941 shares of the company's stock traded hands, compared to its average volume of 413,907. The business's 50 day moving average price is C$183.98 and its two-hundred day moving average price is C$182.61. The company has a market capitalization of C$59.21 billion, a P/E ratio of 26.58, a price-to-earnings-growth ratio of 3.23 and a beta of 0.17. The company has a debt-to-equity ratio of 166.11, a quick ratio of 0.68 and a current ratio of 1.29. Loblaw Companies has a 12-month low of C$145.80 and a 12-month high of C$197.00.

Loblaw Companies Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, April 1st. Stockholders of record on Tuesday, April 1st will be paid a $0.513 dividend. This represents a $2.05 dividend on an annualized basis and a dividend yield of 1.05%. The ex-dividend date is Friday, March 14th. Loblaw Companies's payout ratio is 27.83%.

Insider Activity at Loblaw Companies

In other news, Senior Officer Kieran Barry Columb sold 11,309 shares of the business's stock in a transaction that occurred on Monday, March 3rd. The stock was sold at an average price of C$186.55, for a total transaction of C$2,109,706.39. Also, Director Richard Dufresne sold 25,783 shares of the firm's stock in a transaction on Monday, March 3rd. The stock was sold at an average price of C$186.55, for a total value of C$4,809,847.01. In the last three months, insiders have sold 141,456 shares of company stock worth $25,966,244. 53.77% of the stock is owned by insiders.

About Loblaw Companies

(

Get Free ReportLoblaw is one of Canada's largest grocery, pharmacy, and general merchandise retailers, operating the most expansive store footprint in Ontario and maintaining sizable presences in provinces like Quebec and British Columbia. Key grocery banners include Loblaw, No Frills, and Maxi, while its pharmaceutical operations are the product of its 2014 acquisition of Shoppers Drug Mart.

See Also

Before you consider Loblaw Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Loblaw Companies wasn't on the list.

While Loblaw Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.