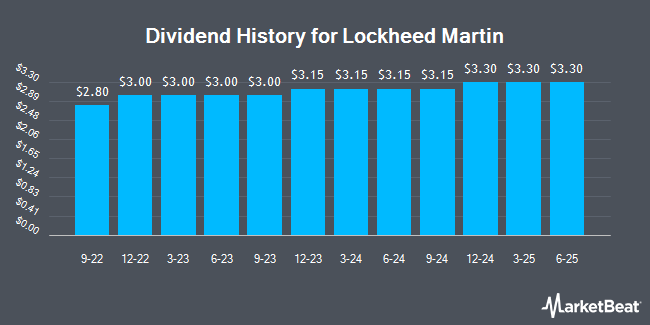

Lockheed Martin Co. (NYSE:LMT - Get Free Report) declared a quarterly dividend on Tuesday, January 28th,RTT News reports. Shareholders of record on Monday, March 3rd will be paid a dividend of 3.30 per share by the aerospace company on Friday, March 28th. This represents a $13.20 dividend on an annualized basis and a yield of 2.88%.

Lockheed Martin has raised its dividend by an average of 6.4% per year over the last three years. Lockheed Martin has a payout ratio of 44.6% meaning its dividend is sufficiently covered by earnings. Research analysts expect Lockheed Martin to earn $27.78 per share next year, which means the company should continue to be able to cover its $13.20 annual dividend with an expected future payout ratio of 47.5%.

Lockheed Martin Price Performance

Shares of LMT stock traded down $45.80 during trading hours on Tuesday, hitting $457.89. 4,014,273 shares of the company's stock were exchanged, compared to its average volume of 1,363,802. The company has a market capitalization of $108.54 billion, a PE ratio of 16.58, a PEG ratio of 4.05 and a beta of 0.48. The company has a current ratio of 1.30, a quick ratio of 1.12 and a debt-to-equity ratio of 2.66. Lockheed Martin has a 12-month low of $413.92 and a 12-month high of $618.95. The business's 50 day simple moving average is $498.68 and its 200-day simple moving average is $537.59.

Lockheed Martin (NYSE:LMT - Get Free Report) last released its earnings results on Tuesday, January 28th. The aerospace company reported $7.67 EPS for the quarter, topping analysts' consensus estimates of $6.58 by $1.09. Lockheed Martin had a return on equity of 101.44% and a net margin of 9.36%. On average, equities research analysts anticipate that Lockheed Martin will post 26.89 earnings per share for the current year.

Analyst Upgrades and Downgrades

Several equities research analysts have commented on LMT shares. StockNews.com lowered shares of Lockheed Martin from a "strong-buy" rating to a "buy" rating in a report on Friday, January 3rd. Royal Bank of Canada lowered their target price on shares of Lockheed Martin from $675.00 to $665.00 and set an "outperform" rating for the company in a research note on Wednesday, October 23rd. Robert W. Baird upped their price target on Lockheed Martin from $519.00 to $626.00 in a research note on Tuesday, October 22nd. Susquehanna cut their price target on Lockheed Martin from $695.00 to $590.00 and set a "positive" rating for the company in a research note on Wednesday, January 8th. Finally, Barclays reduced their price target on Lockheed Martin from $565.00 to $515.00 and set an "equal weight" rating for the company in a report on Monday, January 6th. One investment analyst has rated the stock with a sell rating, five have given a hold rating, nine have assigned a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $577.73.

View Our Latest Report on Lockheed Martin

Lockheed Martin Company Profile

(

Get Free Report)

Lockheed Martin Corporation, a security and aerospace company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide. The company operates through Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space segments.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lockheed Martin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lockheed Martin wasn't on the list.

While Lockheed Martin currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.