Logan Capital Management Inc. bought a new stake in shares of Regions Financial Co. (NYSE:RF - Free Report) during the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The firm bought 94,084 shares of the bank's stock, valued at approximately $2,195,000.

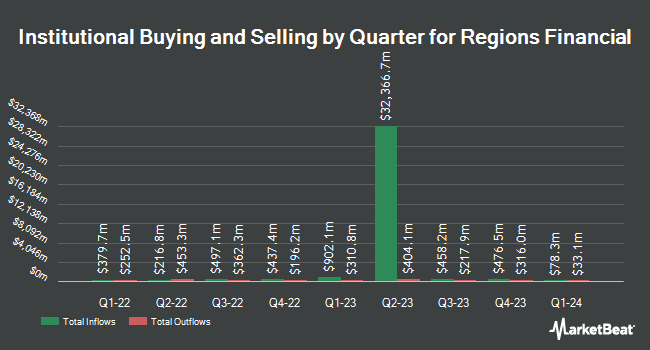

Other large investors have also recently bought and sold shares of the company. State Street Corp lifted its holdings in shares of Regions Financial by 16.3% in the third quarter. State Street Corp now owns 55,485,987 shares of the bank's stock valued at $1,306,813,000 after buying an additional 7,791,399 shares during the period. Charles Schwab Investment Management Inc. raised its position in Regions Financial by 3.0% in the third quarter. Charles Schwab Investment Management Inc. now owns 27,786,933 shares of the bank's stock worth $648,269,000 after acquiring an additional 816,226 shares in the last quarter. Geode Capital Management LLC lifted its holdings in Regions Financial by 1.4% in the 3rd quarter. Geode Capital Management LLC now owns 22,625,214 shares of the bank's stock valued at $526,118,000 after acquiring an additional 315,605 shares during the last quarter. Dimensional Fund Advisors LP boosted its position in shares of Regions Financial by 7.4% during the 2nd quarter. Dimensional Fund Advisors LP now owns 14,252,693 shares of the bank's stock valued at $285,562,000 after purchasing an additional 979,597 shares in the last quarter. Finally, Allspring Global Investments Holdings LLC boosted its position in shares of Regions Financial by 13.3% during the 3rd quarter. Allspring Global Investments Holdings LLC now owns 8,625,734 shares of the bank's stock valued at $201,238,000 after purchasing an additional 1,014,706 shares in the last quarter. Institutional investors and hedge funds own 79.39% of the company's stock.

Wall Street Analyst Weigh In

RF has been the subject of several recent research reports. Argus raised shares of Regions Financial from a "hold" rating to a "buy" rating and set a $26.00 target price for the company in a research note on Thursday, October 24th. StockNews.com upgraded Regions Financial from a "sell" rating to a "hold" rating in a research report on Friday, October 25th. Evercore ISI lifted their target price on Regions Financial from $24.50 to $26.00 and gave the stock an "in-line" rating in a report on Wednesday, October 2nd. Wells Fargo & Company upped their target price on Regions Financial from $24.00 to $28.00 and gave the company an "equal weight" rating in a report on Friday, November 15th. Finally, The Goldman Sachs Group increased their price target on Regions Financial from $29.00 to $33.00 and gave the company a "buy" rating in a research report on Tuesday, November 26th. One analyst has rated the stock with a sell rating, seven have given a hold rating and eleven have assigned a buy rating to the company. According to data from MarketBeat.com, Regions Financial currently has a consensus rating of "Moderate Buy" and a consensus target price of $27.61.

View Our Latest Research Report on Regions Financial

Regions Financial Stock Up 0.2 %

RF stock traded up $0.06 during midday trading on Friday, reaching $25.11. The company had a trading volume of 7,466,738 shares, compared to its average volume of 7,879,551. The company has a 50 day moving average of $25.11 and a two-hundred day moving average of $22.51. The company has a current ratio of 0.84, a quick ratio of 0.83 and a debt-to-equity ratio of 0.35. Regions Financial Co. has a 1 year low of $17.42 and a 1 year high of $27.96. The company has a market capitalization of $22.82 billion, a P/E ratio of 14.19, a PEG ratio of 2.64 and a beta of 1.19.

Regions Financial (NYSE:RF - Get Free Report) last announced its quarterly earnings data on Friday, October 18th. The bank reported $0.49 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.53 by ($0.04). Regions Financial had a return on equity of 12.60% and a net margin of 18.78%. The firm had revenue of $1.79 billion for the quarter, compared to analysts' expectations of $1.80 billion. During the same quarter in the prior year, the business posted $0.49 earnings per share. Regions Financial's revenue was down 3.7% on a year-over-year basis. On average, equities research analysts expect that Regions Financial Co. will post 2.12 earnings per share for the current fiscal year.

Regions Financial Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, January 2nd. Investors of record on Monday, December 2nd will be issued a $0.25 dividend. The ex-dividend date is Monday, December 2nd. This represents a $1.00 dividend on an annualized basis and a yield of 3.98%. Regions Financial's dividend payout ratio is currently 56.50%.

Regions Financial Profile

(

Free Report)

Regions Financial Corporation, a financial holding company, provides banking and bank-related services to individual and corporate customers. It operates through three segments: Corporate Bank, Consumer Bank, and Wealth Management. The Corporate Bank segment offers commercial banking services, such as commercial and industrial, commercial real estate, and investor real estate lending; equipment lease financing; deposit products; and securities underwriting and placement, loan syndication and placement, foreign exchange, derivatives, merger and acquisition, and other advisory services.

Featured Articles

Before you consider Regions Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regions Financial wasn't on the list.

While Regions Financial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.