Korea Investment CORP grew its stake in shares of Logitech International S.A. (NASDAQ:LOGI - Free Report) by 74.6% during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 83,839 shares of the technology company's stock after purchasing an additional 35,814 shares during the period. Korea Investment CORP owned approximately 0.05% of Logitech International worth $6,942,000 as of its most recent SEC filing.

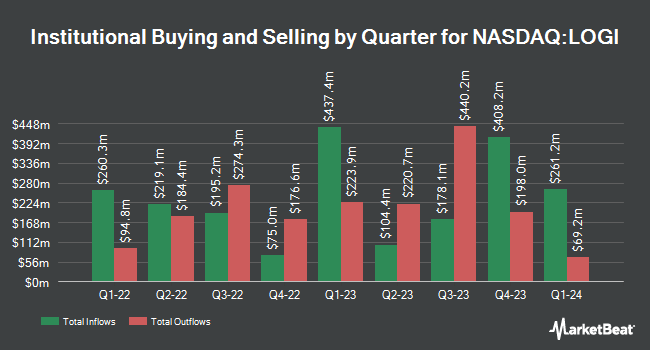

Several other hedge funds and other institutional investors also recently modified their holdings of the stock. PNC Financial Services Group Inc. raised its holdings in Logitech International by 2.3% in the fourth quarter. PNC Financial Services Group Inc. now owns 5,556 shares of the technology company's stock worth $458,000 after purchasing an additional 127 shares in the last quarter. Investment Management Corp of Ontario grew its holdings in shares of Logitech International by 0.4% during the third quarter. Investment Management Corp of Ontario now owns 40,439 shares of the technology company's stock valued at $3,629,000 after buying an additional 170 shares during the last quarter. Tealwood Asset Management Inc. boosted its stake in Logitech International by 1.2% during the 4th quarter. Tealwood Asset Management Inc. now owns 14,952 shares of the technology company's stock valued at $1,231,000 after purchasing an additional 175 shares during the last quarter. EverSource Wealth Advisors LLC increased its holdings in Logitech International by 16.6% in the 4th quarter. EverSource Wealth Advisors LLC now owns 1,494 shares of the technology company's stock worth $123,000 after buying an additional 213 shares in the last quarter. Finally, Townsquare Capital LLC grew its stake in shares of Logitech International by 3.0% in the third quarter. Townsquare Capital LLC now owns 7,632 shares of the technology company's stock worth $685,000 after acquiring an additional 225 shares during the period. Hedge funds and other institutional investors own 45.76% of the company's stock.

Analysts Set New Price Targets

Several research analysts have recently commented on the company. Morgan Stanley raised Logitech International from an "underweight" rating to an "equal weight" rating and raised their price objective for the stock from $73.00 to $92.00 in a research note on Thursday, January 23rd. Kepler Capital Markets raised shares of Logitech International from a "hold" rating to a "buy" rating in a report on Thursday, January 30th. Barclays lifted their target price on Logitech International from $103.00 to $108.00 and gave the stock an "overweight" rating in a report on Wednesday, January 29th. Deutsche Bank Aktiengesellschaft raised shares of Logitech International from a "sell" rating to a "hold" rating in a report on Friday, January 31st. Finally, Citigroup upped their price objective on Logitech International from $92.00 to $105.00 and gave the company a "neutral" rating in a research report on Wednesday, January 29th. Eight investment analysts have rated the stock with a hold rating and three have given a buy rating to the stock. According to data from MarketBeat, the company currently has a consensus rating of "Hold" and a consensus target price of $97.71.

Read Our Latest Report on LOGI

Insider Activity

In related news, insider Samantha Harnett sold 300 shares of the firm's stock in a transaction dated Monday, February 3rd. The shares were sold at an average price of $96.60, for a total transaction of $28,980.00. Following the completion of the sale, the insider now directly owns 7,348 shares in the company, valued at approximately $709,816.80. This trade represents a 3.92 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Company insiders own 0.16% of the company's stock.

Logitech International Stock Down 3.0 %

Shares of LOGI stock traded down $2.11 on Friday, hitting $69.30. The stock had a trading volume of 2,032,602 shares, compared to its average volume of 564,169. The business has a 50 day moving average price of $95.10 and a 200 day moving average price of $87.91. Logitech International S.A. has a one year low of $67.20 and a one year high of $105.65. The company has a market cap of $10.96 billion, a PE ratio of 16.27, a P/E/G ratio of 2.61 and a beta of 0.97.

Logitech International (NASDAQ:LOGI - Get Free Report) last posted its quarterly earnings data on Tuesday, January 28th. The technology company reported $1.42 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.35 by $0.07. Logitech International had a net margin of 14.38% and a return on equity of 30.53%. Equities research analysts expect that Logitech International S.A. will post 4.21 EPS for the current year.

Logitech International declared that its board has approved a stock buyback plan on Wednesday, March 5th that allows the company to repurchase $600.00 million in shares. This repurchase authorization allows the technology company to buy up to 3.9% of its shares through open market purchases. Shares repurchase plans are usually an indication that the company's board believes its stock is undervalued.

Logitech International Company Profile

(

Free Report)

Logitech International SA, through its subsidiaries, designs, manufactures, and markets software-enabled hardware solutions that connect people to working, creating, gaming, and streaming worldwide. The company offers products for gamers and streamers, including mice, racing wheels, headsets, keyboards, microphones, and streaming services; corded and cordless keyboards and keyboard-and-mouse combinations; pointing devices, such as wireless mice and wireless mouse products; conference room cameras, such as ConferenceCams; controllers for video conferencing room solutions; PC-based webcams, including streaming cameras and VC webcams; tablet accessories that includes keyboards for tablets; PC and VC headsets, in-ear headphones, and premium wireless earbuds; and mobile speakers and PC speakers, as well as portable wireless Bluetooth speakers.

Read More

Before you consider Logitech International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Logitech International wasn't on the list.

While Logitech International currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.