Shore Capital reissued their buy rating on shares of Close Brothers Group (LON:CBG - Free Report) in a research note published on Friday, Marketbeat Ratings reports.

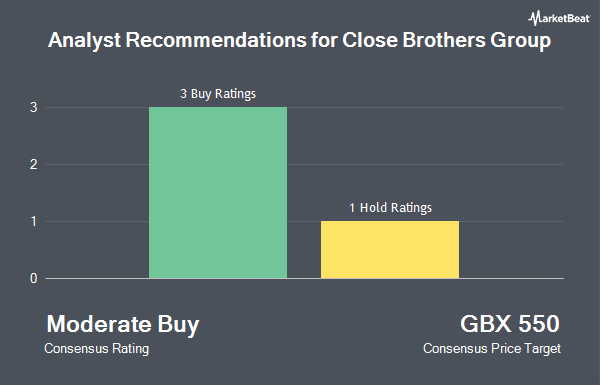

A number of other research firms have also weighed in on CBG. Royal Bank of Canada raised Close Brothers Group to an "outperform" rating and boosted their target price for the company from GBX 375 ($4.87) to GBX 620 ($8.05) in a research note on Thursday, August 29th. Deutsche Bank Aktiengesellschaft began coverage on Close Brothers Group in a research report on Friday, July 5th. They issued a "buy" rating and a GBX 610 ($7.92) price objective for the company. Five analysts have rated the stock with a buy rating, According to MarketBeat, the stock currently has a consensus rating of "Buy" and a consensus target price of GBX 556.60 ($7.23).

Check Out Our Latest Research Report on CBG

Close Brothers Group Stock Performance

LON:CBG traded down GBX 90.80 ($1.18) during trading hours on Friday, reaching GBX 276.60 ($3.59). The company's stock had a trading volume of 5,267,045 shares, compared to its average volume of 913,112. The firm has a market capitalization of £416.26 million, a price-to-earnings ratio of 489.29, a PEG ratio of 1.87 and a beta of 0.82. The firm has a 50-day simple moving average of GBX 453.50 and a 200-day simple moving average of GBX 465.95. Close Brothers Group has a 1 year low of GBX 276.60 ($3.59) and a 1 year high of GBX 844.10 ($10.96).

Insider Transactions at Close Brothers Group

In other Close Brothers Group news, insider Michael N. Biggs acquired 3,500 shares of the business's stock in a transaction dated Tuesday, September 24th. The shares were purchased at an average cost of GBX 416 ($5.40) per share, for a total transaction of £14,560 ($18,904.18). Over the last ninety days, insiders bought 3,600 shares of company stock worth $1,501,136. Company insiders own 2.91% of the company's stock.

Close Brothers Group Company Profile

(

Get Free Report)

Close Brothers Group plc, a merchant banking company, engages in the provision of financial services to small businesses and individuals in the United Kingdom. It operates through five segments: Commercial, Retail, Property, Asset Management, and Securities. The company offers banking services comprising of debt factoring, invoice discounting, asset-based lending; financing for SMEs, residential housing, transport, industrial equipment, renewable energy, motorcycle, used car, and commercial vehicle financing; insurance, refurbishment, and bridging financing, savings products for individuals and corporates, hire purchase, lease, and loan related services.

Further Reading

Before you consider Close Brothers Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Close Brothers Group wasn't on the list.

While Close Brothers Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.