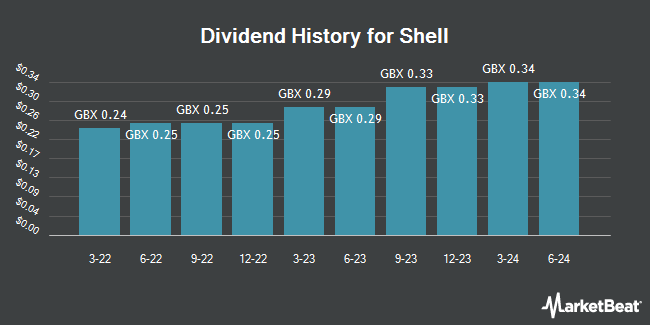

Shell plc (LON:SHEL - Get Free Report) announced a dividend on Thursday, October 31st, Upcoming.Co.Uk reports. Investors of record on Thursday, November 14th will be given a dividend of $0.34 per share on Thursday, December 19th. This represents a dividend yield of 1.06%. The ex-dividend date of this dividend is Thursday, November 14th. The official announcement can be seen at this link.

Shell Stock Performance

SHEL traded up GBX 88 ($1.14) during trading on Thursday, reaching GBX 2,578.50 ($33.44). 13,404,826 shares of the company's stock were exchanged, compared to its average volume of 11,600,452. The company has a debt-to-equity ratio of 40.32, a current ratio of 1.41 and a quick ratio of 0.87. Shell has a 1 year low of GBX 2,345 ($30.41) and a 1 year high of GBX 2,961 ($38.40). The company's fifty day simple moving average is GBX 2,568.75 and its 200-day simple moving average is GBX 2,726.63. The stock has a market capitalization of £159.35 billion, a P/E ratio of 1,178.14, a price-to-earnings-growth ratio of 2.50 and a beta of 0.51.

Wall Street Analyst Weigh In

A number of brokerages have issued reports on SHEL. Bank of America reissued a "buy" rating and issued a GBX 3,400 ($44.09) price target on shares of Shell in a report on Wednesday, September 4th. Berenberg Bank reissued a "buy" rating and set a GBX 3,400 ($44.09) price target on shares of Shell in a report on Tuesday, July 9th. Finally, JPMorgan Chase & Co. restated an "overweight" rating on shares of Shell in a research report on Tuesday, September 24th. Five analysts have rated the stock with a buy rating, Based on data from MarketBeat, Shell presently has a consensus rating of "Buy" and an average price target of GBX 3,400 ($44.09).

Check Out Our Latest Stock Analysis on SHEL

Shell Company Profile

(

Get Free Report)

Shell plc operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and Rest of the Americas. The company operates through Integrated Gas, Upstream, Marketing, Chemicals and Products, and Renewables and Energy Solutions segments. It explores for and extracts crude oil, natural gas, and natural gas liquids; markets and transports oil and gas; produces gas-to-liquids fuels and other products; and operates upstream and midstream infrastructure to deliver gas to market.

Further Reading

Before you consider Shell, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shell wasn't on the list.

While Shell currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.