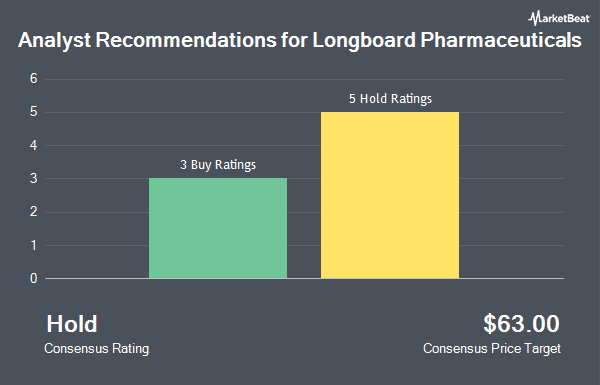

Shares of Longboard Pharmaceuticals, Inc. (NASDAQ:LBPH - Get Free Report) have earned an average rating of "Hold" from the nine brokerages that are covering the stock, Marketbeat reports. Five analysts have rated the stock with a hold rating and four have given a buy rating to the company. The average 12 month price target among analysts that have issued ratings on the stock in the last year is $59.56.

A number of research analysts have recently commented on LBPH shares. Evercore ISI reaffirmed an "outperform" rating and set a $80.00 price objective on shares of Longboard Pharmaceuticals in a research report on Monday, August 26th. B. Riley reaffirmed a "neutral" rating and set a $60.00 price objective (up previously from $45.00) on shares of Longboard Pharmaceuticals in a research report on Monday, October 14th. HC Wainwright reaffirmed a "neutral" rating and set a $60.00 price objective (down previously from $80.00) on shares of Longboard Pharmaceuticals in a research report on Tuesday, October 15th. Citigroup upped their price objective on shares of Longboard Pharmaceuticals from $45.00 to $50.00 and gave the company a "buy" rating in a research report on Friday, August 2nd. Finally, Wedbush lowered shares of Longboard Pharmaceuticals from a "strong-buy" rating to a "hold" rating in a research report on Monday, October 14th.

Read Our Latest Report on Longboard Pharmaceuticals

Insider Activity at Longboard Pharmaceuticals

In other Longboard Pharmaceuticals news, CMO Randall Kaye sold 16,667 shares of the company's stock in a transaction dated Tuesday, October 15th. The shares were sold at an average price of $59.03, for a total transaction of $983,853.01. Following the sale, the chief marketing officer now directly owns 17,920 shares of the company's stock, valued at approximately $1,057,817.60. This represents a 48.19 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. 4.64% of the stock is currently owned by insiders.

Institutional Trading of Longboard Pharmaceuticals

Large investors have recently added to or reduced their stakes in the company. Ameritas Investment Partners Inc. lifted its position in shares of Longboard Pharmaceuticals by 93.3% during the first quarter. Ameritas Investment Partners Inc. now owns 2,486 shares of the company's stock worth $54,000 after purchasing an additional 1,200 shares in the last quarter. KBC Group NV acquired a new position in shares of Longboard Pharmaceuticals during the third quarter worth approximately $65,000. Zurcher Kantonalbank Zurich Cantonalbank lifted its position in shares of Longboard Pharmaceuticals by 64.2% during the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 7,744 shares of the company's stock worth $258,000 after purchasing an additional 3,028 shares in the last quarter. Squarepoint Ops LLC lifted its position in shares of Longboard Pharmaceuticals by 30.4% during the second quarter. Squarepoint Ops LLC now owns 13,972 shares of the company's stock worth $378,000 after purchasing an additional 3,260 shares in the last quarter. Finally, American International Group Inc. lifted its position in shares of Longboard Pharmaceuticals by 58.6% during the first quarter. American International Group Inc. now owns 12,283 shares of the company's stock worth $265,000 after purchasing an additional 4,540 shares in the last quarter. 63.28% of the stock is owned by institutional investors.

Longboard Pharmaceuticals Trading Up 0.1 %

Longboard Pharmaceuticals stock traded up $0.03 on Friday, reaching $59.80. 1,289,112 shares of the stock were exchanged, compared to its average volume of 1,120,069. The stock has a market cap of $2.34 billion, a PE ratio of -26.81 and a beta of 1.07. Longboard Pharmaceuticals has a twelve month low of $3.60 and a twelve month high of $59.95. The firm has a fifty day moving average price of $48.60 and a two-hundred day moving average price of $35.51.

Longboard Pharmaceuticals (NASDAQ:LBPH - Get Free Report) last released its earnings results on Thursday, November 7th. The company reported ($0.63) earnings per share for the quarter, missing analysts' consensus estimates of ($0.59) by ($0.04). Equities analysts anticipate that Longboard Pharmaceuticals will post -2.22 EPS for the current fiscal year.

About Longboard Pharmaceuticals

(

Get Free ReportLongboard Pharmaceuticals, Inc, a clinical-stage biopharmaceutical company, focuses on developing novel and transformative medicines for neurological diseases. The company develops bexicaserin (LP352), which has completed Phase 1b/2a clinical trial for the treatment of seizures associated with developmental and epileptic encephalopathies.

Featured Articles

Before you consider Longboard Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Longboard Pharmaceuticals wasn't on the list.

While Longboard Pharmaceuticals currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.