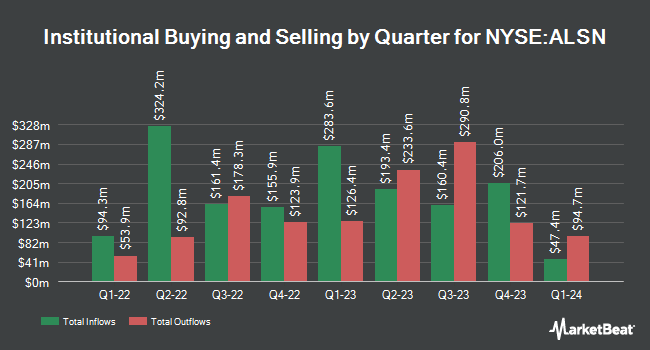

Loomis Sayles & Co. L P boosted its holdings in Allison Transmission Holdings, Inc. (NYSE:ALSN - Free Report) by 252.5% in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 593,044 shares of the auto parts company's stock after acquiring an additional 424,813 shares during the quarter. Loomis Sayles & Co. L P owned about 0.68% of Allison Transmission worth $56,974,000 as of its most recent filing with the SEC.

A number of other hedge funds and other institutional investors also recently bought and sold shares of the business. Versant Capital Management Inc grew its holdings in shares of Allison Transmission by 1,200.0% in the 2nd quarter. Versant Capital Management Inc now owns 364 shares of the auto parts company's stock worth $28,000 after acquiring an additional 336 shares during the period. Triad Wealth Partners LLC acquired a new position in shares of Allison Transmission during the 2nd quarter worth $33,000. Venturi Wealth Management LLC raised its stake in shares of Allison Transmission by 27.8% during the 3rd quarter. Venturi Wealth Management LLC now owns 744 shares of the auto parts company's stock worth $71,000 after buying an additional 162 shares during the last quarter. Capital Performance Advisors LLP purchased a new stake in shares of Allison Transmission in the 3rd quarter worth about $82,000. Finally, Fifth Third Bancorp grew its stake in Allison Transmission by 139.8% in the 2nd quarter. Fifth Third Bancorp now owns 868 shares of the auto parts company's stock valued at $66,000 after acquiring an additional 506 shares during the last quarter. Institutional investors and hedge funds own 96.90% of the company's stock.

Wall Street Analysts Forecast Growth

ALSN has been the topic of several recent research reports. Bank of America upped their price target on shares of Allison Transmission from $67.00 to $77.00 and gave the company an "underperform" rating in a report on Wednesday, October 30th. Oppenheimer increased their target price on Allison Transmission from $90.00 to $115.00 and gave the company an "outperform" rating in a report on Wednesday, October 30th. JPMorgan Chase & Co. boosted their price target on Allison Transmission from $80.00 to $100.00 and gave the stock a "neutral" rating in a report on Friday, October 11th. Robert W. Baird upped their price objective on Allison Transmission from $103.00 to $108.00 and gave the company a "neutral" rating in a research report on Wednesday, October 30th. Finally, Citigroup lifted their price objective on Allison Transmission from $115.00 to $125.00 and gave the stock a "neutral" rating in a research report on Wednesday, November 20th. Two investment analysts have rated the stock with a sell rating, four have issued a hold rating, two have given a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Hold" and a consensus target price of $94.25.

Read Our Latest Stock Analysis on Allison Transmission

Allison Transmission Trading Down 0.4 %

NYSE:ALSN traded down $0.45 during mid-day trading on Monday, reaching $119.20. The company's stock had a trading volume of 783,513 shares, compared to its average volume of 617,039. Allison Transmission Holdings, Inc. has a twelve month low of $53.09 and a twelve month high of $122.53. The company's fifty day simple moving average is $103.23 and its two-hundred day simple moving average is $88.56. The company has a debt-to-equity ratio of 1.48, a current ratio of 2.83 and a quick ratio of 2.25. The stock has a market cap of $10.33 billion, a P/E ratio of 14.56, a P/E/G ratio of 2.13 and a beta of 0.98.

Allison Transmission (NYSE:ALSN - Get Free Report) last issued its quarterly earnings results on Tuesday, October 29th. The auto parts company reported $2.27 EPS for the quarter, topping the consensus estimate of $2.01 by $0.26. The firm had revenue of $824.00 million during the quarter, compared to analyst estimates of $790.08 million. Allison Transmission had a net margin of 22.66% and a return on equity of 51.13%. Allison Transmission's revenue for the quarter was up 12.0% compared to the same quarter last year. During the same quarter in the prior year, the business posted $1.76 earnings per share. On average, equities analysts predict that Allison Transmission Holdings, Inc. will post 8.21 EPS for the current year.

Allison Transmission Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, November 27th. Investors of record on Monday, November 18th will be issued a $0.25 dividend. This represents a $1.00 dividend on an annualized basis and a yield of 0.84%. The ex-dividend date is Monday, November 18th. Allison Transmission's payout ratio is currently 12.18%.

Insider Buying and Selling at Allison Transmission

In related news, SVP John Coll sold 2,000 shares of the business's stock in a transaction that occurred on Friday, November 15th. The stock was sold at an average price of $117.73, for a total transaction of $235,460.00. Following the transaction, the senior vice president now directly owns 8,420 shares of the company's stock, valued at approximately $991,286.60. The trade was a 19.19 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through the SEC website. Also, VP Thomas Eifert sold 1,741 shares of the stock in a transaction that occurred on Monday, October 7th. The shares were sold at an average price of $100.00, for a total transaction of $174,100.00. Following the completion of the sale, the vice president now directly owns 9,601 shares of the company's stock, valued at $960,100. This trade represents a 15.35 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 7,741 shares of company stock valued at $781,520. Company insiders own 0.93% of the company's stock.

Allison Transmission Company Profile

(

Free Report)

Allison Transmission Holdings, Inc, together with its subsidiaries, designs, manufactures, and sells fully automatic transmissions for medium- and heavy-duty commercial vehicles and medium- and heavy-tactical U.S. defense vehicles, and electrified propulsion systems worldwide. It provides commercial-duty on-highway, off-highway and defense fully automatic transmissions, and electric hybrid and fully electric systems.

Read More

Before you consider Allison Transmission, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allison Transmission wasn't on the list.

While Allison Transmission currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.