Loomis Sayles & Co. L P lessened its position in Wix.com Ltd. (NASDAQ:WIX - Free Report) by 3.0% during the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 183,068 shares of the information services provider's stock after selling 5,678 shares during the period. Loomis Sayles & Co. L P owned 0.33% of Wix.com worth $39,277,000 at the end of the most recent reporting period.

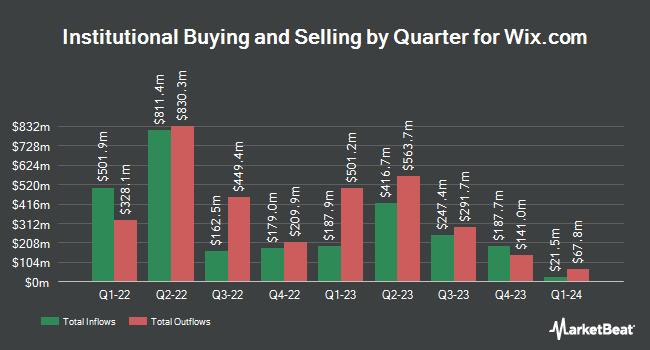

A number of other hedge funds have also recently modified their holdings of WIX. Korea Investment CORP increased its holdings in Wix.com by 0.5% during the 4th quarter. Korea Investment CORP now owns 20,528 shares of the information services provider's stock valued at $4,404,000 after purchasing an additional 100 shares during the period. United Super Pty Ltd in its capacity as Trustee for the Construction & Building Unions Superannuation Fund bought a new stake in shares of Wix.com in the 4th quarter worth approximately $386,000. LPL Financial LLC increased its stake in shares of Wix.com by 24.4% during the fourth quarter. LPL Financial LLC now owns 7,277 shares of the information services provider's stock valued at $1,561,000 after buying an additional 1,429 shares during the period. KLP Kapitalforvaltning AS bought a new position in shares of Wix.com during the fourth quarter valued at approximately $4,119,000. Finally, Marietta Investment Partners LLC purchased a new stake in Wix.com in the fourth quarter worth $1,251,000. Hedge funds and other institutional investors own 81.52% of the company's stock.

Wix.com Trading Up 0.1 %

WIX stock traded up $0.11 during midday trading on Tuesday, hitting $163.49. The company's stock had a trading volume of 262,623 shares, compared to its average volume of 619,173. Wix.com Ltd. has a 12 month low of $117.58 and a 12 month high of $247.11. The firm's 50-day moving average is $203.44 and its 200-day moving average is $197.20. The company has a market cap of $9.17 billion, a PE ratio of 69.37, a P/E/G ratio of 2.83 and a beta of 1.64.

Wix.com declared that its board has initiated a stock buyback plan on Thursday, February 27th that authorizes the company to buyback $200.00 million in outstanding shares. This buyback authorization authorizes the information services provider to reacquire up to 1.8% of its stock through open market purchases. Stock buyback plans are often a sign that the company's board believes its shares are undervalued.

Analysts Set New Price Targets

Several research analysts have commented on the stock. Needham & Company LLC restated a "buy" rating and issued a $235.00 price objective on shares of Wix.com in a report on Wednesday, February 19th. Citigroup raised their price objective on shares of Wix.com from $275.00 to $280.00 and gave the stock a "buy" rating in a report on Thursday, February 20th. Barclays lifted their price objective on Wix.com from $236.00 to $240.00 and gave the company an "overweight" rating in a research report on Thursday, February 20th. Raymond James upgraded Wix.com from an "outperform" rating to a "strong-buy" rating and raised their target price for the company from $225.00 to $300.00 in a research note on Tuesday, January 21st. Finally, Piper Sandler upped their price target on Wix.com from $249.00 to $262.00 and gave the stock an "overweight" rating in a research note on Friday, February 21st. One research analyst has rated the stock with a sell rating, three have issued a hold rating, fifteen have given a buy rating and three have issued a strong buy rating to the company. According to data from MarketBeat.com, Wix.com has a consensus rating of "Moderate Buy" and a consensus price target of $243.74.

Check Out Our Latest Stock Analysis on Wix.com

Wix.com Company Profile

(

Free Report)

Wix.com Ltd., together with its subsidiaries, operates as a cloud-based web development platform for registered users and creators worldwide. The company offers Wix Editor, a drag-and-drop visual development and website editing environment platform; and Wix ADI that enables users to have the freedom of customization that the classic editor offers.

See Also

Before you consider Wix.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wix.com wasn't on the list.

While Wix.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for May 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.