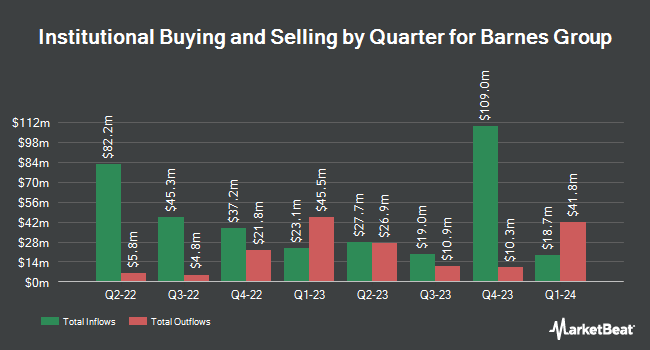

Loomis Sayles & Co. L P lifted its holdings in shares of Barnes Group Inc. (NYSE:B - Free Report) by 12.5% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 238,401 shares of the industrial products company's stock after buying an additional 26,417 shares during the period. Loomis Sayles & Co. L P owned approximately 0.47% of Barnes Group worth $9,634,000 at the end of the most recent reporting period.

Other institutional investors and hedge funds have also added to or reduced their stakes in the company. GAMMA Investing LLC raised its position in shares of Barnes Group by 17.1% during the 3rd quarter. GAMMA Investing LLC now owns 1,630 shares of the industrial products company's stock worth $66,000 after buying an additional 238 shares in the last quarter. SG Americas Securities LLC bought a new stake in Barnes Group during the third quarter worth approximately $178,000. Quest Partners LLC acquired a new stake in Barnes Group in the third quarter worth approximately $248,000. QRG Capital Management Inc. boosted its stake in Barnes Group by 4.1% during the 2nd quarter. QRG Capital Management Inc. now owns 6,073 shares of the industrial products company's stock valued at $251,000 after purchasing an additional 240 shares in the last quarter. Finally, Intech Investment Management LLC acquired a new position in shares of Barnes Group during the 2nd quarter valued at $277,000. 90.82% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several research analysts recently weighed in on the company. DA Davidson reaffirmed a "neutral" rating and set a $47.50 target price (down previously from $52.00) on shares of Barnes Group in a research note on Monday, October 7th. Truist Financial raised their price objective on shares of Barnes Group from $38.00 to $47.50 and gave the company a "hold" rating in a research report on Tuesday, October 8th. Finally, StockNews.com began coverage on shares of Barnes Group in a report on Tuesday. They issued a "sell" rating on the stock.

Check Out Our Latest Research Report on B

Barnes Group Trading Up 0.0 %

Shares of NYSE:B traded up $0.01 during midday trading on Thursday, reaching $46.86. The company had a trading volume of 441,468 shares, compared to its average volume of 434,923. The company has a fifty day simple moving average of $45.10 and a two-hundred day simple moving average of $41.42. The firm has a market cap of $2.39 billion, a price-to-earnings ratio of -60.86, a price-to-earnings-growth ratio of 3.37 and a beta of 1.35. Barnes Group Inc. has a 1-year low of $25.75 and a 1-year high of $47.40. The company has a debt-to-equity ratio of 0.87, a quick ratio of 1.35 and a current ratio of 2.28.

Barnes Group Company Profile

(

Free Report)

Barnes Group Inc provides engineered products, industrial technologies, and solutions in the United States and internationally. The company operates through two segments: Industrial and Aerospace. The Industrial segment offers precision components, products, and systems used by various customers in end-markets, such as mobility, industrial equipment, automation, personal care, packaging, electronics, and medical devices.

See Also

Before you consider Barnes Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Barnes Group wasn't on the list.

While Barnes Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.