Loomis Sayles & Co. L P increased its stake in shares of J&J Snack Foods Corp. (NASDAQ:JJSF - Free Report) by 36.0% in the 4th quarter, according to its most recent 13F filing with the SEC. The firm owned 47,061 shares of the company's stock after buying an additional 12,453 shares during the period. Loomis Sayles & Co. L P owned 0.24% of J&J Snack Foods worth $7,301,000 as of its most recent filing with the SEC.

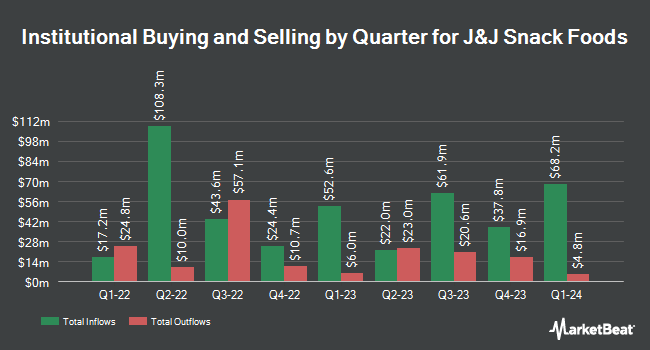

Several other institutional investors and hedge funds also recently made changes to their positions in the company. JPMorgan Chase & Co. increased its position in J&J Snack Foods by 60.6% during the fourth quarter. JPMorgan Chase & Co. now owns 71,571 shares of the company's stock worth $11,103,000 after acquiring an additional 26,999 shares during the period. ICW Investment Advisors LLC lifted its stake in shares of J&J Snack Foods by 5.5% in the 4th quarter. ICW Investment Advisors LLC now owns 4,979 shares of the company's stock valued at $772,000 after acquiring an additional 259 shares during the last quarter. Vanguard Group Inc. boosted its stake in shares of J&J Snack Foods by 1.2% during the fourth quarter. Vanguard Group Inc. now owns 1,653,173 shares of the company's stock valued at $256,457,000 after purchasing an additional 20,238 shares in the last quarter. Bridge City Capital LLC grew its holdings in J&J Snack Foods by 0.9% during the 4th quarter. Bridge City Capital LLC now owns 16,571 shares of the company's stock worth $2,571,000 after acquiring an additional 147 shares during the last quarter. Finally, LPL Financial LLC raised its stake in shares of J&J Snack Foods by 15.1% during the fourth quarter. LPL Financial LLC now owns 4,314 shares of the company's stock valued at $669,000 after acquiring an additional 567 shares during the last quarter. Institutional investors and hedge funds own 76.04% of the company's stock.

J&J Snack Foods Price Performance

Shares of JJSF traded up $2.02 during trading hours on Thursday, hitting $132.88. The stock had a trading volume of 33,867 shares, compared to its average volume of 98,654. The firm has a 50 day simple moving average of $131.20 and a 200-day simple moving average of $152.48. J&J Snack Foods Corp. has a 1-year low of $116.60 and a 1-year high of $180.80. The firm has a market capitalization of $2.59 billion, a P/E ratio of 30.62 and a beta of 0.66.

J&J Snack Foods (NASDAQ:JJSF - Get Free Report) last issued its quarterly earnings data on Monday, February 3rd. The company reported $0.33 EPS for the quarter, missing analysts' consensus estimates of $0.62 by ($0.29). J&J Snack Foods had a return on equity of 9.84% and a net margin of 5.31%. Equities analysts predict that J&J Snack Foods Corp. will post 4.75 EPS for the current fiscal year.

J&J Snack Foods Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, April 8th. Shareholders of record on Tuesday, March 18th will be given a $0.78 dividend. This represents a $3.12 dividend on an annualized basis and a yield of 2.35%. The ex-dividend date is Tuesday, March 18th. J&J Snack Foods's payout ratio is 71.89%.

Analyst Upgrades and Downgrades

Several equities research analysts have recently weighed in on the company. Jefferies Financial Group decreased their price target on J&J Snack Foods from $175.00 to $135.00 and set a "hold" rating for the company in a research note on Tuesday, February 18th. Benchmark reissued a "buy" rating and issued a $200.00 price objective on shares of J&J Snack Foods in a research note on Tuesday, February 4th.

Read Our Latest Analysis on JJSF

J&J Snack Foods Company Profile

(

Free Report)

J&J Snack Foods Corp. engages in the manufacturing of nutritional snack foods and distribution of frozen beverages to the food service and retail supermarket industries. It operates through the following segments: Food Service, Retail Supermarkets, and Frozen Beverages. The Food Service segment includes soft pretzels, frozen novelties, churros, handheld products, and baked goods.

Recommended Stories

Before you consider J&J Snack Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and J&J Snack Foods wasn't on the list.

While J&J Snack Foods currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.