Loomis Sayles & Co. L P decreased its stake in shares of The Andersons, Inc. (NASDAQ:ANDE - Free Report) by 45.2% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 145,335 shares of the basic materials company's stock after selling 119,743 shares during the quarter. Loomis Sayles & Co. L P owned about 0.43% of Andersons worth $7,287,000 at the end of the most recent quarter.

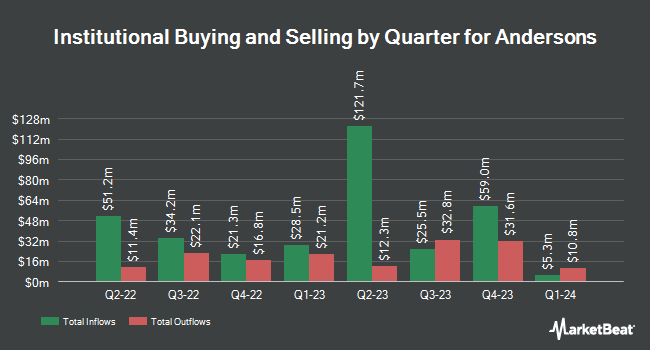

Other hedge funds have also added to or reduced their stakes in the company. Intech Investment Management LLC boosted its stake in Andersons by 375.0% in the 3rd quarter. Intech Investment Management LLC now owns 42,225 shares of the basic materials company's stock worth $2,117,000 after purchasing an additional 33,336 shares in the last quarter. Renaissance Technologies LLC lifted its stake in shares of Andersons by 13.1% in the second quarter. Renaissance Technologies LLC now owns 159,576 shares of the basic materials company's stock worth $7,915,000 after buying an additional 18,500 shares in the last quarter. Deerfield Management Company L.P. Series C purchased a new stake in shares of Andersons during the second quarter valued at approximately $1,040,000. Panagora Asset Management Inc. grew its holdings in shares of Andersons by 5.2% during the second quarter. Panagora Asset Management Inc. now owns 207,913 shares of the basic materials company's stock valued at $10,312,000 after buying an additional 10,222 shares during the last quarter. Finally, Victory Capital Management Inc. increased its position in shares of Andersons by 7.0% during the third quarter. Victory Capital Management Inc. now owns 488,505 shares of the basic materials company's stock valued at $24,494,000 after acquiring an additional 31,881 shares in the last quarter. 87.06% of the stock is owned by institutional investors.

Analyst Ratings Changes

Separately, StockNews.com upgraded Andersons from a "hold" rating to a "buy" rating in a research note on Wednesday, November 13th.

Get Our Latest Research Report on Andersons

Andersons Stock Performance

Andersons stock traded up $0.11 during midday trading on Thursday, reaching $47.93. 194,261 shares of the company traded hands, compared to its average volume of 174,554. The Andersons, Inc. has a 12 month low of $41.76 and a 12 month high of $61.46. The company has a debt-to-equity ratio of 0.36, a current ratio of 1.98 and a quick ratio of 1.23. The business has a 50 day moving average of $48.14 and a two-hundred day moving average of $49.29. The firm has a market capitalization of $1.63 billion, a price-to-earnings ratio of 13.69 and a beta of 0.60.

Andersons (NASDAQ:ANDE - Get Free Report) last released its quarterly earnings results on Monday, November 4th. The basic materials company reported $0.80 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.43 by $0.37. The firm had revenue of $2.62 billion for the quarter, compared to the consensus estimate of $2.90 billion. Andersons had a return on equity of 8.21% and a net margin of 1.06%. The company's revenue for the quarter was down 27.9% on a year-over-year basis. During the same period last year, the business posted $0.13 EPS.

Andersons Company Profile

(

Free Report)

The Andersons, Inc operates in trade, renewables, and nutrient and industrial sectors in the United States, Canada, Mexico, Egypt, Switzerland, and internationally. It operates through three segments: Trade, Renewables, and Nutrient & Industrial. The company's Trade segment operates grain elevators; stores commodities; and provides grain marketing, risk management, and origination services, as well as sells commodities, such as corn, soybeans, wheat, oats, ethanol, and corn oil.

Read More

Before you consider Andersons, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Andersons wasn't on the list.

While Andersons currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.