Lord Abbett & CO. LLC acquired a new stake in U-Haul Holding (NASDAQ:UHAL - Free Report) during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The firm acquired 224,036 shares of the transportation company's stock, valued at approximately $17,358,000. Lord Abbett & CO. LLC owned about 0.11% of U-Haul as of its most recent SEC filing.

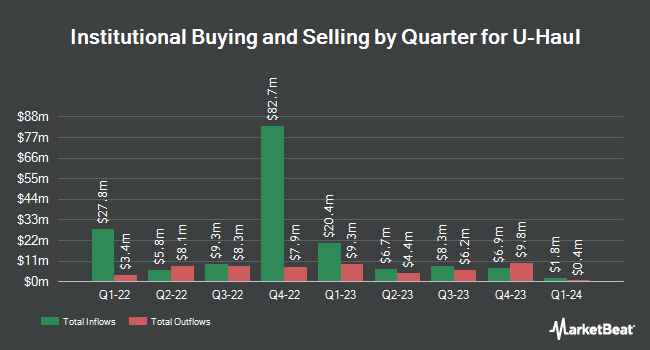

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Motley Fool Asset Management LLC bought a new stake in shares of U-Haul during the third quarter valued at approximately $201,000. Legacy Capital Group California Inc. bought a new stake in U-Haul during the 3rd quarter valued at $244,000. Anthracite Investment Company Inc. acquired a new position in U-Haul during the 3rd quarter worth $269,000. Atom Investors LP bought a new position in shares of U-Haul in the third quarter worth $301,000. Finally, Lodestone Wealth Management LLC raised its stake in shares of U-Haul by 5.6% during the third quarter. Lodestone Wealth Management LLC now owns 4,407 shares of the transportation company's stock valued at $341,000 after purchasing an additional 233 shares in the last quarter. 3.63% of the stock is owned by institutional investors and hedge funds.

U-Haul Price Performance

UHAL stock traded down $1.21 during trading on Monday, hitting $72.05. The company had a trading volume of 95,673 shares, compared to its average volume of 97,420. The firm has a market capitalization of $14.13 billion, a price-to-earnings ratio of 31.06 and a beta of 1.09. The company has a current ratio of 2.33, a quick ratio of 2.16 and a debt-to-equity ratio of 0.88. The business has a 50 day moving average of $72.55 and a 200 day moving average of $69.40. U-Haul Holding has a fifty-two week low of $59.70 and a fifty-two week high of $79.04.

U-Haul (NASDAQ:UHAL - Get Free Report) last posted its quarterly earnings data on Wednesday, November 6th. The transportation company reported $0.91 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.37 by ($0.46). U-Haul had a net margin of 8.39% and a return on equity of 6.46%. The company had revenue of $1.66 billion during the quarter, compared to the consensus estimate of $1.69 billion. During the same quarter last year, the business earned $1.36 earnings per share. As a group, research analysts predict that U-Haul Holding will post 2.31 earnings per share for the current year.

U-Haul Company Profile

(

Free Report)

U-Haul Holding Company operates as a do-it-yourself moving and storage operator for household and commercial goods in the United States and Canada. The company's Moving and Storage segment rents trucks, trailers, portable moving and storage units, specialty rental items, and self-storage spaces primarily to the household movers; and sells moving supplies, towing accessories, and propane.

Featured Articles

Before you consider U-Haul, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and U-Haul wasn't on the list.

While U-Haul currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.