Lord Abbett & CO. LLC grew its position in shares of The Cooper Companies, Inc. (NASDAQ:COO - Free Report) by 6.3% in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 251,402 shares of the medical device company's stock after acquiring an additional 14,957 shares during the quarter. Lord Abbett & CO. LLC owned 0.13% of Cooper Companies worth $27,740,000 at the end of the most recent reporting period.

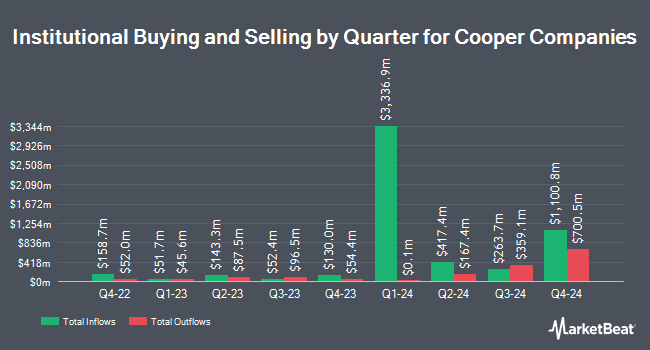

A number of other hedge funds and other institutional investors also recently made changes to their positions in COO. Wealth Enhancement Advisory Services LLC increased its position in shares of Cooper Companies by 2.8% in the second quarter. Wealth Enhancement Advisory Services LLC now owns 6,797 shares of the medical device company's stock valued at $593,000 after acquiring an additional 184 shares during the last quarter. Blue Trust Inc. increased its position in shares of Cooper Companies by 112.7% during the 2nd quarter. Blue Trust Inc. now owns 553 shares of the medical device company's stock worth $48,000 after purchasing an additional 293 shares during the last quarter. Raymond James & Associates raised its stake in shares of Cooper Companies by 4.4% during the 2nd quarter. Raymond James & Associates now owns 647,106 shares of the medical device company's stock worth $56,492,000 after purchasing an additional 27,442 shares in the last quarter. First Horizon Advisors Inc. boosted its holdings in shares of Cooper Companies by 4.8% in the 2nd quarter. First Horizon Advisors Inc. now owns 2,709 shares of the medical device company's stock valued at $236,000 after buying an additional 125 shares during the last quarter. Finally, Fifth Third Bancorp grew its stake in shares of Cooper Companies by 6.3% in the second quarter. Fifth Third Bancorp now owns 8,465 shares of the medical device company's stock valued at $739,000 after buying an additional 502 shares in the last quarter. 24.39% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several analysts have issued reports on COO shares. StockNews.com lowered shares of Cooper Companies from a "buy" rating to a "hold" rating in a research report on Wednesday, December 11th. Wells Fargo & Company raised their target price on shares of Cooper Companies from $115.00 to $118.00 and gave the company an "overweight" rating in a research note on Friday, December 6th. Needham & Company LLC reaffirmed a "hold" rating on shares of Cooper Companies in a research report on Friday, December 6th. Robert W. Baird raised their price target on Cooper Companies from $118.00 to $125.00 and gave the company an "outperform" rating in a report on Thursday, August 29th. Finally, Piper Sandler increased their price objective on shares of Cooper Companies from $115.00 to $120.00 and gave the company an "overweight" rating in a research report on Thursday, August 29th. Four research analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $117.00.

View Our Latest Report on Cooper Companies

Insider Transactions at Cooper Companies

In related news, CEO Albert G. White III sold 114,992 shares of the company's stock in a transaction that occurred on Thursday, September 19th. The shares were sold at an average price of $110.53, for a total transaction of $12,710,065.76. Following the completion of the transaction, the chief executive officer now directly owns 165,273 shares in the company, valued at $18,267,624.69. This represents a 41.03 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. 2.00% of the stock is owned by insiders.

Cooper Companies Price Performance

COO traded down $0.87 on Monday, hitting $93.98. 1,963,229 shares of the stock were exchanged, compared to its average volume of 1,167,068. The company has a debt-to-equity ratio of 0.32, a current ratio of 1.91 and a quick ratio of 1.12. The Cooper Companies, Inc. has a 12 month low of $84.76 and a 12 month high of $112.38. The firm has a market capitalization of $18.76 billion, a price-to-earnings ratio of 48.19, a PEG ratio of 2.52 and a beta of 0.97. The business has a 50-day moving average of $103.26 and a two-hundred day moving average of $99.00.

Cooper Companies (NASDAQ:COO - Get Free Report) last posted its quarterly earnings results on Thursday, December 5th. The medical device company reported $1.04 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.00 by $0.04. Cooper Companies had a net margin of 10.07% and a return on equity of 9.38%. The business had revenue of $1.02 billion for the quarter, compared to analyst estimates of $1.03 billion. During the same quarter last year, the business posted $0.87 EPS. The firm's revenue for the quarter was up 9.8% on a year-over-year basis. Sell-side analysts forecast that The Cooper Companies, Inc. will post 3.98 EPS for the current fiscal year.

Cooper Companies Profile

(

Free Report)

The Cooper Companies, Inc, together with its subsidiaries, develops, manufactures, and markets contact lens wearers. The company operates in two segments, CooperVision and CooperSurgical. The CooperVision segment provides spherical lense, including lenses that correct near and farsightedness; and toric and multifocal lenses comprising lenses correcting vision challenges, such as astigmatism, presbyopia, and myopia in the Americas, Europe, Middle East, Africa, and Asia Pacific.

Featured Articles

Before you consider Cooper Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cooper Companies wasn't on the list.

While Cooper Companies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.