Lord Abbett & CO. LLC decreased its position in shares of Best Buy Co., Inc. (NYSE:BBY - Free Report) by 9.4% during the 3rd quarter, according to its most recent disclosure with the SEC. The firm owned 837,292 shares of the technology retailer's stock after selling 87,182 shares during the period. Lord Abbett & CO. LLC owned 0.39% of Best Buy worth $86,492,000 as of its most recent SEC filing.

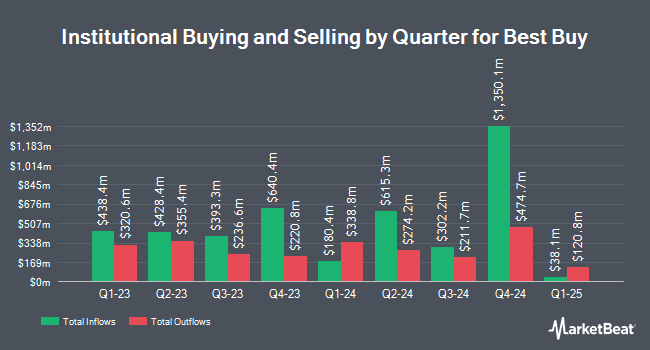

Other hedge funds have also recently bought and sold shares of the company. QRG Capital Management Inc. increased its stake in shares of Best Buy by 10.5% during the 3rd quarter. QRG Capital Management Inc. now owns 31,745 shares of the technology retailer's stock valued at $3,279,000 after acquiring an additional 3,025 shares during the last quarter. Asset Management One Co. Ltd. increased its position in Best Buy by 27.4% during the third quarter. Asset Management One Co. Ltd. now owns 90,341 shares of the technology retailer's stock worth $9,332,000 after purchasing an additional 19,405 shares during the last quarter. Mirae Asset Global Investments Co. Ltd. increased its position in Best Buy by 13.3% during the third quarter. Mirae Asset Global Investments Co. Ltd. now owns 154,564 shares of the technology retailer's stock worth $15,806,000 after purchasing an additional 18,171 shares during the last quarter. Oppenheimer Asset Management Inc. purchased a new position in Best Buy during the third quarter worth approximately $2,384,000. Finally, Charles Schwab Investment Management Inc. boosted its holdings in shares of Best Buy by 4.1% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 6,164,953 shares of the technology retailer's stock valued at $636,840,000 after purchasing an additional 241,988 shares during the last quarter. Institutional investors and hedge funds own 80.96% of the company's stock.

Best Buy Stock Down 0.9 %

Shares of BBY stock traded down $0.80 during mid-day trading on Friday, reaching $87.60. 2,238,124 shares of the company were exchanged, compared to its average volume of 3,080,782. The company has a debt-to-equity ratio of 0.37, a quick ratio of 0.22 and a current ratio of 1.00. The business's 50 day simple moving average is $91.54 and its 200 day simple moving average is $90.41. The company has a market capitalization of $18.73 billion, a P/E ratio of 14.97, a P/E/G ratio of 2.19 and a beta of 1.44. Best Buy Co., Inc. has a fifty-two week low of $69.29 and a fifty-two week high of $103.71.

Best Buy (NYSE:BBY - Get Free Report) last announced its quarterly earnings data on Tuesday, November 26th. The technology retailer reported $1.26 earnings per share for the quarter, missing the consensus estimate of $1.30 by ($0.04). Best Buy had a return on equity of 45.93% and a net margin of 3.01%. The company had revenue of $9.45 billion for the quarter, compared to analyst estimates of $9.63 billion. During the same period in the prior year, the business earned $1.29 earnings per share. Best Buy's revenue was down 3.2% on a year-over-year basis. Research analysts predict that Best Buy Co., Inc. will post 6.18 earnings per share for the current year.

Best Buy Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Tuesday, January 7th. Stockholders of record on Tuesday, December 17th will be given a $0.94 dividend. The ex-dividend date of this dividend is Tuesday, December 17th. This represents a $3.76 annualized dividend and a dividend yield of 4.29%. Best Buy's payout ratio is 64.27%.

Analysts Set New Price Targets

Several brokerages recently weighed in on BBY. JPMorgan Chase & Co. increased their target price on Best Buy from $111.00 to $117.00 and gave the stock an "overweight" rating in a research report on Friday, November 22nd. Wells Fargo & Company cut their price objective on Best Buy from $95.00 to $89.00 and set an "equal weight" rating on the stock in a report on Wednesday, November 27th. Barclays lifted their price objective on Best Buy from $81.00 to $95.00 and gave the company an "equal weight" rating in a research note on Friday, August 30th. DA Davidson reissued a "buy" rating and set a $117.00 target price on shares of Best Buy in a research report on Tuesday, October 15th. Finally, Evercore ISI lifted their price target on shares of Best Buy from $90.00 to $94.00 and gave the company an "in-line" rating in a research report on Friday, August 30th. One analyst has rated the stock with a sell rating, eight have issued a hold rating, ten have issued a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $101.06.

Check Out Our Latest Report on BBY

Insider Activity

In other Best Buy news, CFO Matthew M. Bilunas sold 69,166 shares of the firm's stock in a transaction dated Wednesday, December 11th. The shares were sold at an average price of $87.46, for a total value of $6,049,258.36. Following the transaction, the chief financial officer now owns 92,070 shares of the company's stock, valued at $8,052,442.20. This trade represents a 42.90 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. Company insiders own 0.59% of the company's stock.

Best Buy Company Profile

(

Free Report)

Best Buy Co, Inc engages in the retail of technology products in the United States, Canada, and international. Its stores provide computing and mobile phone products, such as desktops, notebooks, and peripherals; mobile phones comprising related mobile network carrier commissions; networking products; tablets covering e-readers; smartwatches; and consumer electronics consisting of digital imaging, health and fitness products, portable audio comprising headphones and portable speakers, and smart home products, as well as home theaters, which includes home theater accessories, soundbars, and televisions.

See Also

Before you consider Best Buy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Best Buy wasn't on the list.

While Best Buy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.