Lord Abbett & CO. LLC grew its position in Arlo Technologies, Inc. (NYSE:ARLO - Free Report) by 26.7% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 1,029,209 shares of the company's stock after purchasing an additional 216,870 shares during the quarter. Lord Abbett & CO. LLC owned approximately 1.03% of Arlo Technologies worth $12,463,000 as of its most recent SEC filing.

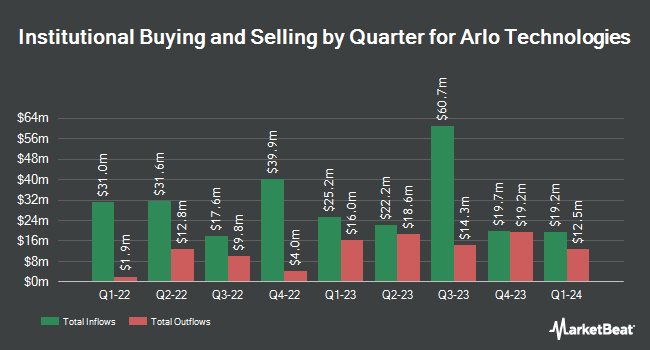

A number of other institutional investors and hedge funds have also modified their holdings of ARLO. Orion Capital Management LLC boosted its stake in Arlo Technologies by 16.5% during the 3rd quarter. Orion Capital Management LLC now owns 45,160 shares of the company's stock valued at $547,000 after purchasing an additional 6,400 shares during the period. Geode Capital Management LLC lifted its holdings in shares of Arlo Technologies by 2.2% during the third quarter. Geode Capital Management LLC now owns 2,192,273 shares of the company's stock worth $26,554,000 after buying an additional 48,221 shares during the last quarter. Barclays PLC boosted its position in shares of Arlo Technologies by 234.5% in the third quarter. Barclays PLC now owns 185,281 shares of the company's stock valued at $2,244,000 after acquiring an additional 129,889 shares during the period. Y Intercept Hong Kong Ltd acquired a new stake in shares of Arlo Technologies in the third quarter worth $386,000. Finally, State Street Corp grew its stake in shares of Arlo Technologies by 0.6% in the third quarter. State Street Corp now owns 4,269,561 shares of the company's stock worth $51,704,000 after acquiring an additional 26,492 shares during the last quarter. 83.18% of the stock is currently owned by institutional investors and hedge funds.

Arlo Technologies Price Performance

Shares of Arlo Technologies stock traded down $0.46 during trading on Tuesday, hitting $12.39. 708,202 shares of the company's stock traded hands, compared to its average volume of 944,352. Arlo Technologies, Inc. has a twelve month low of $8.33 and a twelve month high of $17.64. The company has a market cap of $1.24 billion, a PE ratio of -49.48 and a beta of 1.79. The firm's fifty day moving average price is $11.67 and its 200 day moving average price is $12.62.

Analyst Upgrades and Downgrades

ARLO has been the topic of several research analyst reports. Craig Hallum decreased their price target on shares of Arlo Technologies from $17.00 to $15.00 and set a "buy" rating on the stock in a research report on Friday, November 8th. BWS Financial reiterated a "buy" rating and issued a $24.00 target price on shares of Arlo Technologies in a research note on Friday, November 8th.

Read Our Latest Stock Report on ARLO

Insider Buying and Selling

In other news, CFO Kurtis Joseph Binder sold 7,098 shares of Arlo Technologies stock in a transaction that occurred on Monday, September 30th. The shares were sold at an average price of $11.94, for a total value of $84,750.12. Following the completion of the transaction, the chief financial officer now owns 892,595 shares in the company, valued at approximately $10,657,584.30. The trade was a 0.79 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, CEO Matthew Blake Mcrae sold 316,644 shares of the stock in a transaction that occurred on Monday, December 2nd. The stock was sold at an average price of $11.54, for a total value of $3,654,071.76. Following the sale, the chief executive officer now owns 3,160,988 shares in the company, valued at approximately $36,477,801.52. This trade represents a 9.11 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 351,330 shares of company stock worth $4,057,187 in the last 90 days. 3.80% of the stock is owned by company insiders.

About Arlo Technologies

(

Free Report)

Arlo Technologies, Inc, together with its subsidiaries, provides a cloud-based platform in the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions. The company offers Arlo Essential Cameras and Doorbells (2nd Generation) delivers smart home protection, including automated privacy shield, 180-degree field of view, and 2K video resolution; Arlo Home Security System, an all-in-one multi-sensor that provides access to security experts for monitoring and responding to emergency situations; Arlo Pro 5S, a wireless 2K video resolution security camera; Arlo Go 2, a camera for monitoring remote areas, large properties, construction sites, vacation homes, boat or RV slips, and hard-to-access areas; Arlo Ultra 2 provides 4K video with HDR, an ultra-wide, 180-degree field of view, auto zoom and tracking on moving objects, and color night vision; and Arlo Floodlight Camera, a wire-free floodlight camera.

Recommended Stories

Before you consider Arlo Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arlo Technologies wasn't on the list.

While Arlo Technologies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.