Lord Abbett & CO. LLC lessened its holdings in shares of Universal Health Services, Inc. (NYSE:UHS - Free Report) by 66.6% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 66,768 shares of the health services provider's stock after selling 133,144 shares during the period. Lord Abbett & CO. LLC owned about 0.10% of Universal Health Services worth $15,291,000 at the end of the most recent reporting period.

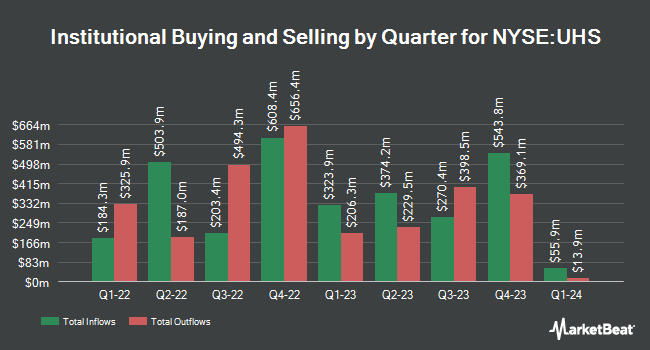

Other hedge funds have also recently modified their holdings of the company. State Street Corp boosted its holdings in Universal Health Services by 0.6% during the 3rd quarter. State Street Corp now owns 2,724,075 shares of the health services provider's stock valued at $623,840,000 after acquiring an additional 17,527 shares during the period. Geode Capital Management LLC grew its holdings in shares of Universal Health Services by 4.0% in the third quarter. Geode Capital Management LLC now owns 1,661,530 shares of the health services provider's stock worth $379,403,000 after purchasing an additional 63,754 shares during the last quarter. Charles Schwab Investment Management Inc. increased its stake in Universal Health Services by 1.9% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 603,705 shares of the health services provider's stock worth $138,254,000 after buying an additional 11,353 shares during the period. Bank of New York Mellon Corp lifted its holdings in Universal Health Services by 0.5% during the 2nd quarter. Bank of New York Mellon Corp now owns 486,438 shares of the health services provider's stock valued at $89,957,000 after buying an additional 2,620 shares in the last quarter. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its position in Universal Health Services by 13.5% in the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 346,969 shares of the health services provider's stock valued at $79,459,000 after buying an additional 41,218 shares during the period. Institutional investors own 86.05% of the company's stock.

Analyst Upgrades and Downgrades

Several research firms have recently weighed in on UHS. Robert W. Baird lifted their price target on shares of Universal Health Services from $236.00 to $274.00 and gave the company an "outperform" rating in a research note on Wednesday, September 4th. TD Cowen decreased their target price on Universal Health Services from $275.00 to $251.00 and set a "buy" rating for the company in a research report on Tuesday, November 26th. Bank of America initiated coverage on Universal Health Services in a research report on Wednesday, November 6th. They set a "neutral" rating and a $223.00 price target on the stock. Cantor Fitzgerald restated a "neutral" rating and issued a $219.00 price objective on shares of Universal Health Services in a report on Friday, October 25th. Finally, Barclays upped their price objective on shares of Universal Health Services from $256.00 to $271.00 and gave the stock an "overweight" rating in a research note on Friday, October 25th. Seven analysts have rated the stock with a hold rating, nine have assigned a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $223.29.

Check Out Our Latest Analysis on UHS

Insider Activity

In other Universal Health Services news, Director Maria Ruderman Singer sold 1,614 shares of the company's stock in a transaction dated Wednesday, December 11th. The shares were sold at an average price of $191.15, for a total value of $308,516.10. Following the completion of the transaction, the director now owns 5,879 shares in the company, valued at approximately $1,123,770.85. This represents a 21.54 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Corporate insiders own 16.10% of the company's stock.

Universal Health Services Stock Down 1.8 %

Shares of UHS stock traded down $3.30 during trading hours on Monday, reaching $184.10. 902,852 shares of the company's stock were exchanged, compared to its average volume of 680,315. Universal Health Services, Inc. has a fifty-two week low of $147.33 and a fifty-two week high of $243.25. The stock's 50 day moving average is $206.97 and its 200-day moving average is $208.55. The company has a current ratio of 1.39, a quick ratio of 1.28 and a debt-to-equity ratio of 0.69. The company has a market cap of $12.15 billion, a price-to-earnings ratio of 12.24, a P/E/G ratio of 0.60 and a beta of 1.28.

Universal Health Services (NYSE:UHS - Get Free Report) last announced its earnings results on Thursday, October 24th. The health services provider reported $3.71 earnings per share (EPS) for the quarter, missing the consensus estimate of $3.75 by ($0.04). Universal Health Services had a net margin of 6.66% and a return on equity of 15.75%. The business had revenue of $3.96 billion for the quarter, compared to analyst estimates of $3.90 billion. During the same period in the prior year, the company earned $2.55 earnings per share. The company's quarterly revenue was up 11.3% on a year-over-year basis. Analysts predict that Universal Health Services, Inc. will post 15.88 earnings per share for the current fiscal year.

Universal Health Services Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, December 17th. Investors of record on Tuesday, December 3rd will be paid a $0.20 dividend. The ex-dividend date of this dividend is Tuesday, December 3rd. This represents a $0.80 dividend on an annualized basis and a yield of 0.43%. Universal Health Services's dividend payout ratio (DPR) is 5.32%.

Universal Health Services Company Profile

(

Free Report)

Universal Health Services, Inc, through its subsidiaries, owns and operates acute care hospitals, and outpatient and behavioral health care facilities. It operates through Acute Care Hospital Services and Behavioral Health Care Services segments. The company's hospitals offer general and specialty surgery, internal medicine, obstetrics, emergency room care, radiology, oncology, diagnostic and coronary care, pediatric services, pharmacy services, and/or behavioral health services.

Featured Articles

Before you consider Universal Health Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Universal Health Services wasn't on the list.

While Universal Health Services currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.