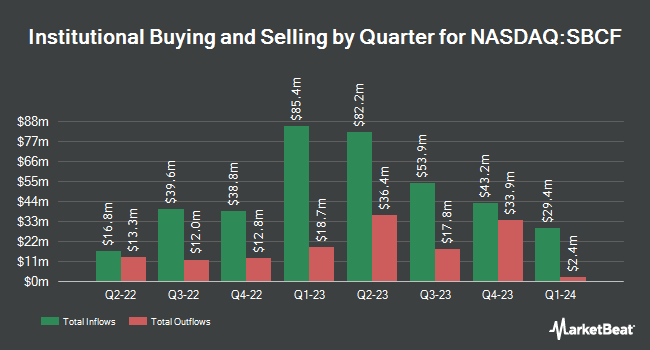

Lord Abbett & CO. LLC reduced its position in Seacoast Banking Co. of Florida (NASDAQ:SBCF - Free Report) by 55.4% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 163,830 shares of the financial services provider's stock after selling 203,777 shares during the quarter. Lord Abbett & CO. LLC owned approximately 0.19% of Seacoast Banking Co. of Florida worth $4,366,000 as of its most recent SEC filing.

Several other hedge funds have also made changes to their positions in the business. SG Americas Securities LLC raised its position in Seacoast Banking Co. of Florida by 227.5% in the 2nd quarter. SG Americas Securities LLC now owns 33,912 shares of the financial services provider's stock valued at $802,000 after purchasing an additional 23,558 shares in the last quarter. Dakota Wealth Management lifted its position in shares of Seacoast Banking Co. of Florida by 16.7% during the 2nd quarter. Dakota Wealth Management now owns 10,515 shares of the financial services provider's stock worth $249,000 after purchasing an additional 1,507 shares during the last quarter. Louisiana State Employees Retirement System grew its stake in shares of Seacoast Banking Co. of Florida by 1.2% during the second quarter. Louisiana State Employees Retirement System now owns 42,300 shares of the financial services provider's stock worth $1,000,000 after purchasing an additional 500 shares in the last quarter. Zurcher Kantonalbank Zurich Cantonalbank increased its holdings in Seacoast Banking Co. of Florida by 5.4% in the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 22,429 shares of the financial services provider's stock valued at $530,000 after buying an additional 1,154 shares during the last quarter. Finally, Panagora Asset Management Inc. raised its stake in Seacoast Banking Co. of Florida by 3.8% in the second quarter. Panagora Asset Management Inc. now owns 224,964 shares of the financial services provider's stock valued at $5,318,000 after buying an additional 8,310 shares in the last quarter. Institutional investors and hedge funds own 81.77% of the company's stock.

Wall Street Analyst Weigh In

Several equities research analysts have recently weighed in on SBCF shares. Truist Financial cut their target price on Seacoast Banking Co. of Florida from $30.00 to $28.00 and set a "hold" rating on the stock in a research report on Monday, October 28th. Keefe, Bruyette & Woods restated an "outperform" rating and issued a $31.00 target price on shares of Seacoast Banking Co. of Florida in a report on Wednesday, August 21st. Finally, Stephens increased their target price on shares of Seacoast Banking Co. of Florida from $25.00 to $26.00 and gave the company an "equal weight" rating in a research report on Monday, October 28th. Three investment analysts have rated the stock with a hold rating and two have given a buy rating to the company's stock. According to MarketBeat, the company currently has an average rating of "Hold" and an average target price of $28.70.

Get Our Latest Research Report on Seacoast Banking Co. of Florida

Seacoast Banking Co. of Florida Stock Performance

Seacoast Banking Co. of Florida stock traded down $0.95 during midday trading on Tuesday, hitting $28.22. 460,919 shares of the company's stock were exchanged, compared to its average volume of 408,435. The firm's 50 day simple moving average is $28.57 and its 200 day simple moving average is $26.60. Seacoast Banking Co. of Florida has a 12-month low of $21.90 and a 12-month high of $31.68. The company has a debt-to-equity ratio of 0.16, a quick ratio of 0.86 and a current ratio of 0.86. The stock has a market cap of $2.41 billion, a price-to-earnings ratio of 20.45 and a beta of 1.08.

Seacoast Banking Co. of Florida (NASDAQ:SBCF - Get Free Report) last posted its quarterly earnings data on Thursday, October 24th. The financial services provider reported $0.36 EPS for the quarter, meeting the consensus estimate of $0.36. The firm had revenue of $130.30 million during the quarter, compared to the consensus estimate of $129.20 million. Seacoast Banking Co. of Florida had a return on equity of 5.44% and a net margin of 14.55%. The firm's revenue was up 5.5% compared to the same quarter last year. During the same period in the prior year, the business earned $0.37 EPS. Equities research analysts predict that Seacoast Banking Co. of Florida will post 1.41 EPS for the current year.

Seacoast Banking Co. of Florida Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Stockholders of record on Friday, December 13th will be issued a $0.18 dividend. This represents a $0.72 annualized dividend and a dividend yield of 2.55%. The ex-dividend date of this dividend is Friday, December 13th. Seacoast Banking Co. of Florida's payout ratio is 52.17%.

Insider Buying and Selling

In other news, CEO Charles M. Shaffer sold 21,255 shares of the company's stock in a transaction on Monday, November 11th. The shares were sold at an average price of $30.36, for a total transaction of $645,301.80. Following the transaction, the chief executive officer now directly owns 126,232 shares of the company's stock, valued at $3,832,403.52. This represents a 14.41 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. 1.50% of the stock is currently owned by corporate insiders.

About Seacoast Banking Co. of Florida

(

Free Report)

Seacoast Banking Corporation of Florida operates as the bank holding company for Seacoast National Bank that provides integrated financial services to retail and commercial customers in Florida. The company offers noninterest and interest-bearing demand deposit, money market, savings, and customer sweep accounts; time certificates of deposit; construction and land development, commercial and residential real estate, and commercial and financial loans; and consumer loans, including installment loans and revolving lines, as well as loans for automobiles, boats, and personal and family purposes.

Featured Articles

Before you consider Seacoast Banking Co. of Florida, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Seacoast Banking Co. of Florida wasn't on the list.

While Seacoast Banking Co. of Florida currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.