Lord Abbett & CO. LLC bought a new stake in Aspen Aerogels, Inc. (NYSE:ASPN - Free Report) in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund bought 365,701 shares of the construction company's stock, valued at approximately $10,126,000. Lord Abbett & CO. LLC owned 0.45% of Aspen Aerogels as of its most recent filing with the Securities & Exchange Commission.

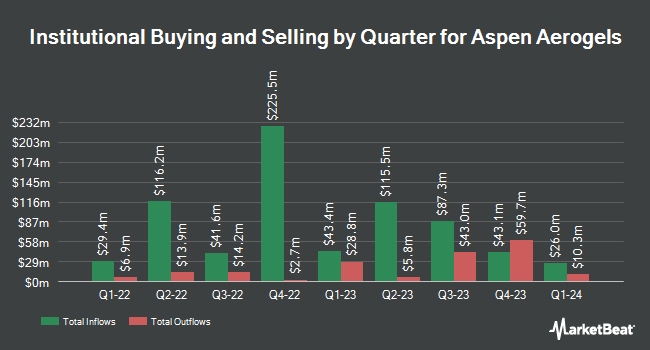

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Franklin Resources Inc. lifted its stake in shares of Aspen Aerogels by 5.3% in the 3rd quarter. Franklin Resources Inc. now owns 29,418 shares of the construction company's stock valued at $815,000 after purchasing an additional 1,483 shares in the last quarter. Wilmington Savings Fund Society FSB purchased a new stake in Aspen Aerogels during the 3rd quarter worth $498,000. Geode Capital Management LLC increased its holdings in Aspen Aerogels by 5.7% in the 3rd quarter. Geode Capital Management LLC now owns 1,385,968 shares of the construction company's stock valued at $38,385,000 after purchasing an additional 75,024 shares in the last quarter. Barclays PLC raised its position in Aspen Aerogels by 333.8% in the third quarter. Barclays PLC now owns 92,302 shares of the construction company's stock valued at $2,557,000 after purchasing an additional 71,024 shares during the period. Finally, Y Intercept Hong Kong Ltd acquired a new stake in shares of Aspen Aerogels in the third quarter valued at about $420,000. Institutional investors and hedge funds own 97.64% of the company's stock.

Analyst Ratings Changes

A number of equities analysts have weighed in on ASPN shares. Barclays decreased their price target on Aspen Aerogels from $27.00 to $25.00 and set an "overweight" rating for the company in a report on Tuesday, November 12th. TD Cowen raised their price target on shares of Aspen Aerogels from $36.00 to $41.00 and gave the company a "buy" rating in a report on Tuesday, August 20th. HC Wainwright reiterated a "buy" rating and issued a $30.00 price objective on shares of Aspen Aerogels in a report on Wednesday, October 16th. StockNews.com raised Aspen Aerogels to a "sell" rating in a report on Wednesday, November 13th. Finally, Roth Mkm reduced their price objective on shares of Aspen Aerogels from $36.00 to $31.00 and set a "buy" rating on the stock in a research note on Friday, November 8th. One investment analyst has rated the stock with a sell rating, nine have assigned a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $28.70.

View Our Latest Analysis on Aspen Aerogels

Aspen Aerogels Stock Performance

NYSE ASPN traded up $0.04 during trading hours on Tuesday, hitting $12.97. The company had a trading volume of 1,249,720 shares, compared to its average volume of 1,623,954. Aspen Aerogels, Inc. has a fifty-two week low of $10.75 and a fifty-two week high of $33.15. The firm has a market cap of $1.06 billion, a P/E ratio of 1,293.00 and a beta of 2.11. The company has a quick ratio of 2.48, a current ratio of 2.93 and a debt-to-equity ratio of 0.27. The business has a fifty day simple moving average of $17.13 and a 200-day simple moving average of $22.78.

Insiders Place Their Bets

In other Aspen Aerogels news, CEO Donald R. Young sold 63,355 shares of Aspen Aerogels stock in a transaction on Monday, September 30th. The stock was sold at an average price of $30.03, for a total transaction of $1,902,550.65. Following the sale, the chief executive officer now owns 483,640 shares of the company's stock, valued at $14,523,709.20. The trade was a 11.58 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. 4.30% of the stock is owned by insiders.

Aspen Aerogels Company Profile

(

Free Report)

Aspen Aerogels, Inc designs, develops, manufactures, and sells aerogel insulation products primarily for use in the energy infrastructure and sustainable insulation materials markets in the United States, Asia, Canada, Europe, and Latin America. It operates in two segments, Energy Industrial and Thermal Barrier.

Recommended Stories

Before you consider Aspen Aerogels, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aspen Aerogels wasn't on the list.

While Aspen Aerogels currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.