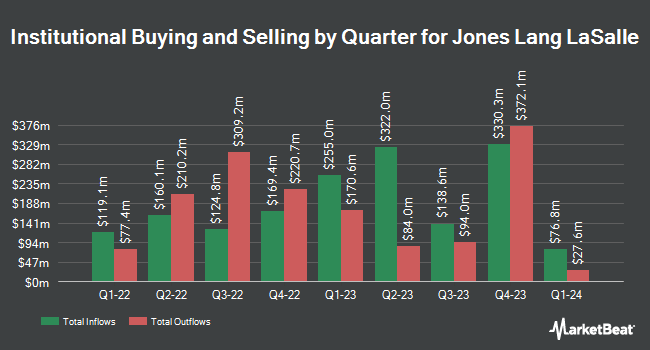

Lord Abbett & CO. LLC purchased a new position in shares of Jones Lang LaSalle Incorporated (NYSE:JLL - Free Report) in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 90,000 shares of the financial services provider's stock, valued at approximately $24,283,000. Lord Abbett & CO. LLC owned approximately 0.19% of Jones Lang LaSalle at the end of the most recent quarter.

Other large investors have also bought and sold shares of the company. FMR LLC raised its stake in shares of Jones Lang LaSalle by 15.0% during the 3rd quarter. FMR LLC now owns 3,530,720 shares of the financial services provider's stock worth $952,624,000 after purchasing an additional 459,466 shares during the period. Select Equity Group L.P. bought a new stake in Jones Lang LaSalle in the 2nd quarter valued at about $55,152,000. Massachusetts Financial Services Co. MA lifted its holdings in Jones Lang LaSalle by 20.9% during the second quarter. Massachusetts Financial Services Co. MA now owns 1,049,392 shares of the financial services provider's stock valued at $215,419,000 after purchasing an additional 181,246 shares during the last quarter. International Assets Investment Management LLC increased its stake in shares of Jones Lang LaSalle by 167,988.5% in the third quarter. International Assets Investment Management LLC now owns 146,237 shares of the financial services provider's stock worth $39,456,000 after purchasing an additional 146,150 shares in the last quarter. Finally, Artemis Investment Management LLP grew its stake in Jones Lang LaSalle by 43.0% in the 3rd quarter. Artemis Investment Management LLP now owns 331,514 shares of the financial services provider's stock valued at $89,446,000 after buying an additional 99,613 shares in the last quarter. 94.80% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

A number of research analysts have recently commented on JLL shares. JPMorgan Chase & Co. boosted their price target on shares of Jones Lang LaSalle from $263.00 to $327.00 and gave the company an "overweight" rating in a research report on Monday. StockNews.com upgraded Jones Lang LaSalle from a "buy" rating to a "strong-buy" rating in a report on Friday, September 13th. Keefe, Bruyette & Woods raised shares of Jones Lang LaSalle from a "market perform" rating to an "outperform" rating and raised their price target for the stock from $292.00 to $325.00 in a report on Tuesday, December 10th. Wolfe Research raised Jones Lang LaSalle from a "peer perform" rating to an "outperform" rating and set a $353.00 price target for the company in a research report on Monday, November 25th. Finally, The Goldman Sachs Group initiated coverage on Jones Lang LaSalle in a research note on Friday, December 6th. They set a "buy" rating and a $352.00 target price on the stock. Six equities research analysts have rated the stock with a buy rating and two have assigned a strong buy rating to the company's stock. According to data from MarketBeat, Jones Lang LaSalle has an average rating of "Buy" and an average price target of $301.57.

Get Our Latest Analysis on Jones Lang LaSalle

Jones Lang LaSalle Stock Up 0.8 %

NYSE JLL traded up $2.06 during trading hours on Monday, reaching $271.65. 278,881 shares of the company's stock traded hands, compared to its average volume of 287,250. Jones Lang LaSalle Incorporated has a 52-week low of $167.11 and a 52-week high of $288.50. The firm has a 50-day simple moving average of $269.44 and a 200 day simple moving average of $246.82. The firm has a market cap of $12.89 billion, a PE ratio of 27.47 and a beta of 1.34. The company has a debt-to-equity ratio of 0.16, a current ratio of 2.29 and a quick ratio of 2.29.

Jones Lang LaSalle (NYSE:JLL - Get Free Report) last posted its quarterly earnings results on Wednesday, November 6th. The financial services provider reported $3.50 earnings per share for the quarter, topping the consensus estimate of $2.67 by $0.83. Jones Lang LaSalle had a return on equity of 8.95% and a net margin of 2.12%. The company had revenue of $5.87 billion for the quarter, compared to the consensus estimate of $5.62 billion. During the same quarter in the prior year, the business posted $2.01 EPS. The firm's quarterly revenue was up 14.8% compared to the same quarter last year. Sell-side analysts anticipate that Jones Lang LaSalle Incorporated will post 13.37 EPS for the current fiscal year.

Jones Lang LaSalle Company Profile

(

Free Report)

Jones Lang LaSalle Incorporated operates as a commercial real estate and investment management company. It engages in the buying, building, occupying, managing, and investing in a commercial, industrial, hotel, residential, and retail properties in Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Recommended Stories

Before you consider Jones Lang LaSalle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jones Lang LaSalle wasn't on the list.

While Jones Lang LaSalle currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.