Los Angeles Capital Management LLC lifted its position in Bath & Body Works, Inc. (NYSE:BBWI - Free Report) by 404.4% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 134,544 shares of the company's stock after acquiring an additional 107,868 shares during the period. Los Angeles Capital Management LLC owned 0.06% of Bath & Body Works worth $4,295,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

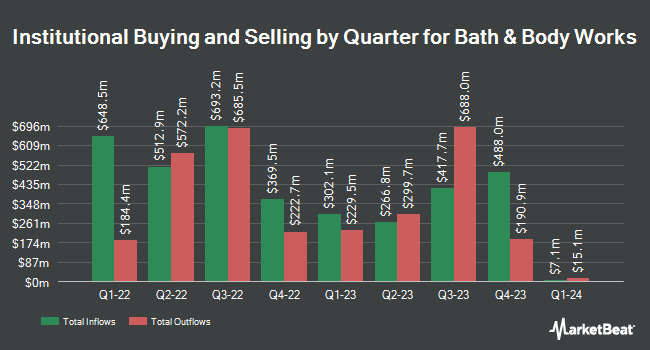

Other hedge funds have also bought and sold shares of the company. First Community Trust NA acquired a new position in shares of Bath & Body Works in the second quarter valued at approximately $30,000. Livforsakringsbolaget Skandia Omsesidigt lifted its holdings in Bath & Body Works by 300.0% in the 3rd quarter. Livforsakringsbolaget Skandia Omsesidigt now owns 1,200 shares of the company's stock valued at $38,000 after purchasing an additional 900 shares in the last quarter. GAMMA Investing LLC boosted its position in shares of Bath & Body Works by 65.4% in the second quarter. GAMMA Investing LLC now owns 1,846 shares of the company's stock worth $72,000 after acquiring an additional 730 shares during the last quarter. EntryPoint Capital LLC lifted its position in Bath & Body Works by 224.0% during the first quarter. EntryPoint Capital LLC now owns 1,471 shares of the company's stock valued at $74,000 after buying an additional 1,017 shares in the last quarter. Finally, Abich Financial Wealth Management LLC acquired a new stake in shares of Bath & Body Works in the third quarter valued at about $103,000. Hedge funds and other institutional investors own 95.14% of the company's stock.

Wall Street Analyst Weigh In

Several brokerages have issued reports on BBWI. UBS Group cut their price objective on Bath & Body Works from $52.00 to $38.00 and set a "neutral" rating on the stock in a research note on Thursday, August 29th. Evercore ISI dropped their price target on shares of Bath & Body Works from $45.00 to $35.00 and set an "in-line" rating on the stock in a research report on Wednesday, August 28th. Wells Fargo & Company cut their price target on shares of Bath & Body Works from $35.00 to $32.00 and set an "equal weight" rating on the stock in a report on Wednesday, November 6th. Robert W. Baird decreased their target price on shares of Bath & Body Works from $54.00 to $45.00 and set an "outperform" rating for the company in a research report on Thursday, August 29th. Finally, Morgan Stanley reduced their price target on shares of Bath & Body Works from $56.00 to $51.00 and set an "overweight" rating for the company in a report on Thursday, September 5th. One equities research analyst has rated the stock with a sell rating, six have issued a hold rating and nine have given a buy rating to the company. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $42.44.

View Our Latest Stock Report on Bath & Body Works

Insider Activity at Bath & Body Works

In related news, CEO Gina Boswell acquired 6,000 shares of the company's stock in a transaction dated Wednesday, October 9th. The stock was bought at an average cost of $29.64 per share, with a total value of $177,840.00. Following the acquisition, the chief executive officer now owns 242,987 shares of the company's stock, valued at approximately $7,202,134.68. The trade was a 0.00 % increase in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. 0.27% of the stock is currently owned by insiders.

Bath & Body Works Stock Performance

BBWI traded up $0.05 during trading on Wednesday, reaching $31.61. The company's stock had a trading volume of 2,718,735 shares, compared to its average volume of 3,824,511. Bath & Body Works, Inc. has a 52-week low of $26.20 and a 52-week high of $52.99. The company's fifty day moving average price is $30.04 and its 200-day moving average price is $36.67. The company has a market capitalization of $6.93 billion, a price-to-earnings ratio of 7.64, a price-to-earnings-growth ratio of 1.00 and a beta of 1.79.

Bath & Body Works (NYSE:BBWI - Get Free Report) last issued its quarterly earnings data on Wednesday, August 28th. The company reported $0.37 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.35 by $0.02. The business had revenue of $1.53 billion during the quarter, compared to analyst estimates of $1.54 billion. Bath & Body Works had a negative return on equity of 41.94% and a net margin of 12.69%. Equities analysts predict that Bath & Body Works, Inc. will post 3.18 earnings per share for the current year.

Bath & Body Works Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Friday, December 6th. Stockholders of record on Friday, November 22nd will be issued a $0.20 dividend. The ex-dividend date is Friday, November 22nd. This represents a $0.80 dividend on an annualized basis and a dividend yield of 2.53%. Bath & Body Works's payout ratio is 19.37%.

Bath & Body Works Company Profile

(

Free Report)

Bath & Body Works, Inc operates a specialty retailer of home fragrance, body care, and soaps and sanitizer products. It sells its products under the Bath & Body Works, White Barn, and other brand names through retail stores and e-commerce sites located in the United States and Canada, as well as through international stores operated by partners under franchise, license, and wholesale arrangements.

Further Reading

Before you consider Bath & Body Works, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bath & Body Works wasn't on the list.

While Bath & Body Works currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.