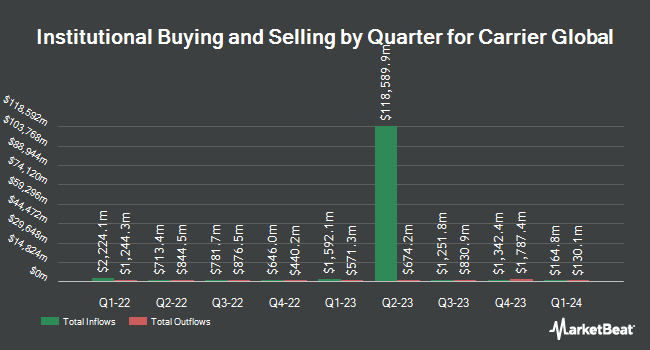

Los Angeles Capital Management LLC lessened its holdings in shares of Carrier Global Co. (NYSE:CARR - Free Report) by 62.4% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 537,784 shares of the company's stock after selling 894,222 shares during the period. Los Angeles Capital Management LLC owned about 0.06% of Carrier Global worth $43,286,000 at the end of the most recent quarter.

Other large investors have also added to or reduced their stakes in the company. Mitchell Mcleod Pugh & Williams Inc. lifted its position in shares of Carrier Global by 7.1% during the 3rd quarter. Mitchell Mcleod Pugh & Williams Inc. now owns 6,761 shares of the company's stock worth $544,000 after buying an additional 450 shares during the last quarter. Legacy Capital Wealth Partners LLC acquired a new stake in shares of Carrier Global in the 3rd quarter valued at approximately $229,000. Sigma Planning Corp grew its holdings in shares of Carrier Global by 4.5% during the 3rd quarter. Sigma Planning Corp now owns 12,729 shares of the company's stock valued at $1,025,000 after purchasing an additional 549 shares during the last quarter. Covestor Ltd increased its position in Carrier Global by 62.3% during the 3rd quarter. Covestor Ltd now owns 3,851 shares of the company's stock worth $311,000 after purchasing an additional 1,478 shares in the last quarter. Finally, Essex Savings Bank lifted its stake in Carrier Global by 2.2% in the 3rd quarter. Essex Savings Bank now owns 6,608 shares of the company's stock valued at $532,000 after purchasing an additional 144 shares during the last quarter. Institutional investors and hedge funds own 91.00% of the company's stock.

Carrier Global Stock Up 2.1 %

Shares of Carrier Global stock traded up $1.55 during trading hours on Friday, reaching $76.68. The company's stock had a trading volume of 3,403,874 shares, compared to its average volume of 3,986,720. The company has a market capitalization of $68.80 billion, a P/E ratio of 19.41, a P/E/G ratio of 2.71 and a beta of 1.34. The stock's fifty day simple moving average is $77.19 and its two-hundred day simple moving average is $69.29. Carrier Global Co. has a one year low of $50.31 and a one year high of $83.32. The company has a debt-to-equity ratio of 0.69, a quick ratio of 0.82 and a current ratio of 1.08.

Carrier Global announced that its board has approved a share repurchase plan on Thursday, October 24th that authorizes the company to repurchase $3.00 billion in shares. This repurchase authorization authorizes the company to repurchase up to 4.6% of its shares through open market purchases. Shares repurchase plans are often a sign that the company's management believes its stock is undervalued.

Carrier Global Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Monday, November 18th. Shareholders of record on Friday, October 25th will be paid a dividend of $0.19 per share. The ex-dividend date of this dividend is Friday, October 25th. This represents a $0.76 dividend on an annualized basis and a yield of 0.99%. Carrier Global's dividend payout ratio (DPR) is currently 19.24%.

Wall Street Analysts Forecast Growth

CARR has been the topic of several research reports. Morgan Stanley initiated coverage on Carrier Global in a report on Friday, September 6th. They set an "equal weight" rating and a $75.00 price target on the stock. Stephens reduced their price objective on shares of Carrier Global from $85.00 to $80.00 and set an "equal weight" rating on the stock in a research note on Monday, October 28th. Oppenheimer upped their price target on Carrier Global from $74.00 to $88.00 and gave the company an "outperform" rating in a research report on Wednesday, October 2nd. Robert W. Baird lowered their price objective on Carrier Global from $88.00 to $86.00 and set an "outperform" rating for the company in a research report on Friday, October 25th. Finally, Baird R W upgraded Carrier Global from a "hold" rating to a "strong-buy" rating in a report on Monday, July 15th. Seven equities research analysts have rated the stock with a hold rating, six have given a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, Carrier Global has a consensus rating of "Moderate Buy" and a consensus target price of $81.33.

Get Our Latest Analysis on CARR

Carrier Global Profile

(

Free Report)

Carrier Global Corporation provides heating, ventilating, and air conditioning (HVAC), refrigeration, fire, security, and building automation technologies in the United States, Europe, the Asia Pacific, and internationally. It operates through three segments: HVAC, Refrigeration, and Fire & Security.

Recommended Stories

Before you consider Carrier Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carrier Global wasn't on the list.

While Carrier Global currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.