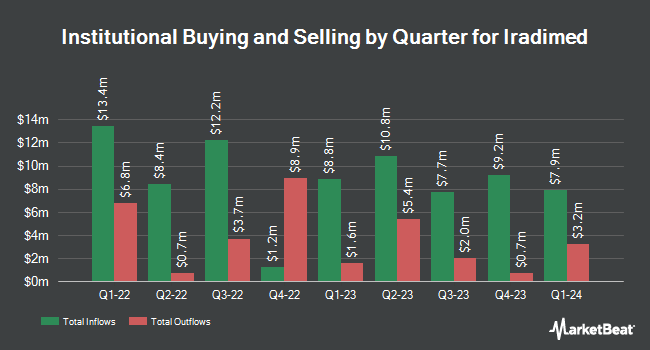

Los Angeles Capital Management LLC cut its stake in Iradimed Corporation (NASDAQ:IRMD - Free Report) by 13.3% during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 39,063 shares of the medical equipment provider's stock after selling 6,000 shares during the period. Los Angeles Capital Management LLC owned 0.31% of Iradimed worth $2,148,000 as of its most recent SEC filing.

A number of other hedge funds also recently added to or reduced their stakes in IRMD. R Squared Ltd acquired a new stake in shares of Iradimed in the 4th quarter worth about $30,000. Huntington National Bank increased its stake in shares of Iradimed by 51.3% in the third quarter. Huntington National Bank now owns 1,487 shares of the medical equipment provider's stock valued at $75,000 after purchasing an additional 504 shares during the period. Gladius Capital Management LP raised its holdings in shares of Iradimed by 126.6% during the third quarter. Gladius Capital Management LP now owns 1,727 shares of the medical equipment provider's stock valued at $87,000 after buying an additional 965 shares during the last quarter. Quantbot Technologies LP raised its holdings in shares of Iradimed by 83.0% during the third quarter. Quantbot Technologies LP now owns 2,320 shares of the medical equipment provider's stock valued at $117,000 after buying an additional 1,052 shares during the last quarter. Finally, Wilmington Savings Fund Society FSB acquired a new position in shares of Iradimed during the third quarter worth approximately $126,000. 92.34% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Several analysts recently commented on IRMD shares. Roth Mkm restated a "buy" rating and issued a $72.00 target price (up from $60.00) on shares of Iradimed in a research report on Friday, February 14th. StockNews.com raised Iradimed from a "buy" rating to a "strong-buy" rating in a report on Friday, February 21st.

Read Our Latest Stock Report on IRMD

Iradimed Price Performance

Shares of Iradimed stock traded up $0.22 on Tuesday, hitting $53.51. The company had a trading volume of 19,710 shares, compared to its average volume of 41,257. Iradimed Corporation has a 52 week low of $40.18 and a 52 week high of $63.29. The company has a market cap of $678.07 million, a PE ratio of 35.67 and a beta of 0.82. The business has a 50-day simple moving average of $57.52 and a 200-day simple moving average of $53.04.

Iradimed (NASDAQ:IRMD - Get Free Report) last released its earnings results on Thursday, February 13th. The medical equipment provider reported $0.40 earnings per share for the quarter, missing analysts' consensus estimates of $0.45 by ($0.05). Iradimed had a return on equity of 24.12% and a net margin of 26.26%. The firm had revenue of $19.39 million during the quarter, compared to analyst estimates of $19.09 million. On average, equities research analysts predict that Iradimed Corporation will post 1.66 earnings per share for the current fiscal year.

Iradimed Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, March 5th. Shareholders of record on Monday, February 24th will be issued a $0.17 dividend. This represents a $0.68 dividend on an annualized basis and a yield of 1.27%. This is an increase from Iradimed's previous quarterly dividend of $0.15. The ex-dividend date of this dividend is Monday, February 24th. Iradimed's dividend payout ratio is presently 45.33%.

Iradimed Company Profile

(

Free Report)

IRadimed Corp. engages in the development, manufacture, marketing, and distribution of Magnetic Resonance Imaging compatible medical devices. It also provides a non-magnetic Intravenous infusion pump system that is specifically designed for use during MRI procedures. The company was founded by Roger Susi in July 1992 and is headquartered in Winter Springs, FL.

Recommended Stories

Before you consider Iradimed, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Iradimed wasn't on the list.

While Iradimed currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.