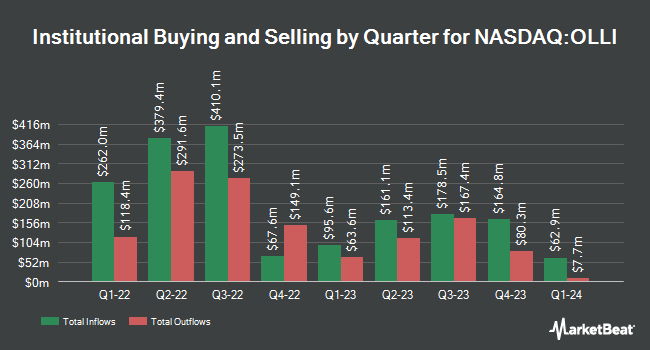

Los Angeles Capital Management LLC lessened its stake in shares of Ollie's Bargain Outlet Holdings, Inc. (NASDAQ:OLLI - Free Report) by 61.7% in the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 214,603 shares of the company's stock after selling 345,451 shares during the period. Los Angeles Capital Management LLC owned about 0.35% of Ollie's Bargain Outlet worth $20,859,000 at the end of the most recent quarter.

Other hedge funds and other institutional investors also recently bought and sold shares of the company. Texas Permanent School Fund Corp increased its holdings in Ollie's Bargain Outlet by 1.1% during the first quarter. Texas Permanent School Fund Corp now owns 53,905 shares of the company's stock valued at $4,289,000 after buying an additional 602 shares during the period. Duality Advisers LP acquired a new stake in Ollie's Bargain Outlet in the first quarter valued at approximately $303,000. Envestnet Portfolio Solutions Inc. increased its position in shares of Ollie's Bargain Outlet by 24.5% during the first quarter. Envestnet Portfolio Solutions Inc. now owns 3,954 shares of the company's stock worth $315,000 after purchasing an additional 778 shares in the last quarter. Sei Investments Co. lifted its holdings in shares of Ollie's Bargain Outlet by 15.3% during the 1st quarter. Sei Investments Co. now owns 207,554 shares of the company's stock valued at $16,515,000 after purchasing an additional 27,531 shares during the last quarter. Finally, Meeder Asset Management Inc. acquired a new stake in shares of Ollie's Bargain Outlet in the 1st quarter worth $529,000.

Insider Transactions at Ollie's Bargain Outlet

In related news, CFO Robert F. Helm sold 2,401 shares of the firm's stock in a transaction dated Thursday, October 17th. The stock was sold at an average price of $94.68, for a total transaction of $227,326.68. Following the completion of the transaction, the chief financial officer now directly owns 2,021 shares in the company, valued at $191,348.28. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. In other Ollie's Bargain Outlet news, CFO Robert F. Helm sold 2,401 shares of the stock in a transaction dated Thursday, October 17th. The stock was sold at an average price of $94.68, for a total value of $227,326.68. Following the sale, the chief financial officer now owns 2,021 shares of the company's stock, valued at $191,348.28. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, SVP Kevin Mclain sold 15,000 shares of the business's stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $98.99, for a total value of $1,484,850.00. Following the transaction, the senior vice president now directly owns 10,610 shares of the company's stock, valued at approximately $1,050,283.90. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 24,880 shares of company stock worth $2,462,470. 0.87% of the stock is currently owned by insiders.

Wall Street Analysts Forecast Growth

A number of research analysts recently issued reports on the stock. Gordon Haskett upgraded shares of Ollie's Bargain Outlet from an "accumulate" rating to a "buy" rating and boosted their target price for the company from $105.00 to $107.00 in a research report on Monday, August 26th. Royal Bank of Canada raised their target price on Ollie's Bargain Outlet from $100.00 to $106.00 and gave the stock an "outperform" rating in a report on Wednesday, October 2nd. Piper Sandler reissued an "overweight" rating and issued a $107.00 price target on shares of Ollie's Bargain Outlet in a report on Friday, October 4th. JPMorgan Chase & Co. cut their target price on shares of Ollie's Bargain Outlet from $113.00 to $105.00 and set an "overweight" rating for the company in a report on Friday, August 30th. Finally, StockNews.com cut Ollie's Bargain Outlet from a "hold" rating to a "sell" rating in a report on Tuesday, October 22nd. One investment analyst has rated the stock with a sell rating, two have given a hold rating and ten have assigned a buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of $104.92.

Read Our Latest Research Report on OLLI

Ollie's Bargain Outlet Price Performance

Shares of OLLI stock traded down $0.90 during trading on Monday, hitting $98.10. 962,450 shares of the stock traded hands, compared to its average volume of 1,027,086. The firm has a market capitalization of $6.02 billion, a P/E ratio of 29.91, a price-to-earnings-growth ratio of 2.46 and a beta of 0.84. Ollie's Bargain Outlet Holdings, Inc. has a 52-week low of $68.05 and a 52-week high of $104.98. The firm's fifty day moving average price is $94.99 and its 200-day moving average price is $91.49.

Ollie's Bargain Outlet (NASDAQ:OLLI - Get Free Report) last released its quarterly earnings results on Thursday, August 29th. The company reported $0.78 earnings per share for the quarter, hitting analysts' consensus estimates of $0.78. The business had revenue of $578.38 million during the quarter, compared to analysts' expectations of $561.60 million. Ollie's Bargain Outlet had a return on equity of 13.27% and a net margin of 9.19%. The company's revenue was up 12.4% compared to the same quarter last year. During the same period in the prior year, the business posted $0.67 EPS. As a group, equities research analysts expect that Ollie's Bargain Outlet Holdings, Inc. will post 3.28 earnings per share for the current year.

About Ollie's Bargain Outlet

(

Free Report)

Ollie's Bargain Outlet Holdings, Inc operates as a retailer of brand name merchandise in the United States. The company offers housewares, bed and bath, food, floor coverings, health and beauty aids, books and stationery, toys, and electronics; and other products, including hardware, candy, clothing, sporting goods, pet and lawn, and garden products.

Featured Stories

Before you consider Ollie's Bargain Outlet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ollie's Bargain Outlet wasn't on the list.

While Ollie's Bargain Outlet currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.