Los Angeles Capital Management LLC raised its stake in Altria Group, Inc. (NYSE:MO - Free Report) by 729.8% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 1,969,262 shares of the company's stock after acquiring an additional 1,731,932 shares during the quarter. Los Angeles Capital Management LLC owned approximately 0.12% of Altria Group worth $100,511,000 at the end of the most recent reporting period.

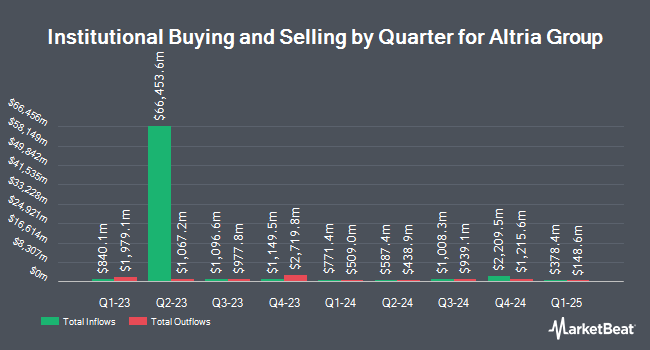

Several other hedge funds have also bought and sold shares of the stock. MFA Wealth Advisors LLC acquired a new position in Altria Group in the 2nd quarter worth about $27,000. Hobbs Group Advisors LLC acquired a new position in shares of Altria Group during the 2nd quarter worth approximately $30,000. Valley Wealth Managers Inc. lifted its position in shares of Altria Group by 63.9% during the 2nd quarter. Valley Wealth Managers Inc. now owns 667 shares of the company's stock valued at $30,000 after buying an additional 260 shares in the last quarter. Lynx Investment Advisory acquired a new stake in Altria Group in the 2nd quarter valued at $44,000. Finally, Covestor Ltd increased its holdings in Altria Group by 33.4% in the 1st quarter. Covestor Ltd now owns 1,047 shares of the company's stock worth $46,000 after acquiring an additional 262 shares in the last quarter. Hedge funds and other institutional investors own 57.41% of the company's stock.

Analysts Set New Price Targets

Several analysts have recently issued reports on MO shares. Deutsche Bank Aktiengesellschaft lifted their target price on shares of Altria Group from $52.00 to $60.00 and gave the company a "buy" rating in a research report on Friday, November 1st. Bank of America cut their price objective on Altria Group from $57.00 to $53.00 and set a "neutral" rating for the company in a research note on Tuesday, October 15th. UBS Group raised their target price on Altria Group from $39.00 to $41.00 and gave the company a "sell" rating in a research report on Monday, September 9th. Citigroup boosted their price target on Altria Group from $44.50 to $48.00 and gave the stock a "neutral" rating in a research report on Tuesday, October 8th. Finally, Stifel Nicolaus raised their price objective on Altria Group from $54.00 to $60.00 and gave the company a "buy" rating in a report on Friday, November 1st. Two equities research analysts have rated the stock with a sell rating, three have assigned a hold rating and three have issued a buy rating to the company. According to MarketBeat, the company currently has an average rating of "Hold" and a consensus target price of $51.33.

Read Our Latest Stock Analysis on MO

Altria Group Stock Up 1.0 %

Shares of Altria Group stock traded up $0.51 during mid-day trading on Friday, hitting $54.05. The stock had a trading volume of 5,712,292 shares, compared to its average volume of 7,545,575. The firm has a 50-day moving average of $51.50 and a two-hundred day moving average of $48.85. The firm has a market cap of $91.60 billion, a P/E ratio of 9.13, a price-to-earnings-growth ratio of 3.07 and a beta of 0.64. Altria Group, Inc. has a 12-month low of $39.25 and a 12-month high of $55.05.

Altria Group (NYSE:MO - Get Free Report) last issued its quarterly earnings data on Thursday, October 31st. The company reported $1.38 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.35 by $0.03. Altria Group had a negative return on equity of 233.80% and a net margin of 42.82%. The firm had revenue of $6.26 billion during the quarter, compared to the consensus estimate of $5.33 billion. During the same period last year, the company earned $1.28 EPS. The company's quarterly revenue was up 18.6% on a year-over-year basis. Sell-side analysts expect that Altria Group, Inc. will post 5.11 earnings per share for the current year.

Altria Group Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, October 10th. Investors of record on Monday, September 16th were issued a $1.02 dividend. This represents a $4.08 annualized dividend and a dividend yield of 7.55%. The ex-dividend date was Monday, September 16th. This is an increase from Altria Group's previous quarterly dividend of $0.98. Altria Group's payout ratio is currently 68.92%.

About Altria Group

(

Free Report)

Altria Group, Inc, through its subsidiaries, manufactures and sells smokeable and oral tobacco products in the United States. The company offers cigarettes primarily under the Marlboro brand; large cigars and pipe tobacco under the Black & Mild brand; moist smokeless tobacco and snus products under the Copenhagen, Skoal, Red Seal, and Husky brands; oral nicotine pouches under the on! brand; and e-vapor products under the NJOY ACE brand.

Featured Articles

Before you consider Altria Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altria Group wasn't on the list.

While Altria Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.