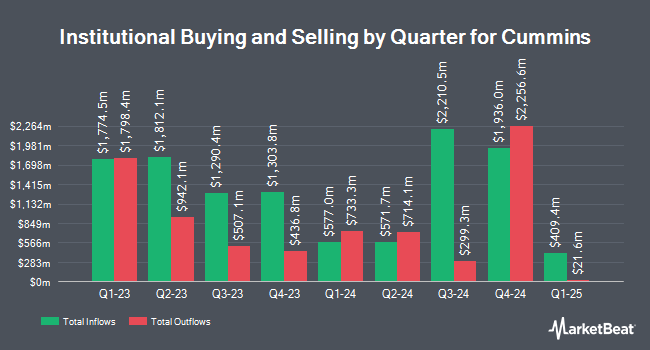

Los Angeles Capital Management LLC grew its position in Cummins Inc. (NYSE:CMI - Free Report) by 18.7% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 40,482 shares of the company's stock after purchasing an additional 6,371 shares during the quarter. Los Angeles Capital Management LLC's holdings in Cummins were worth $13,108,000 as of its most recent SEC filing.

A number of other hedge funds also recently bought and sold shares of the company. CarsonAllaria Wealth Management Ltd. acquired a new stake in shares of Cummins during the second quarter worth $28,000. Cultivar Capital Inc. acquired a new stake in Cummins during the second quarter worth about $28,000. Lynx Investment Advisory acquired a new position in shares of Cummins during the 2nd quarter worth $29,000. LRI Investments LLC bought a new stake in shares of Cummins in the 1st quarter valued at $31,000. Finally, Kathleen S. Wright Associates Inc. acquired a new stake in shares of Cummins during the 3rd quarter worth approximately $34,000. 83.46% of the stock is currently owned by institutional investors.

Cummins Stock Down 0.5 %

Cummins stock traded down $1.77 during midday trading on Tuesday, reaching $356.66. The company's stock had a trading volume of 202,856 shares, compared to its average volume of 1,490,462. The stock's 50-day simple moving average is $323.90 and its 200-day simple moving average is $299.69. Cummins Inc. has a 52-week low of $216.91 and a 52-week high of $370.21. The company has a debt-to-equity ratio of 0.43, a current ratio of 1.32 and a quick ratio of 0.82. The stock has a market capitalization of $48.93 billion, a P/E ratio of 23.67, a PEG ratio of 1.77 and a beta of 0.97.

Cummins (NYSE:CMI - Get Free Report) last announced its quarterly earnings results on Tuesday, November 5th. The company reported $5.86 earnings per share for the quarter, beating the consensus estimate of $4.89 by $0.97. The company had revenue of $8.46 billion during the quarter, compared to analysts' expectations of $8.29 billion. Cummins had a return on equity of 26.86% and a net margin of 6.13%. Cummins's quarterly revenue was up .3% on a year-over-year basis. During the same period last year, the business earned $4.73 earnings per share. On average, sell-side analysts expect that Cummins Inc. will post 20.32 EPS for the current year.

Cummins Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, December 5th. Shareholders of record on Friday, November 22nd will be issued a $1.82 dividend. The ex-dividend date is Friday, November 22nd. This represents a $7.28 dividend on an annualized basis and a yield of 2.04%. Cummins's payout ratio is 48.08%.

Analyst Ratings Changes

Several equities analysts have commented on the stock. Robert W. Baird lifted their target price on shares of Cummins from $330.00 to $372.00 and gave the stock a "neutral" rating in a research report on Wednesday, November 6th. Truist Financial upped their price objective on Cummins from $349.00 to $371.00 and gave the stock a "hold" rating in a report on Wednesday, October 9th. The Goldman Sachs Group boosted their price target on Cummins from $324.00 to $370.00 and gave the company a "neutral" rating in a report on Wednesday, November 6th. JPMorgan Chase & Co. lifted their price objective on Cummins from $285.00 to $340.00 and gave the company an "underweight" rating in a research report on Friday, October 11th. Finally, Vertical Research cut Cummins from a "buy" rating to a "hold" rating and set a $350.00 price objective for the company. in a research note on Wednesday, November 6th. Two research analysts have rated the stock with a sell rating, seven have given a hold rating, four have assigned a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and a consensus target price of $324.83.

View Our Latest Research Report on Cummins

Insider Activity

In other news, SVP Tony Satterthwaite sold 24,250 shares of the business's stock in a transaction dated Friday, August 23rd. The stock was sold at an average price of $308.24, for a total transaction of $7,474,820.00. Following the completion of the transaction, the senior vice president now directly owns 77,442 shares of the company's stock, valued at approximately $23,870,722.08. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. In other news, SVP Tony Satterthwaite sold 24,250 shares of the stock in a transaction dated Friday, August 23rd. The shares were sold at an average price of $308.24, for a total value of $7,474,820.00. Following the completion of the transaction, the senior vice president now owns 77,442 shares in the company, valued at $23,870,722.08. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, VP Sharon R. Barner sold 2,001 shares of the company's stock in a transaction that occurred on Monday, November 11th. The stock was sold at an average price of $358.43, for a total value of $717,218.43. Following the completion of the sale, the vice president now owns 20,803 shares in the company, valued at approximately $7,456,419.29. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 31,193 shares of company stock worth $9,685,552 over the last ninety days. Corporate insiders own 0.56% of the company's stock.

About Cummins

(

Free Report)

Cummins Inc designs, manufactures, distributes, and services diesel and natural gas engines, electric and hybrid powertrains, and related components worldwide. It operates through five segments: Engine, Distribution, Components, Power Systems, and Accelera. The company offers diesel and natural gas-powered engines under the Cummins and other customer brands for the heavy and medium-duty truck, bus, recreational vehicle, light-duty automotive, construction, mining, marine, rail, oil and gas, defense, and agricultural markets; and offers parts and services, as well as remanufactured parts and engines.

Further Reading

Before you consider Cummins, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cummins wasn't on the list.

While Cummins currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report