Los Angeles Capital Management LLC reduced its stake in OneSpan Inc. (NASDAQ:OSPN - Free Report) by 15.2% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 185,621 shares of the company's stock after selling 33,400 shares during the quarter. Los Angeles Capital Management LLC owned 0.49% of OneSpan worth $3,094,000 at the end of the most recent reporting period.

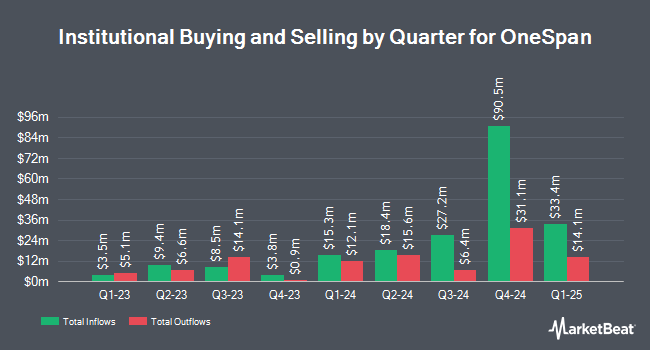

Several other hedge funds and other institutional investors also recently modified their holdings of OSPN. Allspring Global Investments Holdings LLC grew its stake in shares of OneSpan by 100.5% in the 1st quarter. Allspring Global Investments Holdings LLC now owns 11,126 shares of the company's stock valued at $129,000 after purchasing an additional 5,578 shares during the last quarter. Janney Montgomery Scott LLC acquired a new stake in shares of OneSpan in the 1st quarter valued at approximately $1,125,000. Russell Investments Group Ltd. lifted its holdings in shares of OneSpan by 9.8% in the 1st quarter. Russell Investments Group Ltd. now owns 222,959 shares of the company's stock valued at $2,593,000 after buying an additional 19,828 shares during the period. State Board of Administration of Florida Retirement System lifted its holdings in shares of OneSpan by 46.6% in the 1st quarter. State Board of Administration of Florida Retirement System now owns 16,957 shares of the company's stock valued at $197,000 after buying an additional 5,390 shares during the period. Finally, Vanguard Group Inc. lifted its holdings in shares of OneSpan by 8.5% in the 1st quarter. Vanguard Group Inc. now owns 2,794,375 shares of the company's stock valued at $32,499,000 after buying an additional 219,907 shares during the period. 95.52% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several research firms have recently commented on OSPN. Sidoti raised OneSpan from a "neutral" rating to a "buy" rating and raised their price target for the company from $14.00 to $19.00 in a report on Thursday, October 31st. Rosenblatt Securities reaffirmed a "buy" rating and set a $20.00 price objective on shares of OneSpan in a report on Monday, October 28th. Finally, StockNews.com raised OneSpan from a "buy" rating to a "strong-buy" rating in a report on Monday, November 4th. One research analyst has rated the stock with a hold rating, three have given a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Buy" and an average price target of $17.13.

Check Out Our Latest Research Report on OneSpan

OneSpan Stock Performance

OSPN stock traded up $0.24 during midday trading on Wednesday, hitting $17.61. 354,532 shares of the stock were exchanged, compared to its average volume of 404,067. The stock's 50-day moving average price is $15.72 and its 200-day moving average price is $14.32. The stock has a market cap of $669.00 million, a price-to-earnings ratio of 23.80 and a beta of 0.75. OneSpan Inc. has a fifty-two week low of $9.22 and a fifty-two week high of $17.89.

About OneSpan

(

Free Report)

OneSpan Inc, together with its subsidiaries, designs, develops, and markets digital solutions for identity, authentication, and secure digital agreements worldwide. The company offers OneSpan Sign, a range of e-signature requirements for occasional agreement to processing tens of thousands of transactions; OneSpan Cloud Authentication, a cloud-based multifactor authentication solution that supports a range of authentication options, including biometrics, push notification, and visual cryptograms for transaction data security, SMS, and hardware authenticators; and OneSpan Identity Verification, which enables banks and financial institutions identity verification services.

Featured Articles

Before you consider OneSpan, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OneSpan wasn't on the list.

While OneSpan currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.