Los Angeles Capital Management LLC bought a new position in MARA Holdings, Inc. (NASDAQ:MARA - Free Report) in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor bought 31,418 shares of the business services provider's stock, valued at approximately $510,000.

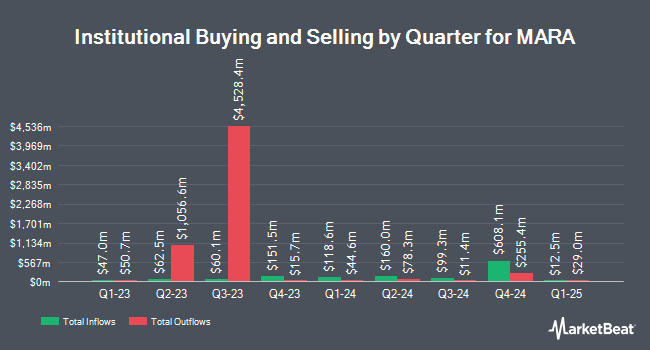

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. ProShare Advisors LLC raised its holdings in shares of MARA by 13.3% in the 1st quarter. ProShare Advisors LLC now owns 41,626 shares of the business services provider's stock worth $940,000 after purchasing an additional 4,873 shares in the last quarter. Vanguard Group Inc. lifted its position in shares of MARA by 1.9% during the 1st quarter. Vanguard Group Inc. now owns 23,915,042 shares of the business services provider's stock valued at $540,002,000 after acquiring an additional 441,455 shares during the last quarter. Ameritas Investment Partners Inc. lifted its position in shares of MARA by 4.1% during the 1st quarter. Ameritas Investment Partners Inc. now owns 22,359 shares of the business services provider's stock valued at $505,000 after acquiring an additional 881 shares during the last quarter. American International Group Inc. raised its holdings in MARA by 4.3% during the 1st quarter. American International Group Inc. now owns 110,489 shares of the business services provider's stock worth $2,495,000 after buying an additional 4,593 shares during the period. Finally, Natixis acquired a new position in shares of MARA in the first quarter worth about $177,000. 44.53% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

Several research firms have weighed in on MARA. Macquarie initiated coverage on shares of MARA in a research report on Tuesday, September 24th. They set an "outperform" rating and a $22.00 price objective on the stock. Cantor Fitzgerald began coverage on MARA in a research report on Thursday, October 10th. They set an "overweight" rating and a $21.00 price target on the stock. JPMorgan Chase & Co. decreased their price objective on MARA from $14.00 to $12.00 and set an "underweight" rating for the company in a research report on Friday, August 23rd. HC Wainwright reaffirmed a "buy" rating and set a $28.00 target price on shares of MARA in a research note on Wednesday. Finally, Needham & Company LLC reissued a "hold" rating on shares of MARA in a research report on Wednesday. Two equities research analysts have rated the stock with a sell rating, three have given a hold rating and four have given a buy rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus price target of $21.57.

Get Our Latest Report on MARA

Insider Buying and Selling

In other news, CFO Salman Hassan Khan sold 16,700 shares of the firm's stock in a transaction on Monday, September 16th. The stock was sold at an average price of $15.70, for a total value of $262,190.00. Following the transaction, the chief financial officer now directly owns 2,103,347 shares in the company, valued at $33,022,547.90. This trade represents a 0.79 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, CEO Frederick G. Thiel sold 27,505 shares of the stock in a transaction dated Wednesday, October 16th. The shares were sold at an average price of $17.50, for a total value of $481,337.50. Following the completion of the transaction, the chief executive officer now directly owns 4,250,804 shares in the company, valued at $74,389,070. The trade was a 0.64 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 91,417 shares of company stock worth $1,524,546 over the last three months. 0.97% of the stock is currently owned by company insiders.

MARA Stock Up 1.3 %

Shares of MARA opened at $21.07 on Friday. The business's 50 day simple moving average is $17.38 and its 200-day simple moving average is $18.60. MARA Holdings, Inc. has a one year low of $9.21 and a one year high of $34.09. The company has a market capitalization of $6.78 billion, a P/E ratio of 26.67 and a beta of 5.52. The company has a debt-to-equity ratio of 0.22, a current ratio of 4.00 and a quick ratio of 3.75.

MARA (NASDAQ:MARA - Get Free Report) last announced its earnings results on Tuesday, November 12th. The business services provider reported ($0.42) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.38) by ($0.04). MARA had a negative return on equity of 8.40% and a net margin of 27.48%. The company had revenue of $131.60 million for the quarter, compared to analyst estimates of $140.26 million. During the same quarter in the previous year, the company posted ($0.05) earnings per share. MARA's revenue for the quarter was up 34.4% on a year-over-year basis. As a group, sell-side analysts predict that MARA Holdings, Inc. will post -0.72 EPS for the current fiscal year.

MARA Company Profile

(

Free Report)

MARA Holdings, Inc operates as a digital asset technology company that mines digital assets with a focus on the bitcoin ecosystem in United States. The company was formerly known as Marathon Digital Holdings, Inc and changed its name to MARA Holdings, Inc in August 2024. MARA Holdings, Inc was incorporated in 2010 and is headquartered in Fort Lauderdale, Florida.

See Also

Before you consider MARA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MARA wasn't on the list.

While MARA currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.