Thrivent Financial for Lutherans cut its stake in shares of Louisiana-Pacific Co. (NYSE:LPX - Free Report) by 87.1% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 14,694 shares of the building manufacturing company's stock after selling 99,153 shares during the period. Thrivent Financial for Lutherans' holdings in Louisiana-Pacific were worth $1,579,000 as of its most recent SEC filing.

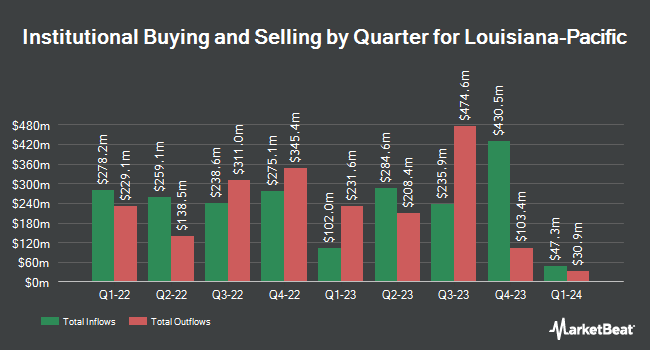

A number of other institutional investors and hedge funds have also added to or reduced their stakes in the stock. Harbor Capital Advisors Inc. acquired a new position in shares of Louisiana-Pacific during the 3rd quarter worth about $38,000. GAMMA Investing LLC grew its holdings in Louisiana-Pacific by 57.3% during the second quarter. GAMMA Investing LLC now owns 486 shares of the building manufacturing company's stock valued at $40,000 after purchasing an additional 177 shares during the period. V Square Quantitative Management LLC acquired a new position in Louisiana-Pacific during the third quarter valued at approximately $43,000. Covestor Ltd raised its holdings in Louisiana-Pacific by 61.0% in the third quarter. Covestor Ltd now owns 430 shares of the building manufacturing company's stock worth $46,000 after purchasing an additional 163 shares during the period. Finally, International Assets Investment Management LLC bought a new position in shares of Louisiana-Pacific during the second quarter worth $53,000. Institutional investors own 94.73% of the company's stock.

Insider Buying and Selling

In related news, Director Lizanne C. Gottung sold 2,500 shares of the firm's stock in a transaction dated Monday, September 16th. The shares were sold at an average price of $98.30, for a total value of $245,750.00. Following the completion of the sale, the director now directly owns 21,005 shares in the company, valued at approximately $2,064,791.50. This trade represents a 10.64 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, Director Ozey K. Horton, Jr. sold 300 shares of Louisiana-Pacific stock in a transaction dated Tuesday, November 12th. The stock was sold at an average price of $113.41, for a total value of $34,023.00. Following the transaction, the director now owns 28,638 shares of the company's stock, valued at $3,247,835.58. The trade was a 1.04 % decrease in their position. The disclosure for this sale can be found here. 1.26% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

A number of research firms recently commented on LPX. BMO Capital Markets upped their price objective on shares of Louisiana-Pacific from $99.00 to $103.00 and gave the company a "market perform" rating in a research report on Tuesday, November 12th. TD Securities increased their price target on Louisiana-Pacific from $115.00 to $123.00 and gave the stock a "hold" rating in a report on Wednesday, November 6th. Bank of America lifted their price objective on Louisiana-Pacific from $73.00 to $75.00 and gave the company an "underperform" rating in a report on Thursday, September 12th. Royal Bank of Canada increased their target price on Louisiana-Pacific from $119.00 to $125.00 and gave the stock an "outperform" rating in a research note on Wednesday, November 6th. Finally, Truist Financial lifted their price target on shares of Louisiana-Pacific from $105.00 to $113.00 and gave the company a "buy" rating in a research note on Tuesday, October 15th. Two analysts have rated the stock with a sell rating, six have given a hold rating and three have issued a buy rating to the company. According to data from MarketBeat.com, the company presently has an average rating of "Hold" and an average target price of $102.22.

Get Our Latest Stock Analysis on Louisiana-Pacific

Louisiana-Pacific Stock Up 1.3 %

Louisiana-Pacific stock traded up $1.56 during mid-day trading on Friday, reaching $118.20. The company's stock had a trading volume of 230,390 shares, compared to its average volume of 828,805. The company has a debt-to-equity ratio of 0.21, a quick ratio of 1.69 and a current ratio of 2.92. Louisiana-Pacific Co. has a 12 month low of $60.37 and a 12 month high of $122.87. The business's 50 day simple moving average is $107.68 and its 200 day simple moving average is $97.27. The company has a market capitalization of $8.30 billion, a price-to-earnings ratio of 20.38, a price-to-earnings-growth ratio of 2.81 and a beta of 1.88.

Louisiana-Pacific Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Wednesday, November 27th. Investors of record on Wednesday, November 20th were given a $0.26 dividend. This represents a $1.04 dividend on an annualized basis and a dividend yield of 0.88%. The ex-dividend date was Wednesday, November 20th. Louisiana-Pacific's dividend payout ratio is currently 17.93%.

About Louisiana-Pacific

(

Free Report)

Louisiana-Pacific Corporation, together with its subsidiaries, provides building solutions primarily for use in new home construction, repair and remodeling, and outdoor structure markets. It operates through Siding, Oriented Strand Board, LP South America, and Other segments. The Siding segment offers LP SmartSide trim and siding products, LP SmartSide ExpertFinish trim and siding products, LP BuilderSeries lap siding products, and LP Outdoor Building Solutions; and engineered wood siding, trim, soffit, and fascia products.

See Also

Before you consider Louisiana-Pacific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Louisiana-Pacific wasn't on the list.

While Louisiana-Pacific currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.