Lountzis Asset Management LLC acquired a new stake in Procore Technologies, Inc. (NYSE:PCOR - Free Report) during the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor acquired 99,806 shares of the company's stock, valued at approximately $6,160,000. Procore Technologies comprises 2.6% of Lountzis Asset Management LLC's investment portfolio, making the stock its 13th largest position. Lountzis Asset Management LLC owned about 0.07% of Procore Technologies as of its most recent SEC filing.

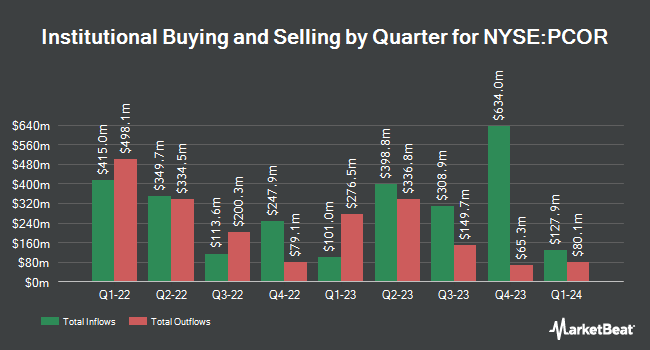

A number of other institutional investors have also recently made changes to their positions in the company. Atria Investments Inc boosted its stake in Procore Technologies by 11.9% in the 3rd quarter. Atria Investments Inc now owns 4,950 shares of the company's stock worth $306,000 after purchasing an additional 527 shares during the period. Kornitzer Capital Management Inc. KS grew its stake in Procore Technologies by 24.9% during the third quarter. Kornitzer Capital Management Inc. KS now owns 175,800 shares of the company's stock valued at $10,850,000 after acquiring an additional 35,000 shares in the last quarter. Olympiad Research LP increased its holdings in Procore Technologies by 42.4% during the 3rd quarter. Olympiad Research LP now owns 9,899 shares of the company's stock worth $611,000 after acquiring an additional 2,947 shares during the period. WoodTrust Financial Corp purchased a new stake in Procore Technologies in the 3rd quarter worth approximately $201,000. Finally, Malaga Cove Capital LLC purchased a new stake in Procore Technologies in the 3rd quarter worth approximately $277,000. Hedge funds and other institutional investors own 81.10% of the company's stock.

Procore Technologies Trading Up 0.3 %

Shares of Procore Technologies stock traded up $0.19 on Monday, hitting $70.65. The stock had a trading volume of 1,217,751 shares, compared to its average volume of 1,559,942. The company has a quick ratio of 1.57, a current ratio of 1.57 and a debt-to-equity ratio of 0.03. Procore Technologies, Inc. has a one year low of $49.46 and a one year high of $83.35. The stock's 50-day simple moving average is $61.04 and its two-hundred day simple moving average is $63.72. The stock has a market cap of $10.50 billion, a price-to-earnings ratio of -140.92 and a beta of 0.71.

Procore Technologies (NYSE:PCOR - Get Free Report) last announced its quarterly earnings results on Wednesday, October 30th. The company reported ($0.11) earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of ($0.11). The business had revenue of $295.89 million for the quarter, compared to analyst estimates of $287.42 million. Procore Technologies had a negative net margin of 6.59% and a negative return on equity of 2.51%. As a group, sell-side analysts predict that Procore Technologies, Inc. will post -0.23 EPS for the current year.

Wall Street Analyst Weigh In

Several research analysts have recently weighed in on the stock. JPMorgan Chase & Co. decreased their price target on shares of Procore Technologies from $90.00 to $75.00 and set an "overweight" rating on the stock in a report on Friday, August 2nd. JMP Securities lowered their price target on Procore Technologies from $82.00 to $75.00 and set a "market outperform" rating on the stock in a report on Thursday, October 31st. BMO Capital Markets dropped their price target on Procore Technologies from $85.00 to $71.00 and set an "outperform" rating for the company in a research report on Friday, August 2nd. Baird R W upgraded shares of Procore Technologies to a "strong-buy" rating in a research report on Tuesday, September 24th. Finally, TD Cowen lifted their target price on shares of Procore Technologies from $65.00 to $70.00 and gave the company a "buy" rating in a research report on Monday, October 28th. Five equities research analysts have rated the stock with a hold rating, eleven have issued a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $69.94.

Get Our Latest Report on PCOR

Insider Buying and Selling at Procore Technologies

In related news, CFO Howard Fu sold 1,500 shares of the firm's stock in a transaction on Thursday, November 7th. The stock was sold at an average price of $71.75, for a total value of $107,625.00. Following the completion of the sale, the chief financial officer now owns 171,997 shares of the company's stock, valued at $12,340,784.75. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. In other Procore Technologies news, SVP William Fred Fleming, Jr. sold 15,000 shares of the company's stock in a transaction that occurred on Wednesday, November 6th. The stock was sold at an average price of $70.75, for a total transaction of $1,061,250.00. Following the transaction, the senior vice president now owns 75,120 shares in the company, valued at approximately $5,314,740. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CFO Howard Fu sold 1,500 shares of the firm's stock in a transaction that occurred on Thursday, November 7th. The shares were sold at an average price of $71.75, for a total value of $107,625.00. Following the completion of the transaction, the chief financial officer now owns 171,997 shares of the company's stock, valued at approximately $12,340,784.75. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 115,227 shares of company stock valued at $7,045,139 in the last 90 days. Insiders own 29.00% of the company's stock.

Procore Technologies Company Profile

(

Free Report)

Procore Technologies, Inc engages in the provision of a cloud-based construction management platform and related software products in the United States and internationally. The company's platform enables owners, general and specialty contractors, architects, and engineers to collaborate on construction projects.

See Also

Before you consider Procore Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Procore Technologies wasn't on the list.

While Procore Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.