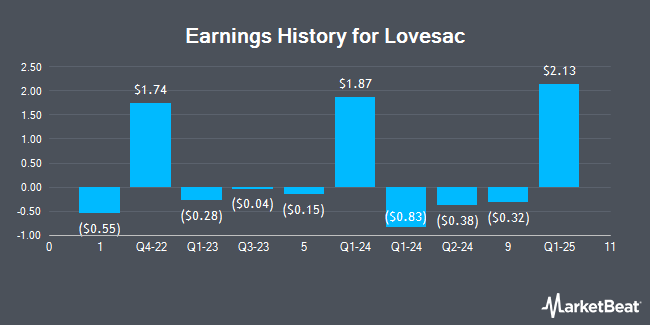

Lovesac (NASDAQ:LOVE - Get Free Report) is anticipated to announce its earnings results before the market opens on Thursday, April 10th. Analysts expect the company to announce earnings of $1.80 per share and revenue of $230.33 million for the quarter. Individual that are interested in participating in the company's earnings conference call can do so using this link.

Lovesac Price Performance

NASDAQ:LOVE traded down $1.29 during trading hours on Monday, reaching $13.14. 994,221 shares of the company were exchanged, compared to its average volume of 355,344. The company has a market capitalization of $202.79 million, a P/E ratio of 38.65, a P/E/G ratio of 0.65 and a beta of 3.08. The business has a 50 day moving average of $20.10 and a 200 day moving average of $25.80. Lovesac has a 1-year low of $12.99 and a 1-year high of $39.49.

Analyst Ratings Changes

Several equities research analysts recently weighed in on LOVE shares. Roth Mkm upped their price objective on shares of Lovesac from $35.00 to $42.00 and gave the stock a "buy" rating in a research report on Tuesday, December 10th. DA Davidson reaffirmed a "buy" rating and set a $35.00 price target on shares of Lovesac in a report on Tuesday, March 25th. Six analysts have rated the stock with a buy rating, According to data from MarketBeat.com, the company presently has an average rating of "Buy" and an average price target of $38.33.

View Our Latest Research Report on LOVE

Insider Activity at Lovesac

In related news, Director Albert Jack Krause sold 30,000 shares of the business's stock in a transaction on Friday, January 17th. The stock was sold at an average price of $26.33, for a total transaction of $789,900.00. Following the sale, the director now owns 147,849 shares in the company, valued at $3,892,864.17. The trade was a 16.87 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. 12.33% of the stock is currently owned by insiders.

Lovesac Company Profile

(

Get Free Report)

The Lovesac Company designs, manufactures, and sells furniture. It offers sactionals, such as seats and sides; sacs, including foam beanbag chairs; and other products comprising drink holders, footsac blankets, decorative pillows, fitted seat tables, and ottomans. The company markets its products primarily through www.lovesac.com website, as well as showrooms at top tier malls, lifestyle centers, mobile concierges, kiosks, and street locations in 41 states in the United States; and in store pop-up- shops and shop-in-shops, and barter inventory transactions.

See Also

Before you consider Lovesac, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lovesac wasn't on the list.

While Lovesac currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.