Royal London Asset Management Ltd. grew its holdings in shares of LPL Financial Holdings Inc. (NASDAQ:LPLA - Free Report) by 6.2% during the third quarter, according to the company in its most recent disclosure with the SEC. The fund owned 51,542 shares of the financial services provider's stock after buying an additional 2,998 shares during the quarter. Royal London Asset Management Ltd. owned 0.07% of LPL Financial worth $11,990,000 at the end of the most recent reporting period.

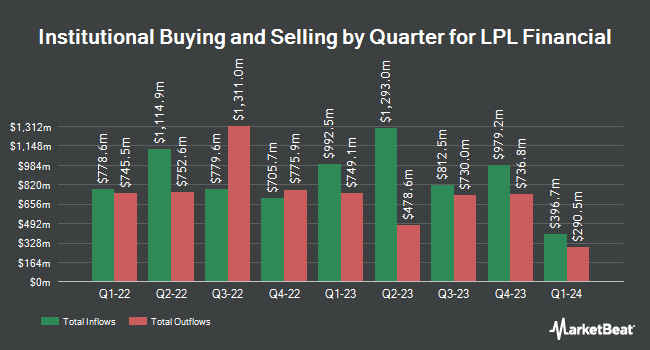

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Daiwa Securities Group Inc. lifted its holdings in LPL Financial by 50.6% during the 3rd quarter. Daiwa Securities Group Inc. now owns 15,841 shares of the financial services provider's stock valued at $3,685,000 after buying an additional 5,320 shares in the last quarter. Raymond James & Associates increased its position in shares of LPL Financial by 5.4% during the second quarter. Raymond James & Associates now owns 394,091 shares of the financial services provider's stock worth $110,070,000 after acquiring an additional 20,123 shares during the period. Coronation Fund Managers Ltd. raised its stake in shares of LPL Financial by 68.2% during the third quarter. Coronation Fund Managers Ltd. now owns 217,451 shares of the financial services provider's stock valued at $50,586,000 after acquiring an additional 88,196 shares in the last quarter. Assenagon Asset Management S.A. boosted its holdings in shares of LPL Financial by 882.4% in the second quarter. Assenagon Asset Management S.A. now owns 85,914 shares of the financial services provider's stock valued at $23,996,000 after purchasing an additional 77,169 shares during the period. Finally, Bridgewater Associates LP grew its stake in LPL Financial by 230.4% in the third quarter. Bridgewater Associates LP now owns 35,848 shares of the financial services provider's stock worth $8,339,000 after purchasing an additional 24,998 shares in the last quarter. 95.66% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several brokerages have weighed in on LPLA. Barclays upped their target price on LPL Financial from $273.00 to $311.00 and gave the stock an "overweight" rating in a report on Thursday, October 31st. TD Cowen upped their price objective on shares of LPL Financial from $271.00 to $277.00 and gave the stock a "hold" rating in a research note on Thursday, October 31st. Morgan Stanley raised their target price on shares of LPL Financial from $303.00 to $309.00 and gave the company an "overweight" rating in a research report on Thursday, October 17th. Jefferies Financial Group lowered their price target on shares of LPL Financial from $309.00 to $282.00 and set a "buy" rating for the company in a research report on Friday, October 4th. Finally, StockNews.com upgraded shares of LPL Financial from a "sell" rating to a "hold" rating in a research note on Saturday, November 9th. One equities research analyst has rated the stock with a sell rating, four have given a hold rating and nine have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $290.83.

Check Out Our Latest Analysis on LPLA

LPL Financial Stock Down 0.9 %

Shares of LPLA stock traded down $3.09 during trading hours on Friday, reaching $327.56. 388,786 shares of the company's stock were exchanged, compared to its average volume of 504,436. LPL Financial Holdings Inc. has a fifty-two week low of $187.19 and a fifty-two week high of $332.54. The stock's 50 day moving average is $284.54 and its 200-day moving average is $257.15. The company has a current ratio of 2.16, a quick ratio of 2.16 and a debt-to-equity ratio of 1.60. The company has a market cap of $24.53 billion, a price-to-earnings ratio of 24.63, a P/E/G ratio of 1.60 and a beta of 0.86.

LPL Financial (NASDAQ:LPLA - Get Free Report) last announced its earnings results on Wednesday, October 30th. The financial services provider reported $4.16 earnings per share (EPS) for the quarter, beating the consensus estimate of $3.69 by $0.47. The company had revenue of $3.11 billion for the quarter, compared to analyst estimates of $3.04 billion. LPL Financial had a return on equity of 49.47% and a net margin of 8.73%. The firm's quarterly revenue was up 6.0% compared to the same quarter last year. During the same period in the prior year, the company posted $3.74 EPS. Analysts predict that LPL Financial Holdings Inc. will post 16.1 earnings per share for the current fiscal year.

LPL Financial Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Monday, December 2nd. Investors of record on Thursday, November 14th were paid a $0.30 dividend. This represents a $1.20 dividend on an annualized basis and a yield of 0.37%. The ex-dividend date was Thursday, November 14th. LPL Financial's dividend payout ratio (DPR) is presently 9.02%.

About LPL Financial

(

Free Report)

LPL Financial Holdings Inc, together with its subsidiaries, provides an integrated platform of brokerage and investment advisory services to independent financial advisors and financial advisors at enterprises in the United States. Its brokerage offerings include variable and fixed annuities, mutual funds, equities, fixed income, alternative investments, retirement and 529 education savings plans, and insurance.

See Also

Before you consider LPL Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LPL Financial wasn't on the list.

While LPL Financial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.