LPL Financial LLC boosted its holdings in shares of Kyndryl Holdings, Inc. (NYSE:KD - Free Report) by 22.4% during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 99,506 shares of the company's stock after buying an additional 18,198 shares during the period. LPL Financial LLC's holdings in Kyndryl were worth $3,443,000 as of its most recent SEC filing.

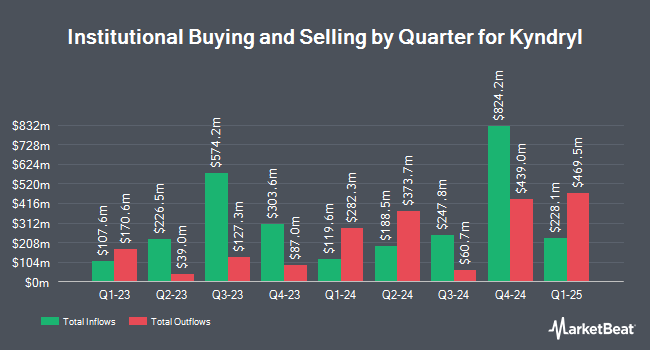

A number of other large investors have also recently made changes to their positions in KD. Mediolanum International Funds Ltd bought a new position in shares of Kyndryl during the fourth quarter valued at about $16,856,000. Raymond James Financial Inc. bought a new position in shares of Kyndryl during the 4th quarter worth approximately $11,359,000. Diversify Advisory Services LLC purchased a new position in shares of Kyndryl in the 4th quarter worth approximately $5,309,000. Ieq Capital LLC purchased a new position in shares of Kyndryl in the 4th quarter worth approximately $3,503,000. Finally, Thrivent Financial for Lutherans grew its holdings in shares of Kyndryl by 51.4% in the fourth quarter. Thrivent Financial for Lutherans now owns 274,897 shares of the company's stock valued at $9,511,000 after acquiring an additional 93,302 shares in the last quarter. 71.53% of the stock is owned by institutional investors.

Kyndryl Stock Performance

NYSE:KD traded down $0.75 during trading hours on Thursday, reaching $29.11. The stock had a trading volume of 267,929 shares, compared to its average volume of 2,042,946. Kyndryl Holdings, Inc. has a 12-month low of $19.24 and a 12-month high of $43.61. The company has a debt-to-equity ratio of 2.55, a quick ratio of 1.09 and a current ratio of 1.09. The stock has a 50 day simple moving average of $34.87 and a 200 day simple moving average of $32.94. The stock has a market cap of $6.77 billion, a P/E ratio of 53.04, a price-to-earnings-growth ratio of 10.84 and a beta of 1.91.

Insider Buying and Selling

In other Kyndryl news, General Counsel Edward Sebold sold 27,500 shares of the stock in a transaction dated Thursday, February 6th. The shares were sold at an average price of $42.83, for a total transaction of $1,177,825.00. Following the completion of the transaction, the general counsel now owns 132,818 shares in the company, valued at $5,688,594.94. This trade represents a 17.15 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, SVP Vineet Khurana sold 55,465 shares of the business's stock in a transaction that occurred on Thursday, February 6th. The shares were sold at an average price of $42.81, for a total transaction of $2,374,456.65. Following the completion of the sale, the senior vice president now directly owns 43,877 shares in the company, valued at approximately $1,878,374.37. This trade represents a 55.83 % decrease in their position. The disclosure for this sale can be found here. 1.04% of the stock is currently owned by insiders.

Analysts Set New Price Targets

Several research firms have weighed in on KD. Oppenheimer boosted their price objective on Kyndryl from $37.00 to $43.00 and gave the stock an "outperform" rating in a research report on Tuesday, February 4th. Susquehanna boosted their price target on shares of Kyndryl from $40.00 to $46.00 and gave the stock a "positive" rating in a report on Wednesday, February 5th.

Read Our Latest Analysis on Kyndryl

About Kyndryl

(

Free Report)

Kyndryl Holdings, Inc operates as a technology services company and IT infrastructure services provider worldwide. The company offers cloud services; core enterprise and zCloud services; application, data, and artificial intelligence services; digital workplace services; security and resiliency services; and network services and edge services.

Read More

Before you consider Kyndryl, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kyndryl wasn't on the list.

While Kyndryl currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.