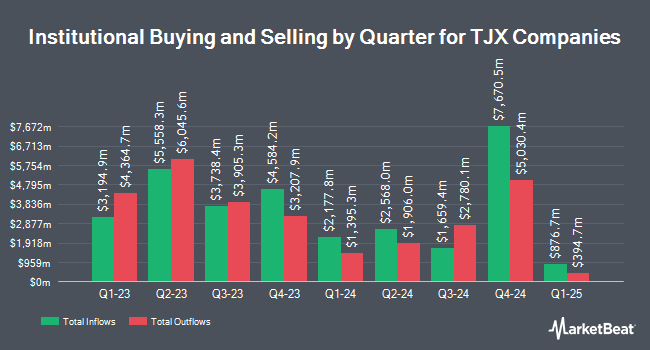

LPL Financial LLC lifted its stake in The TJX Companies, Inc. (NYSE:TJX - Free Report) by 15.3% during the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 1,009,386 shares of the apparel and home fashions retailer's stock after buying an additional 134,175 shares during the quarter. LPL Financial LLC owned about 0.09% of TJX Companies worth $121,944,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other large investors have also recently made changes to their positions in TJX. State Street Corp raised its stake in TJX Companies by 1.0% during the 3rd quarter. State Street Corp now owns 47,556,435 shares of the apparel and home fashions retailer's stock worth $5,589,783,000 after acquiring an additional 469,287 shares during the period. Geode Capital Management LLC lifted its stake in shares of TJX Companies by 1.5% during the 3rd quarter. Geode Capital Management LLC now owns 23,857,584 shares of the apparel and home fashions retailer's stock valued at $2,795,121,000 after buying an additional 363,707 shares in the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its stake in shares of TJX Companies by 7.5% during the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 9,182,564 shares of the apparel and home fashions retailer's stock valued at $1,079,319,000 after buying an additional 643,833 shares in the last quarter. Franklin Resources Inc. boosted its holdings in TJX Companies by 9.9% in the 3rd quarter. Franklin Resources Inc. now owns 7,271,499 shares of the apparel and home fashions retailer's stock worth $837,951,000 after buying an additional 657,529 shares during the period. Finally, Nordea Investment Management AB increased its stake in TJX Companies by 13.3% in the 4th quarter. Nordea Investment Management AB now owns 7,031,237 shares of the apparel and home fashions retailer's stock worth $850,428,000 after buying an additional 827,103 shares in the last quarter. 91.09% of the stock is owned by hedge funds and other institutional investors.

TJX Companies Price Performance

Shares of TJX Companies stock opened at $119.64 on Tuesday. The stock has a market cap of $134.49 billion, a price-to-earnings ratio of 28.15, a price-to-earnings-growth ratio of 2.75 and a beta of 0.96. The company has a debt-to-equity ratio of 0.35, a quick ratio of 0.50 and a current ratio of 1.19. The stock has a 50 day moving average price of $121.68 and a 200-day moving average price of $120.16. The TJX Companies, Inc. has a one year low of $92.35 and a one year high of $128.00.

TJX Companies (NYSE:TJX - Get Free Report) last posted its quarterly earnings data on Wednesday, February 26th. The apparel and home fashions retailer reported $1.23 EPS for the quarter, topping the consensus estimate of $1.16 by $0.07. TJX Companies had a net margin of 8.63% and a return on equity of 61.82%. The company had revenue of $16.35 billion during the quarter, compared to analyst estimates of $16.24 billion. Equities analysts expect that The TJX Companies, Inc. will post 4.18 EPS for the current year.

Insider Buying and Selling

In other TJX Companies news, CEO Ernie Herrman sold 23,428 shares of the stock in a transaction on Wednesday, March 5th. The stock was sold at an average price of $123.03, for a total value of $2,882,346.84. Following the sale, the chief executive officer now owns 484,189 shares in the company, valued at $59,569,772.67. This trade represents a 4.62 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director Alan M. Bennett sold 8,000 shares of the business's stock in a transaction on Thursday, February 27th. The shares were sold at an average price of $123.53, for a total transaction of $988,240.00. The disclosure for this sale can be found here. 0.13% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

A number of equities analysts have recently weighed in on TJX shares. Barclays upped their price objective on TJX Companies from $136.00 to $137.00 and gave the stock an "overweight" rating in a research note on Thursday, February 27th. Morgan Stanley lifted their price objective on shares of TJX Companies from $130.00 to $135.00 and gave the company an "overweight" rating in a research report on Tuesday, January 21st. Telsey Advisory Group restated an "outperform" rating and set a $145.00 target price on shares of TJX Companies in a research report on Thursday, February 27th. Robert W. Baird lifted their price target on shares of TJX Companies from $138.00 to $140.00 and gave the company an "outperform" rating in a report on Thursday, February 27th. Finally, Wells Fargo & Company increased their price objective on shares of TJX Companies from $115.00 to $120.00 and gave the company an "equal weight" rating in a report on Friday, January 10th. Three analysts have rated the stock with a hold rating and fifteen have assigned a buy rating to the stock. According to data from MarketBeat, TJX Companies currently has an average rating of "Moderate Buy" and an average price target of $135.06.

Check Out Our Latest Report on TJX

About TJX Companies

(

Free Report)

The TJX Companies, Inc, together with its subsidiaries, operates as an off-price apparel and home fashions retailer in the United States, Canada, Europe, and Australia. It operates through four segments: Marmaxx, HomeGoods, TJX Canada, and TJX International. The company sells family apparel, including footwear and accessories; home fashions, such as home basics, furniture, rugs, lighting products, giftware, soft home products, decorative accessories, tabletop, and cookware, as well as expanded pet, and gourmet food departments; jewelry and accessories; and other merchandise.

Featured Articles

Want to see what other hedge funds are holding TJX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for The TJX Companies, Inc. (NYSE:TJX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider TJX Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TJX Companies wasn't on the list.

While TJX Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report