LPL Financial LLC grew its holdings in shares of Mueller Industries, Inc. (NYSE:MLI - Free Report) by 59.9% in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 161,041 shares of the industrial products company's stock after purchasing an additional 60,354 shares during the period. LPL Financial LLC owned approximately 0.14% of Mueller Industries worth $12,780,000 at the end of the most recent quarter.

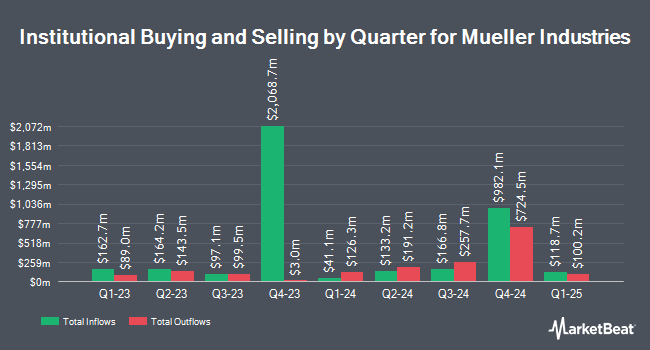

Several other institutional investors have also added to or reduced their stakes in the business. William Blair Investment Management LLC acquired a new position in shares of Mueller Industries in the 4th quarter valued at $201,376,000. Allianz Asset Management GmbH increased its holdings in shares of Mueller Industries by 135.7% in the fourth quarter. Allianz Asset Management GmbH now owns 508,333 shares of the industrial products company's stock valued at $40,341,000 after purchasing an additional 292,697 shares during the period. Four Tree Island Advisory LLC purchased a new position in shares of Mueller Industries in the fourth quarter worth about $19,376,000. Barclays PLC lifted its stake in Mueller Industries by 343.9% during the 3rd quarter. Barclays PLC now owns 197,206 shares of the industrial products company's stock valued at $14,613,000 after acquiring an additional 152,780 shares during the period. Finally, Retirement Systems of Alabama purchased a new stake in shares of Mueller Industries in the 4th quarter valued at $11,877,000. Institutional investors and hedge funds own 94.50% of the company's stock.

Insiders Place Their Bets

In related news, Director Scott Jay Goldman sold 10,000 shares of Mueller Industries stock in a transaction dated Thursday, February 13th. The stock was sold at an average price of $79.81, for a total value of $798,100.00. Following the completion of the transaction, the director now owns 56,098 shares in the company, valued at $4,477,181.38. The trade was a 15.13 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Insiders own 2.80% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, Northcoast Research raised shares of Mueller Industries from a "neutral" rating to a "buy" rating and set a $105.00 target price for the company in a report on Wednesday, December 11th.

Check Out Our Latest Report on MLI

Mueller Industries Stock Down 1.4 %

Shares of MLI stock traded down $0.97 on Monday, hitting $69.63. The company had a trading volume of 1,245,594 shares, compared to its average volume of 904,752. Mueller Industries, Inc. has a twelve month low of $50.85 and a twelve month high of $96.81. The firm has a market cap of $7.71 billion, a P/E ratio of 13.11 and a beta of 0.96. The company has a 50-day moving average price of $79.12 and a 200-day moving average price of $79.96.

Mueller Industries (NYSE:MLI - Get Free Report) last issued its quarterly earnings data on Tuesday, February 4th. The industrial products company reported $1.21 EPS for the quarter, topping analysts' consensus estimates of $1.12 by $0.09. Mueller Industries had a net margin of 16.05% and a return on equity of 22.97%.

Mueller Industries Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, March 28th. Shareholders of record on Friday, March 14th were issued a $0.25 dividend. This is a boost from Mueller Industries's previous quarterly dividend of $0.20. The ex-dividend date was Friday, March 14th. This represents a $1.00 dividend on an annualized basis and a yield of 1.44%. Mueller Industries's payout ratio is presently 18.83%.

Mueller Industries Company Profile

(

Free Report)

Mueller Industries, Inc manufactures and sells copper, brass, aluminum, and plastic products in the United States, the United Kingdom, Canada, South Korea, the Middle East, China, and Mexico. It operates through three segments: Piping Systems, Industrial Metals, and Climate. The Piping Systems segment offers copper tubes, fittings, line sets, and pipe nipples.

Featured Articles

Before you consider Mueller Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mueller Industries wasn't on the list.

While Mueller Industries currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.