LPL Financial LLC decreased its holdings in shares of Bloom Energy Co. (NYSE:BE - Free Report) by 18.8% in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 178,069 shares of the company's stock after selling 41,104 shares during the quarter. LPL Financial LLC owned 0.08% of Bloom Energy worth $3,955,000 at the end of the most recent quarter.

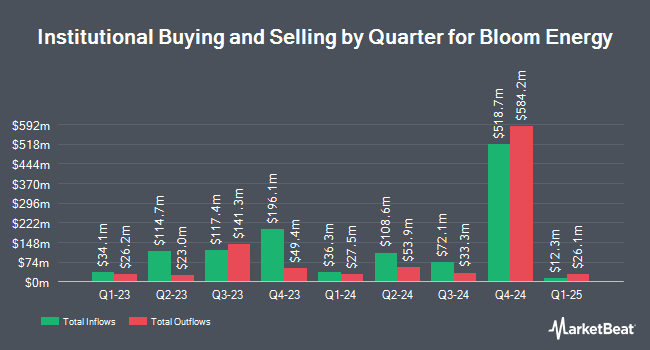

Other hedge funds have also bought and sold shares of the company. KLP Kapitalforvaltning AS bought a new position in Bloom Energy during the 4th quarter valued at approximately $944,000. Virtu Financial LLC purchased a new stake in Bloom Energy during the 4th quarter valued at $785,000. Semanteon Capital Management LP purchased a new stake in shares of Bloom Energy in the fourth quarter worth $1,259,000. Teacher Retirement System of Texas purchased a new position in shares of Bloom Energy in the fourth quarter valued at about $214,000. Finally, Trivest Advisors Ltd purchased a new position in Bloom Energy in the 4th quarter worth approximately $30,539,000. 77.04% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

BE has been the topic of several analyst reports. BMO Capital Markets reissued a "market perform" rating on shares of Bloom Energy in a research report on Friday, February 28th. Hsbc Global Res upgraded shares of Bloom Energy from a "hold" rating to a "strong-buy" rating in a report on Tuesday, April 8th. Piper Sandler dropped their target price on shares of Bloom Energy from $33.00 to $31.00 and set an "overweight" rating on the stock in a research note on Friday, February 28th. Bank of America lowered their price target on shares of Bloom Energy from $20.00 to $18.00 and set an "underperform" rating for the company in a research report on Tuesday, January 28th. Finally, TD Cowen lifted their target price on Bloom Energy from $13.00 to $20.00 and gave the company a "hold" rating in a research note on Friday, February 28th. Two investment analysts have rated the stock with a sell rating, nine have assigned a hold rating, nine have given a buy rating and two have issued a strong buy rating to the company. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $24.29.

Read Our Latest Stock Analysis on BE

Insider Activity at Bloom Energy

In related news, insider Satish Chitoori sold 1,020 shares of the stock in a transaction on Monday, March 17th. The stock was sold at an average price of $25.09, for a total value of $25,591.80. Following the completion of the sale, the insider now directly owns 178,656 shares in the company, valued at approximately $4,482,479.04. This represents a 0.57 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, insider Shawn Marie Soderberg sold 1,639 shares of Bloom Energy stock in a transaction that occurred on Thursday, January 16th. The stock was sold at an average price of $23.42, for a total value of $38,385.38. Following the sale, the insider now owns 171,040 shares in the company, valued at $4,005,756.80. This represents a 0.95 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 8.81% of the stock is owned by insiders.

Bloom Energy Stock Performance

Shares of BE stock traded up $0.10 during mid-day trading on Monday, hitting $17.74. The stock had a trading volume of 367,110 shares, compared to its average volume of 6,794,024. The company's 50-day simple moving average is $22.56 and its 200-day simple moving average is $20.44. The firm has a market cap of $4.09 billion, a PE ratio of -31.68 and a beta of 3.27. The company has a debt-to-equity ratio of 3.09, a current ratio of 3.36 and a quick ratio of 2.33. Bloom Energy Co. has a fifty-two week low of $9.02 and a fifty-two week high of $29.83.

Bloom Energy Profile

(

Free Report)

Bloom Energy Corporation designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally. The company offers Bloom Energy Server, a solid oxide technology that converts fuel, such as natural gas, biogas, hydrogen, or a blend of these fuels into electricity through an electrochemical process without combustion.

Featured Articles

Before you consider Bloom Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bloom Energy wasn't on the list.

While Bloom Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.