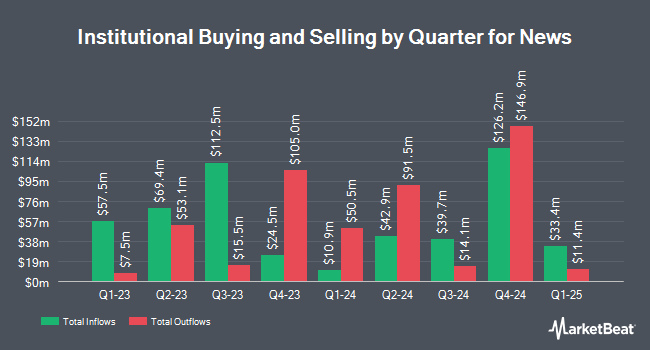

LPL Financial LLC increased its position in shares of News Co. (NASDAQ:NWS - Free Report) by 56.8% during the fourth quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 50,373 shares of the company's stock after buying an additional 18,254 shares during the quarter. LPL Financial LLC's holdings in News were worth $1,533,000 at the end of the most recent quarter.

Other institutional investors have also added to or reduced their stakes in the company. Wilmington Savings Fund Society FSB lifted its holdings in shares of News by 123.7% in the fourth quarter. Wilmington Savings Fund Society FSB now owns 935 shares of the company's stock valued at $28,000 after purchasing an additional 517 shares in the last quarter. Smartleaf Asset Management LLC lifted its holdings in shares of News by 136.3% in the fourth quarter. Smartleaf Asset Management LLC now owns 1,217 shares of the company's stock valued at $37,000 after purchasing an additional 702 shares in the last quarter. Harvest Fund Management Co. Ltd lifted its holdings in shares of News by 2,892.8% in the fourth quarter. Harvest Fund Management Co. Ltd now owns 2,065 shares of the company's stock valued at $61,000 after purchasing an additional 1,996 shares in the last quarter. Asset Management One Co. Ltd. lifted its holdings in shares of News by 22.9% in the fourth quarter. Asset Management One Co. Ltd. now owns 2,668 shares of the company's stock valued at $82,000 after purchasing an additional 497 shares in the last quarter. Finally, Blue Trust Inc. lifted its holdings in News by 72.1% during the fourth quarter. Blue Trust Inc. now owns 3,478 shares of the company's stock worth $97,000 after acquiring an additional 1,457 shares during the period. 14.63% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Separately, Seaport Res Ptn upgraded News to a "strong-buy" rating in a report on Friday, January 31st.

View Our Latest Research Report on News

News Stock Performance

News stock traded up $1.17 during midday trading on Wednesday, reaching $31.46. The stock had a trading volume of 164,955 shares, compared to its average volume of 754,236. The firm's 50-day moving average price is $31.02 and its 200 day moving average price is $30.84. News Co. has a 12 month low of $23.99 and a 12 month high of $35.25. The firm has a market capitalization of $17.85 billion, a PE ratio of 43.10 and a beta of 1.26. The company has a quick ratio of 1.65, a current ratio of 1.73 and a debt-to-equity ratio of 0.22.

News (NASDAQ:NWS - Get Free Report) last announced its quarterly earnings results on Wednesday, February 5th. The company reported $0.33 earnings per share for the quarter, missing the consensus estimate of $0.34 by ($0.01). News had a net margin of 4.22% and a return on equity of 5.31%. As a group, research analysts predict that News Co. will post 1.03 earnings per share for the current fiscal year.

News Announces Dividend

The firm also recently disclosed a semi-annual dividend, which was paid on Wednesday, April 9th. Stockholders of record on Wednesday, March 12th were issued a dividend of $0.10 per share. This represents a dividend yield of 0.6%. The ex-dividend date of this dividend was Wednesday, March 12th. News's payout ratio is 27.40%.

News Profile

(

Free Report)

News Corporation, a media and information services company, creates and distributes authoritative and engaging content, and other products and services for consumers and businesses worldwide. It operates through six segments: Digital Real Estate Services, Subscription Video Services, Dow Jones, Book Publishing, News Media, and Other.

Read More

Before you consider News, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and News wasn't on the list.

While News currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.