LPL Financial LLC cut its stake in shares of Oaktree Specialty Lending Co. (NASDAQ:OCSL - Free Report) by 16.0% during the fourth quarter, according to its most recent disclosure with the SEC. The institutional investor owned 106,660 shares of the credit services provider's stock after selling 20,373 shares during the period. LPL Financial LLC owned about 0.13% of Oaktree Specialty Lending worth $1,630,000 at the end of the most recent reporting period.

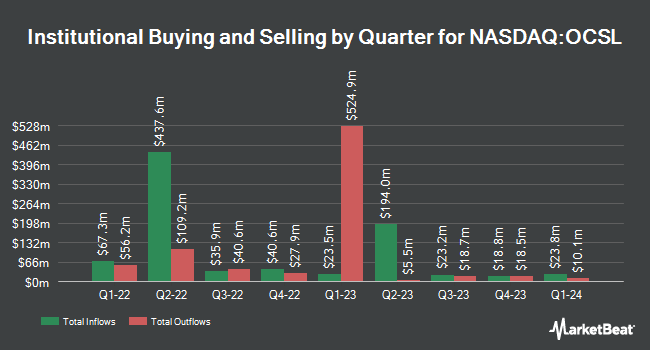

Other large investors have also recently added to or reduced their stakes in the company. Canton Hathaway LLC acquired a new stake in shares of Oaktree Specialty Lending in the 4th quarter valued at $44,000. Spire Wealth Management acquired a new position in shares of Oaktree Specialty Lending during the 4th quarter valued at about $68,000. Geneos Wealth Management Inc. bought a new position in shares of Oaktree Specialty Lending in the 4th quarter valued at approximately $93,000. SG Americas Securities LLC acquired a new stake in Oaktree Specialty Lending in the 4th quarter worth approximately $106,000. Finally, EMC Capital Management boosted its position in Oaktree Specialty Lending by 53.2% during the fourth quarter. EMC Capital Management now owns 8,714 shares of the credit services provider's stock worth $133,000 after purchasing an additional 3,026 shares during the period. Institutional investors and hedge funds own 36.79% of the company's stock.

Analyst Ratings Changes

Separately, Keefe, Bruyette & Woods dropped their price target on shares of Oaktree Specialty Lending from $16.50 to $15.00 and set a "market perform" rating on the stock in a research report on Tuesday, April 8th. One equities research analyst has rated the stock with a sell rating and seven have issued a hold rating to the company. Based on data from MarketBeat, Oaktree Specialty Lending currently has an average rating of "Hold" and an average target price of $16.42.

Read Our Latest Research Report on Oaktree Specialty Lending

Oaktree Specialty Lending Stock Performance

OCSL traded up $0.15 during midday trading on Tuesday, reaching $14.23. The company's stock had a trading volume of 494,300 shares, compared to its average volume of 747,499. The company has a current ratio of 0.30, a quick ratio of 0.30 and a debt-to-equity ratio of 0.63. The company has a fifty day simple moving average of $15.18 and a 200 day simple moving average of $15.60. The stock has a market cap of $1.17 billion, a P/E ratio of 21.24 and a beta of 0.84. Oaktree Specialty Lending Co. has a twelve month low of $12.50 and a twelve month high of $19.95.

Oaktree Specialty Lending (NASDAQ:OCSL - Get Free Report) last announced its quarterly earnings data on Tuesday, February 4th. The credit services provider reported $0.54 earnings per share (EPS) for the quarter, hitting the consensus estimate of $0.54. The business had revenue of $86.65 million for the quarter, compared to the consensus estimate of $91.93 million. Oaktree Specialty Lending had a net margin of 14.75% and a return on equity of 12.07%. Oaktree Specialty Lending's quarterly revenue was down 11.6% on a year-over-year basis. During the same quarter last year, the company posted $0.57 earnings per share. Research analysts expect that Oaktree Specialty Lending Co. will post 2.06 earnings per share for the current year.

Oaktree Specialty Lending Cuts Dividend

The firm also recently declared a quarterly dividend, which was paid on Monday, March 31st. Shareholders of record on Monday, March 17th were paid a dividend of $0.40 per share. The ex-dividend date of this dividend was Monday, March 17th. This represents a $1.60 dividend on an annualized basis and a yield of 11.24%. Oaktree Specialty Lending's dividend payout ratio is currently 238.81%.

Oaktree Specialty Lending Profile

(

Free Report)

Oaktree Specialty Lending Corporation is a business development company. The fund specializing in investments in middle market, bridge financing, first and second lien debt financing, unsecured and mezzanine loan, mezzanine debt, senior and junior secured debt, expansions, sponsor-led acquisitions, preferred equity, and management buyouts in small and mid-sized companies.

See Also

Before you consider Oaktree Specialty Lending, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oaktree Specialty Lending wasn't on the list.

While Oaktree Specialty Lending currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.