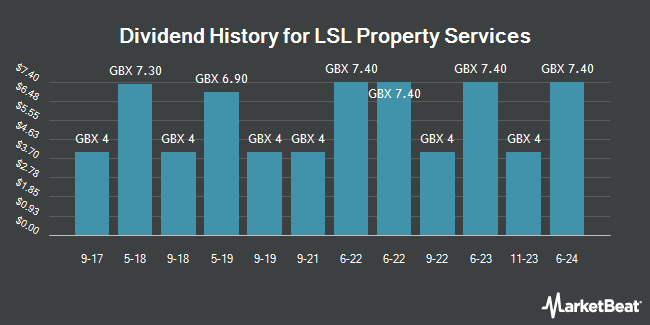

LSL Property Services plc (LON:LSL - Get Free Report) announced a dividend on Wednesday, March 26th, DividendData.Co.Uk reports. Shareholders of record on Thursday, May 8th will be paid a dividend of GBX 7.40 ($0.10) per share on Friday, June 27th. This represents a yield of 2.79%. The ex-dividend date of this dividend is Thursday, May 8th. This is a 85.0% increase from LSL Property Services's previous dividend of $4.00. The official announcement can be accessed at this link.

LSL Property Services Trading Down 0.4 %

Shares of LON:LSL traded down GBX 1 ($0.01) during trading on Friday, hitting GBX 274 ($3.55). The company had a trading volume of 45,014 shares, compared to its average volume of 76,112. The stock has a market cap of £281.94 million, a price-to-earnings ratio of 26.48, a price-to-earnings-growth ratio of 1.49 and a beta of 1.09. The company has a debt-to-equity ratio of 62.42, a current ratio of 1.30 and a quick ratio of 1.06. The company has a fifty day simple moving average of GBX 278.01 and a two-hundred day simple moving average of GBX 287.65. LSL Property Services has a one year low of GBX 252 ($3.26) and a one year high of GBX 355 ($4.59).

LSL Property Services (LON:LSL - Get Free Report) last issued its quarterly earnings results on Wednesday, March 26th. The company reported GBX 21.10 ($0.27) earnings per share (EPS) for the quarter. LSL Property Services had a return on equity of 13.68% and a net margin of 6.74%. As a group, equities analysts forecast that LSL Property Services will post 24.137931 earnings per share for the current year.

Insider Buying and Selling

In other LSL Property Services news, insider Adrian Collins purchased 20,000 shares of the firm's stock in a transaction that occurred on Thursday, March 27th. The stock was purchased at an average cost of GBX 276 ($3.57) per share, with a total value of £55,200 ($71,447.06). Also, insider Adam Castleton acquired 8,725 shares of the business's stock in a transaction on Thursday, January 30th. The stock was acquired at an average cost of GBX 295 ($3.82) per share, for a total transaction of £25,738.75 ($33,314.46). In the last ninety days, insiders bought 28,778 shares of company stock valued at $8,108,927. Company insiders own 15.29% of the company's stock.

LSL Property Services Company Profile

(

Get Free Report)

LSL Property Services plc, together with its subsidiaries, engages in the provision of business-to-business services to mortgage intermediaries and estate agency franchisees, and valuation services to lenders in the United Kingdom. The company operates through three segments: Financial Services, Surveying & Valuation, and Estate Agency Franchising.

Recommended Stories

Before you consider LSL Property Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LSL Property Services wasn't on the list.

While LSL Property Services currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.