LSV Asset Management trimmed its stake in Adeia Inc. (NASDAQ:ADEA - Free Report) by 7.7% in the fourth quarter, according to the company in its most recent disclosure with the SEC. The firm owned 3,143,694 shares of the company's stock after selling 262,300 shares during the quarter. LSV Asset Management owned about 2.88% of Adeia worth $43,949,000 as of its most recent filing with the SEC.

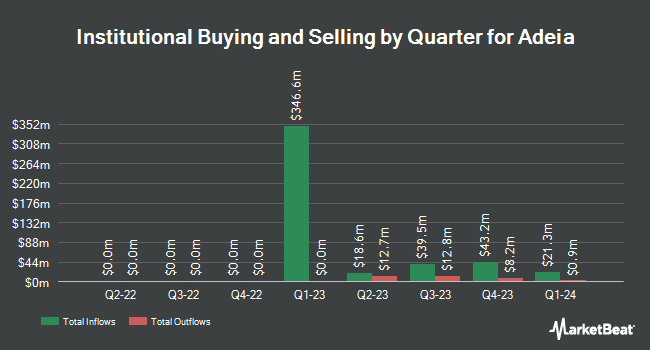

A number of other institutional investors have also recently bought and sold shares of ADEA. Raymond James Financial Inc. acquired a new position in shares of Adeia in the 4th quarter valued at about $2,470,000. Bank of Montreal Can raised its holdings in Adeia by 16.7% in the fourth quarter. Bank of Montreal Can now owns 14,003 shares of the company's stock valued at $196,000 after buying an additional 2,001 shares during the period. Envestnet Asset Management Inc. raised its holdings in Adeia by 5.4% in the fourth quarter. Envestnet Asset Management Inc. now owns 19,441 shares of the company's stock valued at $272,000 after buying an additional 989 shares during the period. Wells Fargo & Company MN lifted its position in Adeia by 39.8% during the fourth quarter. Wells Fargo & Company MN now owns 58,905 shares of the company's stock valued at $823,000 after buying an additional 16,762 shares in the last quarter. Finally, Headlands Technologies LLC purchased a new stake in Adeia during the fourth quarter worth approximately $252,000. 97.36% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several research firms recently weighed in on ADEA. Rosenblatt Securities restated a "buy" rating and set a $20.00 target price on shares of Adeia in a report on Friday, February 28th. BWS Financial restated a "buy" rating and set a $18.00 price objective on shares of Adeia in a research note on Tuesday. Finally, Maxim Group increased their target price on Adeia from $15.00 to $17.00 and gave the company a "buy" rating in a research note on Wednesday, February 19th.

View Our Latest Analysis on Adeia

Adeia Stock Up 2.1 %

ADEA traded up $0.25 during trading hours on Tuesday, reaching $12.10. 732,534 shares of the stock traded hands, compared to its average volume of 533,774. Adeia Inc. has a fifty-two week low of $9.68 and a fifty-two week high of $17.46. The company has a debt-to-equity ratio of 1.15, a current ratio of 3.53 and a quick ratio of 3.53. The company has a market cap of $1.31 billion, a price-to-earnings ratio of 21.23 and a beta of 1.47. The firm's fifty day simple moving average is $13.81 and its two-hundred day simple moving average is $13.15.

Adeia (NASDAQ:ADEA - Get Free Report) last released its quarterly earnings results on Tuesday, February 18th. The company reported $0.42 EPS for the quarter, hitting the consensus estimate of $0.42. Adeia had a return on equity of 32.81% and a net margin of 17.19%. The business had revenue of $119.17 million for the quarter, compared to analysts' expectations of $114.22 million. During the same quarter in the previous year, the firm posted $0.27 earnings per share. As a group, analysts forecast that Adeia Inc. will post 1.09 earnings per share for the current fiscal year.

Adeia Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Monday, March 31st. Investors of record on Monday, March 10th were issued a $0.05 dividend. The ex-dividend date of this dividend was Monday, March 10th. This represents a $0.20 annualized dividend and a yield of 1.65%. Adeia's dividend payout ratio is presently 35.09%.

Adeia Profile

(

Free Report)

Adeia Inc, together with its subsidiaries, operates as a media and semiconductor intellectual property licensing company in the United States, Canada, Asia, Europe, the Middle East, and internationally. The company licenses its patent portfolios across various markets, including multichannel video programming distributors comprising cable, satellite, and telecommunications television providers that aggregate and distribute linear content over networks, as well as television providers that aggregate and stream linear content over broadband networks; over-the-top video service providers and social media companies, such as subscription video-on-demand and advertising-supported streaming service providers, as well as content providers, networks, and media companies.

Further Reading

Before you consider Adeia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adeia wasn't on the list.

While Adeia currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.