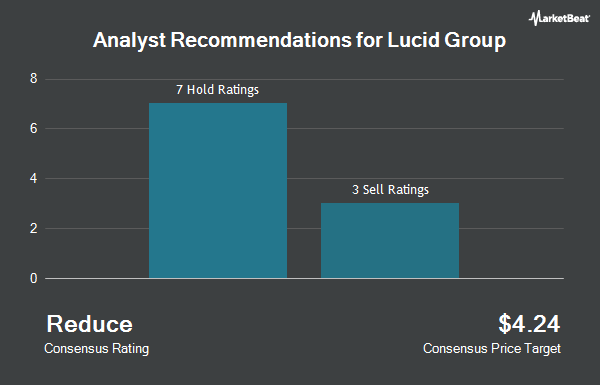

Lucid Group, Inc. (NASDAQ:LCID - Get Free Report) has earned a consensus rating of "Hold" from the ten analysts that are presently covering the company, Marketbeat Ratings reports. One analyst has rated the stock with a sell rating, seven have issued a hold rating and two have given a buy rating to the company. The average 12 month price objective among analysts that have issued a report on the stock in the last year is $3.24.

Several equities analysts have weighed in on LCID shares. Benchmark began coverage on Lucid Group in a report on Wednesday, February 12th. They set a "buy" rating and a $5.00 price objective for the company. Royal Bank of Canada lowered their price objective on Lucid Group from $3.00 to $2.00 and set a "sector perform" rating on the stock in a research note on Tuesday, November 19th. R. F. Lafferty upgraded shares of Lucid Group from a "hold" rating to a "buy" rating and set a $4.00 target price for the company in a research report on Monday, November 11th. Needham & Company LLC restated a "hold" rating on shares of Lucid Group in a research note on Friday, November 8th. Finally, Cantor Fitzgerald reiterated a "neutral" rating and issued a $3.00 price objective on shares of Lucid Group in a research note on Tuesday, January 7th.

View Our Latest Report on LCID

Institutional Investors Weigh In On Lucid Group

Large investors have recently added to or reduced their stakes in the business. Point72 Italy S.r.l. purchased a new position in shares of Lucid Group during the third quarter worth about $3,209,000. Main Management ETF Advisors LLC purchased a new position in Lucid Group in the 3rd quarter worth approximately $863,000. Charles Schwab Investment Management Inc. increased its holdings in shares of Lucid Group by 84.6% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 5,096,667 shares of the company's stock worth $17,991,000 after buying an additional 2,335,452 shares during the last quarter. CWM LLC raised its position in shares of Lucid Group by 24.6% during the 3rd quarter. CWM LLC now owns 34,350 shares of the company's stock valued at $121,000 after buying an additional 6,771 shares in the last quarter. Finally, Nisa Investment Advisors LLC lifted its holdings in shares of Lucid Group by 4,301.7% during the 4th quarter. Nisa Investment Advisors LLC now owns 255,300 shares of the company's stock worth $771,000 after acquiring an additional 249,500 shares during the last quarter. Institutional investors own 75.17% of the company's stock.

Lucid Group Stock Performance

Shares of Lucid Group stock traded up $0.26 on Wednesday, reaching $3.57. 37,041,614 shares of the company traded hands, compared to its average volume of 78,846,961. The company has a 50 day moving average of $2.92 and a 200 day moving average of $2.97. The company has a debt-to-equity ratio of 0.77, a current ratio of 3.71 and a quick ratio of 3.26. Lucid Group has a 52 week low of $1.93 and a 52 week high of $4.43. The firm has a market capitalization of $10.74 billion, a PE ratio of -2.68 and a beta of 0.93.

Lucid Group Company Profile

(

Get Free ReportLucid Group, Inc a technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems. It also designs and develops proprietary software in-house for Lucid vehicles. The company sells vehicles directly to consumers through its retail sales network and direct online sales, including Lucid Financial Services.

Recommended Stories

Before you consider Lucid Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lucid Group wasn't on the list.

While Lucid Group currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.