Lucid Group (NASDAQ:LCID - Get Free Report) was downgraded by investment analysts at Bank of America from a "neutral" rating to an "underperform" rating in a research note issued to investors on Wednesday, MarketBeat reports. They presently have a $1.00 price target on the stock, down from their previous price target of $3.00. Bank of America's price target indicates a potential downside of 54.95% from the company's previous close.

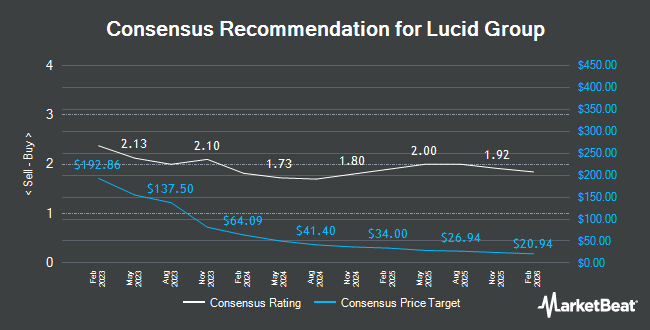

Other analysts have also issued research reports about the company. Benchmark began coverage on Lucid Group in a research note on Wednesday, February 12th. They issued a "buy" rating and a $5.00 price target on the stock. Royal Bank of Canada dropped their price objective on shares of Lucid Group from $3.00 to $2.00 and set a "sector perform" rating for the company in a research report on Tuesday, November 19th. Redburn Atlantic lowered shares of Lucid Group from a "neutral" rating to a "sell" rating and reduced their target price for the company from $3.50 to $1.13 in a research note on Monday, February 24th. R. F. Lafferty raised Lucid Group from a "hold" rating to a "buy" rating and set a $4.00 price objective for the company in a research note on Monday, November 11th. Finally, Needham & Company LLC restated a "hold" rating on shares of Lucid Group in a report on Friday, November 8th. Three research analysts have rated the stock with a sell rating, six have given a hold rating and two have assigned a buy rating to the stock. According to data from MarketBeat.com, Lucid Group has an average rating of "Hold" and an average price target of $2.73.

View Our Latest Analysis on LCID

Lucid Group Stock Performance

Lucid Group stock traded down $0.01 on Wednesday, hitting $2.22. The company's stock had a trading volume of 135,864,308 shares, compared to its average volume of 87,222,867. The company has a quick ratio of 3.26, a current ratio of 3.71 and a debt-to-equity ratio of 0.77. The company has a fifty day moving average price of $2.96 and a 200-day moving average price of $2.96. Lucid Group has a one year low of $1.93 and a one year high of $4.43. The firm has a market cap of $6.69 billion, a P/E ratio of -1.66 and a beta of 0.93.

Institutional Investors Weigh In On Lucid Group

Institutional investors have recently added to or reduced their stakes in the stock. Newbridge Financial Services Group Inc. acquired a new stake in shares of Lucid Group in the 4th quarter valued at about $28,000. Accredited Investors Inc. bought a new position in shares of Lucid Group during the fourth quarter worth about $30,000. Proficio Capital Partners LLC acquired a new stake in Lucid Group in the 4th quarter valued at approximately $31,000. DRW Securities LLC bought a new stake in Lucid Group in the 4th quarter valued at approximately $31,000. Finally, First National Corp MA ADV acquired a new position in Lucid Group during the 4th quarter worth approximately $32,000. 75.17% of the stock is owned by institutional investors.

Lucid Group Company Profile

(

Get Free Report)

Lucid Group, Inc a technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems. It also designs and develops proprietary software in-house for Lucid vehicles. The company sells vehicles directly to consumers through its retail sales network and direct online sales, including Lucid Financial Services.

Read More

Before you consider Lucid Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lucid Group wasn't on the list.

While Lucid Group currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.