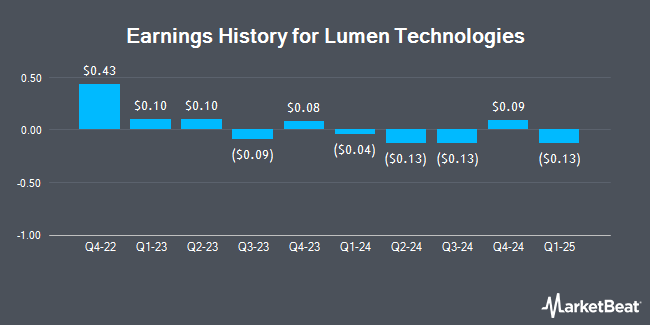

Lumen Technologies (NYSE:LUMN - Get Free Report) released its quarterly earnings data on Tuesday. The technology company reported $0.09 earnings per share for the quarter, beating the consensus estimate of ($0.05) by $0.14, Zacks reports. Lumen Technologies had a negative return on equity of 46.17% and a negative net margin of 0.42%.

Lumen Technologies Trading Down 0.7 %

Shares of LUMN traded down $0.04 during trading hours on Friday, hitting $4.98. 9,403,093 shares of the stock were exchanged, compared to its average volume of 13,235,418. The firm has a market capitalization of $5.05 billion, a P/E ratio of -99.48 and a beta of 1.28. The company has a debt-to-equity ratio of 37.70, a current ratio of 1.21 and a quick ratio of 1.20. Lumen Technologies has a fifty-two week low of $0.97 and a fifty-two week high of $10.33. The business has a 50-day moving average of $5.71 and a 200-day moving average of $6.04.

Analysts Set New Price Targets

A number of equities research analysts have recently weighed in on LUMN shares. TD Cowen reduced their price target on shares of Lumen Technologies from $7.00 to $6.00 and set a "hold" rating on the stock in a research note on Wednesday, November 6th. Royal Bank of Canada reiterated a "sector perform" rating and issued a $4.25 price target (up from $4.00) on shares of Lumen Technologies in a research note on Friday, December 20th. Citigroup upped their target price on Lumen Technologies from $6.50 to $8.00 and gave the stock a "neutral" rating in a report on Friday, November 29th. Finally, The Goldman Sachs Group boosted their price target on Lumen Technologies from $4.50 to $5.00 and gave the stock a "neutral" rating in a report on Wednesday, November 6th. Three research analysts have rated the stock with a sell rating and six have assigned a hold rating to the stock. According to MarketBeat.com, the company currently has an average rating of "Hold" and a consensus target price of $4.66.

View Our Latest Stock Report on LUMN

Lumen Technologies Company Profile

(

Get Free Report)

Lumen Technologies, Inc, a facilities-based technology and communications company, provides various integrated products and services to business and residential customers in the United States and internationally. The company operates in two segments, Business and Mass Markets. It offers dark fiber, edge cloud services, internet protocol, managed security, software-defined wide area networks, secure access service edge, unified communications and collaboration, and optical wavelengths services; ethernet and VPN data networks services; and legacy services to manage cash flow, including time division multiplexing voice, private line, and other legacy services, as well as sells communication equipment, and IT solutions.

Recommended Stories

Before you consider Lumen Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lumen Technologies wasn't on the list.

While Lumen Technologies currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.